Corporation Account Types: Know Where The Money Is — Physician Finance Canada

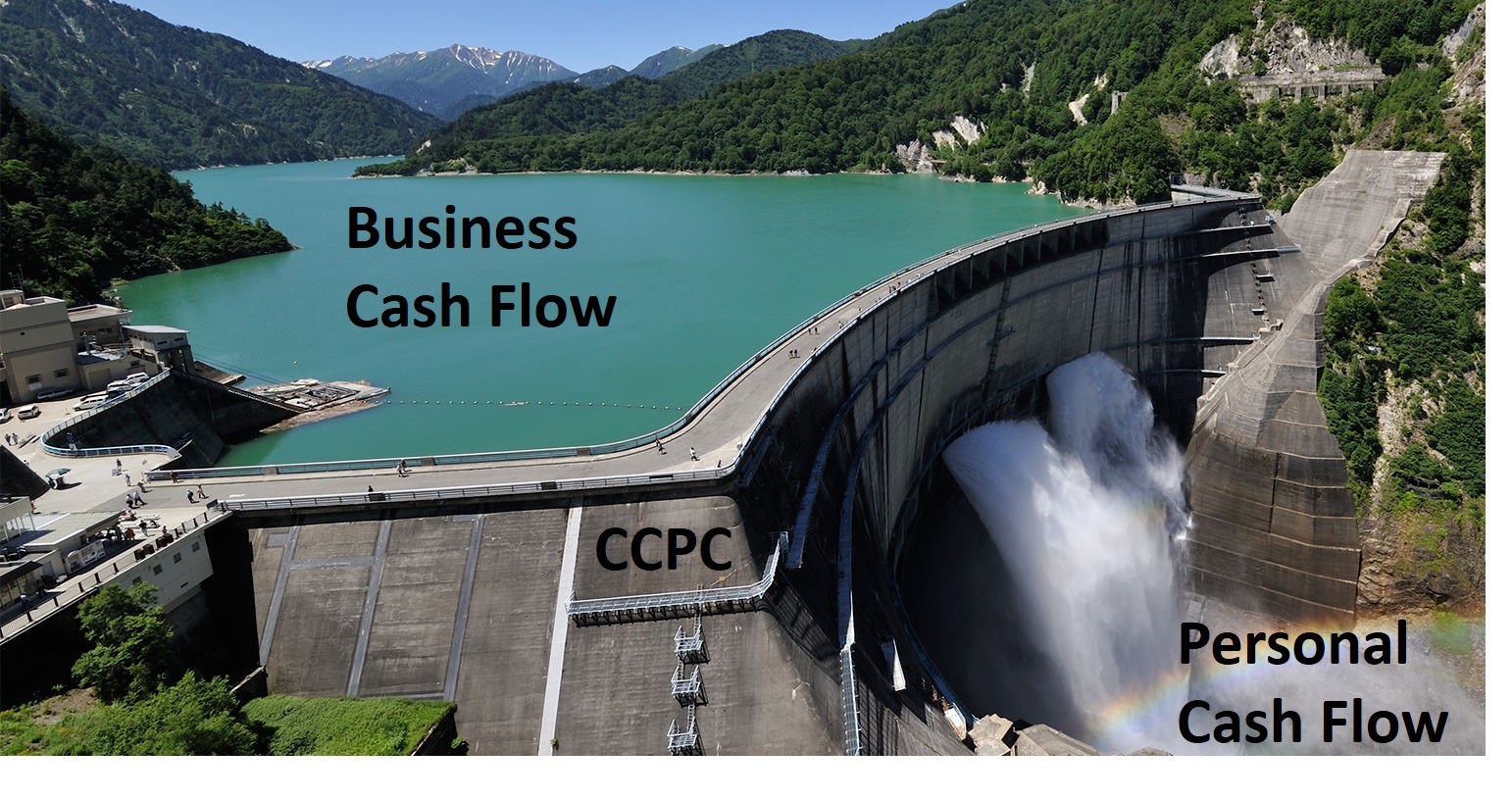

A corporation has different accounts to optimally hold your money. There are also notional accounts that only exist on paper. Still, those can mean real money through the tax refunds and advantages they offer. Learn how.| Physician Finance Canada