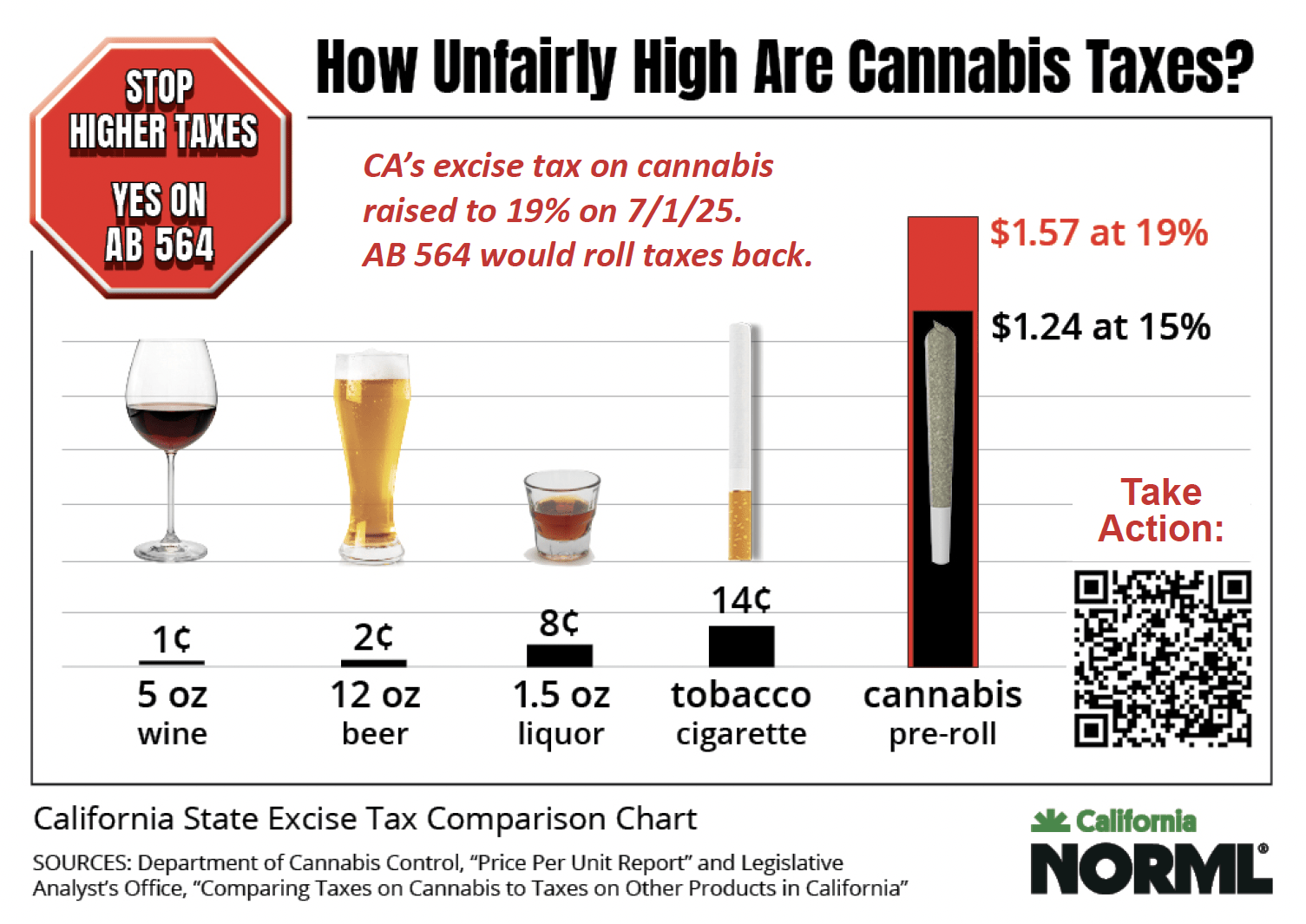

Stop Higher Taxes on Cannabis in California - Action Network

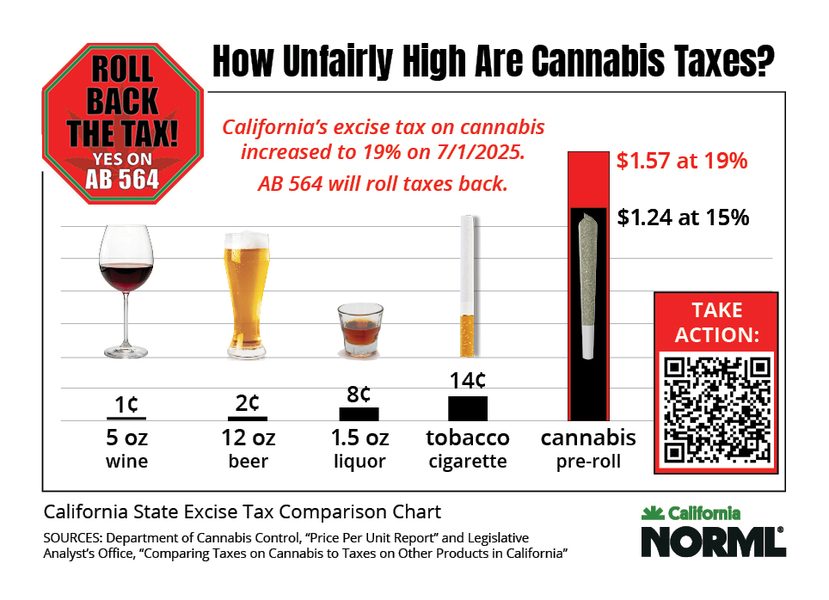

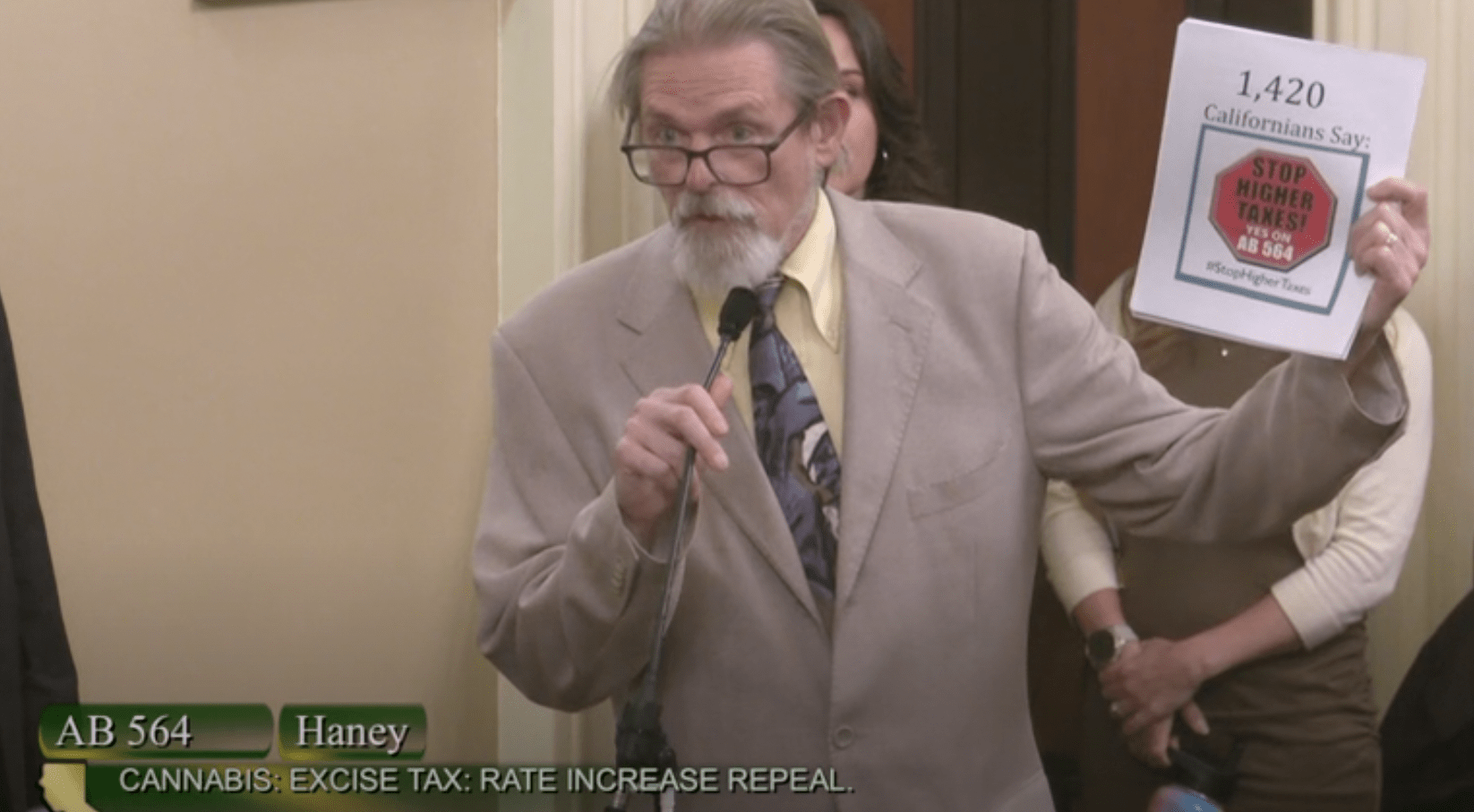

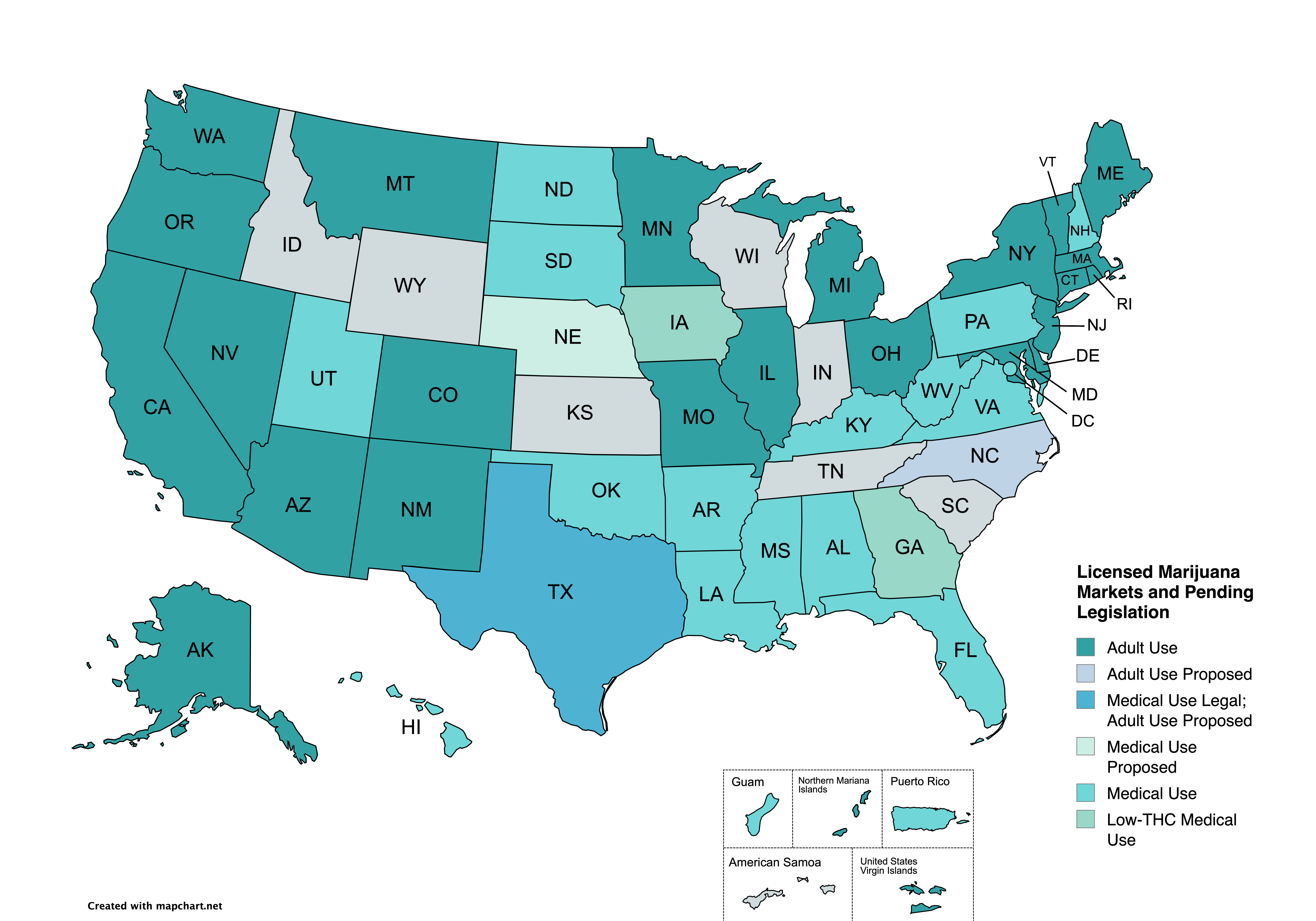

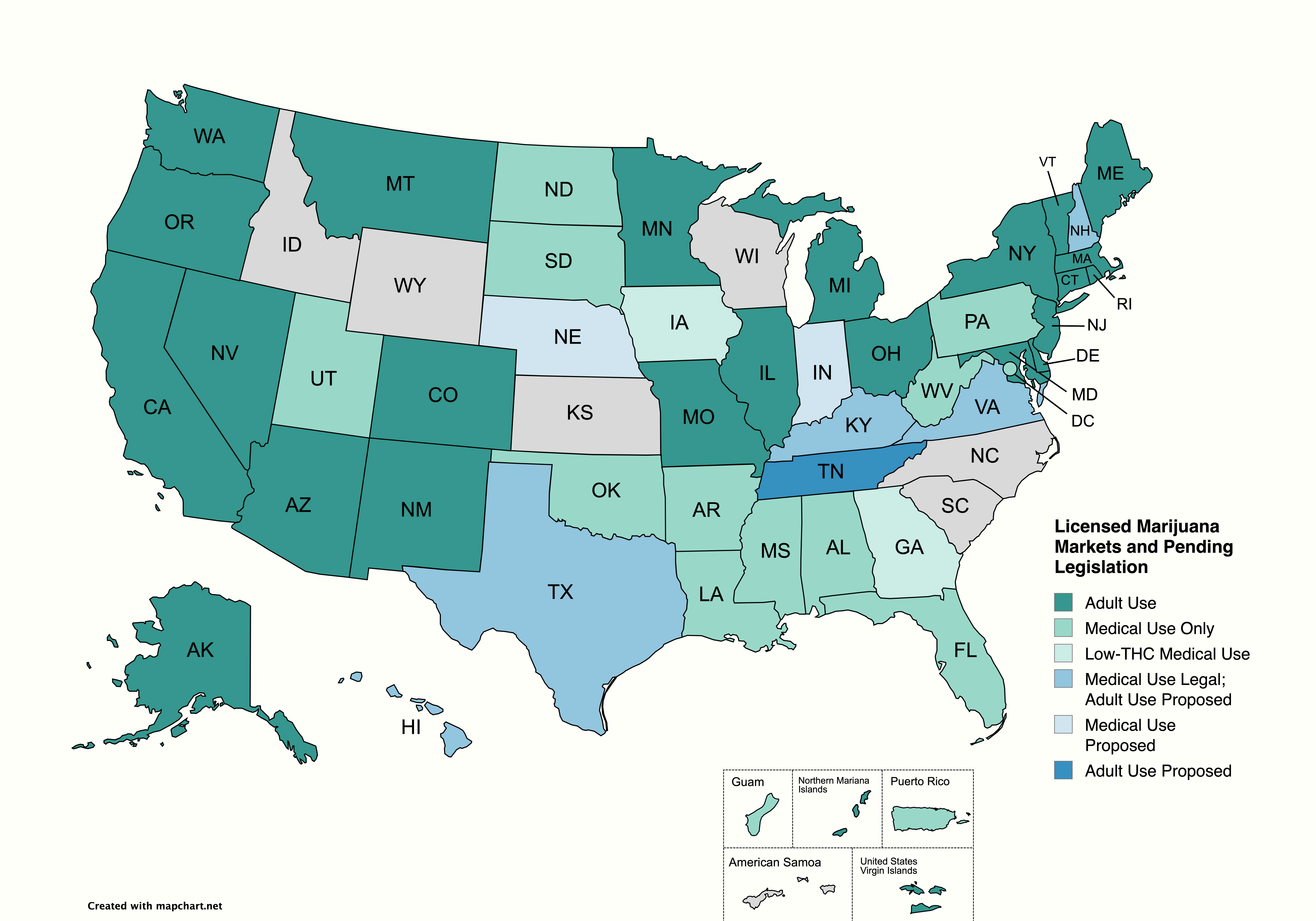

California is set to increase its excise tax on cannabis from 15% to as much as 19% starting on July 1, 2025, as part of a budget compromise made when the cannabis cultivation tax was removed via AB 195 (2022), in order to assure adequate funding for programs funded by cannabis taxes. Cannabis is already unfairly taxed vs. similar products in California. And since cannabis is also subject to sales taxes and local taxes, and these taxes are compounded at the retail level, consumers are already...| actionnetwork.org