Freedom Debt Relief: The Pros and Cons

Freedom Debt Relief is a debt settlement company offering the opportunity to settle debts for a fraction of your balance.| Debt.org

Debt Relief Programs: Explore Your Options and Make a Plan

Discover the pros and cons of the best debt relief option for your needs - from professional debt management to doing it yourself - and get out of debt.| Debt.org

Debt Relief vs. Bankruptcy: Pros, Cons & Key Differences

Compare debt relief and bankruptcy options. Learn the pros, cons, and key factors to choose the best path for your financial situation.| Debt.org

DIY Debt Settlement: Steps & What You Need to Know

Learn steps to help successfully negotiate your own debt settlement, how it compares to working with a company, risks, and alternatives to help you decide.| Debt.org

Understanding Debt Settlement | Is It a Good Idea for You?

Considering debt settlement? Get a balanced view of its benefits and risks, understand the process, and assess if it aligns with your financial goals.| Debt.org

Best Ways to Consolidate Debt: What're Your Options?

Learn the different pros and cons of the best debt consolidation options available to help you get out of debt and improve your financial wellbeing.| Debt.org

Getting Sued While in Debt Settlement - What Are My Options?

Getting sued by collection agencies while in debt settlement can be very frustrating. Learn your options and what to do next.| Debt.org

Understanding Credit | Does Debt Settlement Hurt Your Score?

Struggling with debt? Find out if debt settlement hurts your credit. Get insights into credit scores, debt management, and recovery options. Click for more!| Debt.org

Debt Settlement Fees: How Much Will It Cost You?

Need clarity on debt settlement fees? Get detailed info on types, impacts, and negotiation strategies. Act now to take control of your debt relief plan!| Debt.org

Loan Origination Fees: Definition and Average Costs

Some lenders charge origination fees to process loans. Learn how origination fees are calculated, when they are due, and how to save on them.| Debt.org

Credit Card Debt Relief: How to Get Help With Credit Card Debt

Getting out of credit card debt can be difficult. Learn about your credit card debt relief options and where to find help to free you from your credit card debt.| Debt.org

LendingClub Review - Personal Loans 2025 | Debt.org

LendingClub is one of the most reputable destinations for online personal loans, usually a great method to borrow for a special need or credit. Learn more.| Debt.org

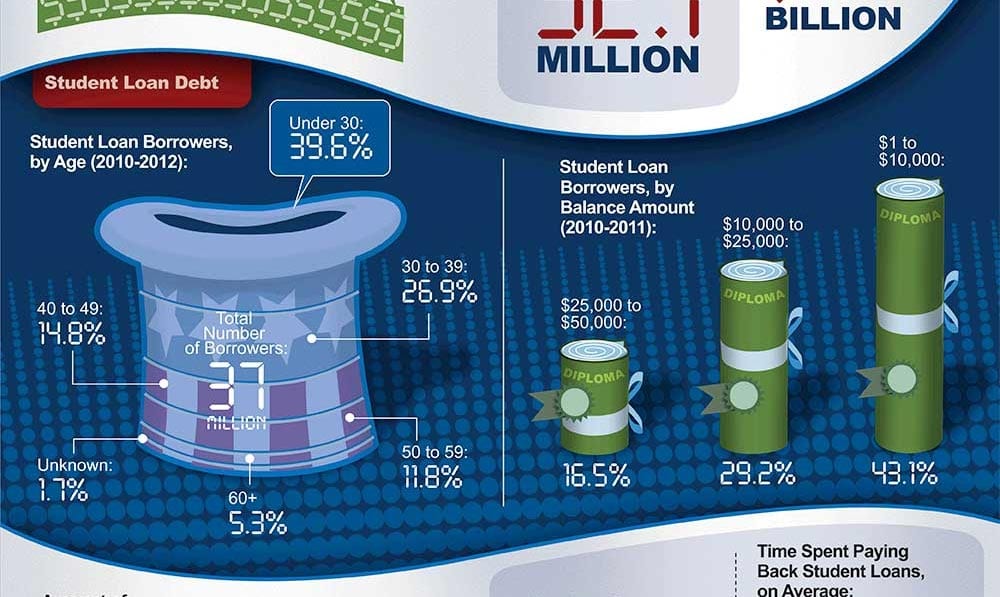

Student Loan Consolidation - Federal & Private Education Loans

Student loan can be one of the largest expenses an adult experiences after graduating college. Learn about the different ways to consolidate student loans, the differences between federal & private student loan consolidation, repayment plan options, & forgiveness.| Debt.org

Debt Settlement for Credit Card Debt: How the Process Works

Debt settlement is the process of negotiating a settlement in order to reduce debt. Learn about the debt settlement process and debt settlement companies.| Debt.org

What Is Chapter 7 Bankruptcy and How Does It Work?

Understand the process of Chapter 7 bankruptcy— from filing to discharge, and tips for everything in between. Get help from experts at Debt.org today.| Debt.org

Chapter 13 Bankruptcy: What Is It & How Does It Work?

Chapter 13 bankruptcy allows you to propose a repayment plan to the court and creditors. Learn about qualifying and filing for chapter 13 bankruptcy.| Debt.org

Unsecured Debt – Types and Solutions

Unsecured debt like credit card debt is any owed amount that is not tied to assets, and it is typically eligible for debt settlement.| Debt.org

401(k) Loans: What You Need to Know

You may consider borrowing from your 401(k) to pay off debts. Learn about the associated taxes, fees, and when borrowing from a 401(k) is best.| Debt.org

What Is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) provides you with access to cash based on the value of your home. Learn how they work, and the pros and cons.| Debt.org

Secured vs Unsecured Personal Loan Options

Know the different types of personal loans when applying for them. Learn the difference between secured and unsecured personal loans.| Debt.org

What Is a Balance Transfer Credit Card & How Do They Work?

Learn about balance transfer credit cards, how they work, how to apply, and if you should get a balance transfer card to help pay off your credit card debt.| Debt.org

Home Equity Loans for Debt Consolidation: What to Know

Home equity loans can be used for debt consolidation by combining your debt into one place, making it easier to make your monthly payments. Learn more.| Debt.org

Debt Management Programs: What You Need to Know

A Debt Management Plan is a 3-5 year payment plan with reduced interest rates facilitated by a non-profit credit counseling agency to help repay debts.| Debt.org

Getting a Personal Loan with Bad Credit | Best Bad Credit Loans 2025

Obtaining loans for bad credit can be limited, but possible. Learn how bad credit affects interest rates, different types of bad credit loans & compare top lenders.| Debt.org

Debt Consolidation Guide: How It Works [February 2025 ]

Debt consolidation can reduce your monthly debt outgoings by rolling multiple debts into a single payment, using a debt consolidation loan or management plan.| Debt.org

How to Improve Your Credit Score: Tips & Tricks

Learning how to raise your credit score may mean the difference between a loan getting approved or denied. Use these tips to keep your credit score healthy.| Debt.org

Bankruptcy: How It Works and Consequences

Facing overwhelming debt? Discover how bankruptcy can offer a fresh start. Understand your options and take the first step towards relief today.| Debt.org

Credit Counseling: How it Works & How to Select an Agency

Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you.| Debt.org