Debt.org - America's Debt Help Organization

America's Debt Help Organization - Your Source for Information on Debt Consolidation, Settlement, Student Loans, Bankruptcy and Mortgages.| Debt.org

Rebuilding Credit After Bankruptcy - Debt.org

Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy.| Debt.org

Debt and Discrimination

The law protects you from lenders’ discriminatory practices when applying for a personal loan. credit card or mortgage.| Debt.org

Charge-Offs | Understanding Full Payment vs. Settlement

Confused about charge-offs? Learn the pros and cons of paying in full versus settling to enhance your finances. Discover your path to credit recovery!| Debt.org

How to Manage Your Student Loan Debt | Solutions & Tips

Student debt among college students is one of the leading causes of financial distress. Learn more about managing student debt with Debt.org.| Debt.org

Student Loan Rehabilitation for Default: Repayment Options

When paying off student loans, consider all loan repayment options to find the one that best fits your financial needs.| Debt.org

Understanding Credit | Does Debt Settlement Hurt Your Score?

Struggling with debt? Find out if debt settlement hurts your credit. Get insights into credit scores, debt management, and recovery options. Click for more!| Debt.org

Credit Unions - Benefits, Types & Regulations

Credit unions are nonprofits that offer members a cheaper price on financial services than some banks. Learn the advantages & disadvantages of credit unions.| Debt.org

How Compound Interest Works: Formula & How to Calculate

Learn how compound interest works including information on what it is, how it is calculated & how to take advantage of accounts that offer compound interest..| Debt.org

Hazards of Paying the Minimum Payment on Your Credit Card

How you treat your monthly credit card bill might reveal as much about your personality as when you scream when under pressure or offer a seat on the bus| Debt.org

Home Equity Loans - Pros and Cons, Minimums and How to Qualify

Home equity loans allow homeowners to borrow money on the equity of their home & repay at a fixed rate. Learn how to obtain the loan & its pros & cons.| Debt.org

Debt Settlement for Credit Card Debt: How the Process Works

Debt settlement is the process of negotiating a settlement in order to reduce debt. Learn about the debt settlement process and debt settlement companies.| Debt.org

Secured Credit Cards: What They Are & How They Help Build Credit

Secured credit cards can be a great way to gain or rebuild your credit. Learn what secured credit cards are, their advantages & disadvantages, & how to get one.| Debt.org

Advice on How to Keep Yourself out of Debt

Enrolling in a two-year college, staying on top of the latest job skills and seeking out scholarships instead of student loans could keep you from landing in debt.| Debt.org

Loans & Credit: Personal Credit & Loan Options

Different types of consumer loans & lines of credit provide options for consumers and businesses to better manage their financial situation & repay debts.| Debt.org

Unsecured Debt – Types and Solutions

Unsecured debt like credit card debt is any owed amount that is not tied to assets, and it is typically eligible for debt settlement.| Debt.org

Secured vs Unsecured Personal Loan Options

Know the different types of personal loans when applying for them. Learn the difference between secured and unsecured personal loans.| Debt.org

Student Loan Resources: Financial Aid & Loan Debt Management

Student loans account for over $1 trillion in debt in America. Learn to acquire, manage, pay back different types of financial aid and other student debts.| Debt.org

Financial Relief for Healthcare | Assistance for Medical Bills

In medical bill debt? Learn about your medical financial assistance options, what happens to unpaid bills & other ways to get out of medical debt.| Debt.org

Credit Report: What’s on Your Credit History Report & Who Checks it?

Credit reports can be confusing. Learn general credit report information including when, where & how to get a credit report.| Debt.org

How To Use Personal Loans To Build Credit

A personal loan is one option to build credit - but there are risks attached. Understand the benefits, downsides and alternatives.| Debt.org

Getting a Personal Loan with Bad Credit | Best Bad Credit Loans 2025

Obtaining loans for bad credit can be limited, but possible. Learn how bad credit affects interest rates, different types of bad credit loans & compare top lenders.| Debt.org

Lines of Credit: Types, How They Work & How to Get Them

Lines of credit can be used for short-term emergencies or long-term projects. Learn which types may be most suitable for your situation.| Debt.org

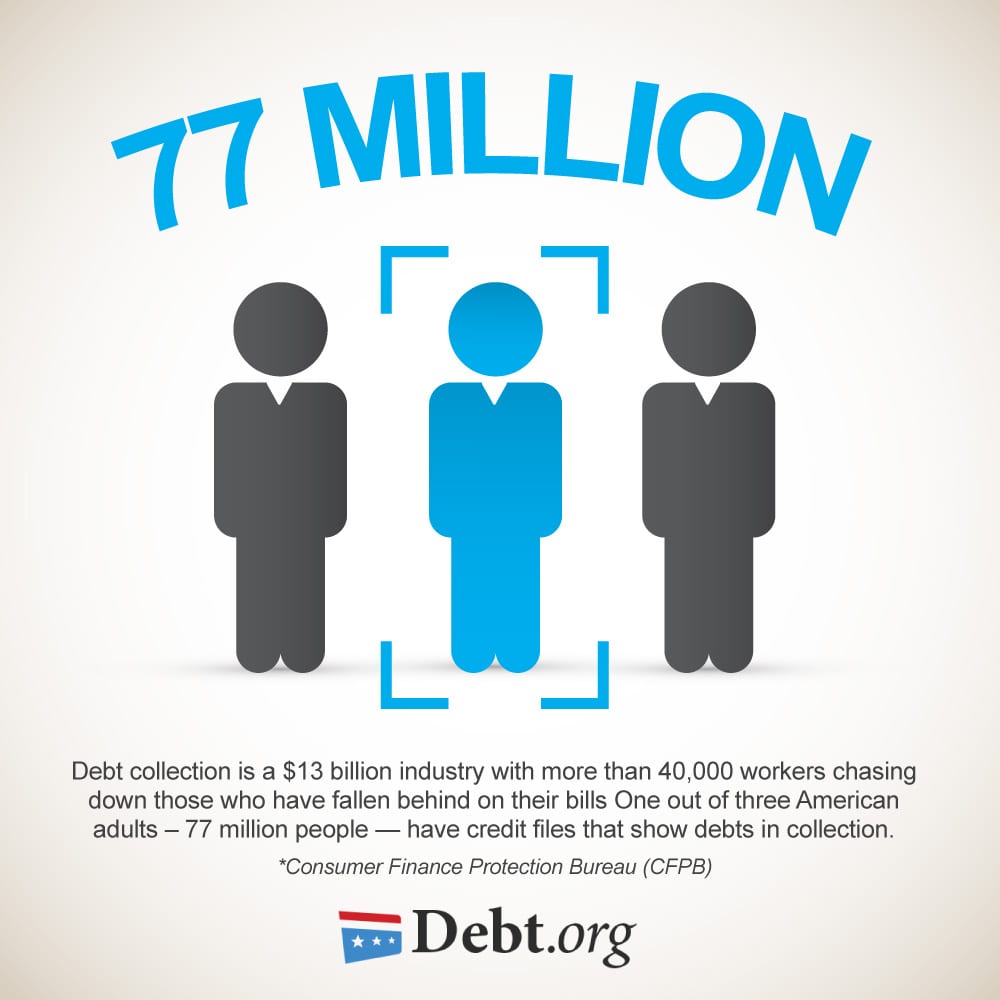

Debt Collectors: Debt Collection Agency Laws & Practices

Need help with debt collectors? Learn about the difference between creditors & debt collectors, the process of collection & arbitration, & your rights as a consumer| Debt.org

Credit Cards: Types of Debt & How Credit Cards Work

Credit cards are a type of revolving debt that can be very helpful when used properly but can also cause serious debt problems.| Debt.org

Best Credit Counseling Agencies & Companies for 2025

Explore the five best credit counseling agencies, and learn about what makes these companies the top-rated credit counselors in the industry.| Debt.org