Statistics for Cash and Credit Card Use for Payments in 2024 - Credit Card Processing and Merchant Account

Statistics for Cash and Credit Card Use for Payments in 2024 including reasons for declining cash use, demographics, and more.| Credit Card Processing and Merchant Account

An Overview of Chip-and-PIN in Payment Processing - Credit Card Processing

An overview of chip and PIN in payment processing to accept credit cards with the history, how it works and benefits of EMV.| Credit Card Processing and Merchant Account

What is a CVV and Security Code on Credit Cards?

What is a CVV or a security code on a credit card which is sometimes used in payments. This goes over the definition and how CVV works.| Credit Card Processing and Merchant Account

The Rise of P2P Payments

Peer-to-Peer (P2P) payments is a significant transformation in the world of financial transactions and impacts credit card processing.| Credit Card Processing and Merchant Account

Interchange Plus Pricing and What You Need to Know - Payments

Interchange plus pricing, also called cost plus pricing, is a transparent pricing model for credit card processing and payments for merchants.| Credit Card Processing and Merchant Account

Reasons Why Credit Cards Get Declined - Credit Card Processing and Merchant Account

The most common reasons credit cards are declined with statistics for each and actionable tips for merchants to solve these transactions.| Credit Card Processing and Merchant Account

Card-Present vs Card-Not-Present in Payments

Card-Present (CP) vs Card-Not-Present (CNP) in payment processing and how it impacts credit card processing fees and interchange rates.| Credit Card Processing and Merchant Account

What is AML and KYC in Payments?

Anti-Money Laundering (AML) and Know-Your-Customer (KYC) in payments and credit card processing are crucial safeguards. Here's how it works.| Credit Card Processing and Merchant Account

Credit Card Fraud in 2023 - Credit Card Processing and Merchant Account

This article focuses on credit card fraud statistics and market numbers for different countries, age groups, and types of payment fraud.| Credit Card Processing and Merchant Account

Types of Credit Card Fraud That Merchants Must Know - Credit Card Processing and Merchant Account

Overview of types of credit card fraud in payments and credit card processing, including fraud detection, statistics, identity theft, & more.| Credit Card Processing and Merchant Account

Chargeback Statistics in Credit Card Processing

Chargeback statistics for credit card processing including common reasons and chargeback rates by industry and country in payments.| Credit Card Processing and Merchant Account

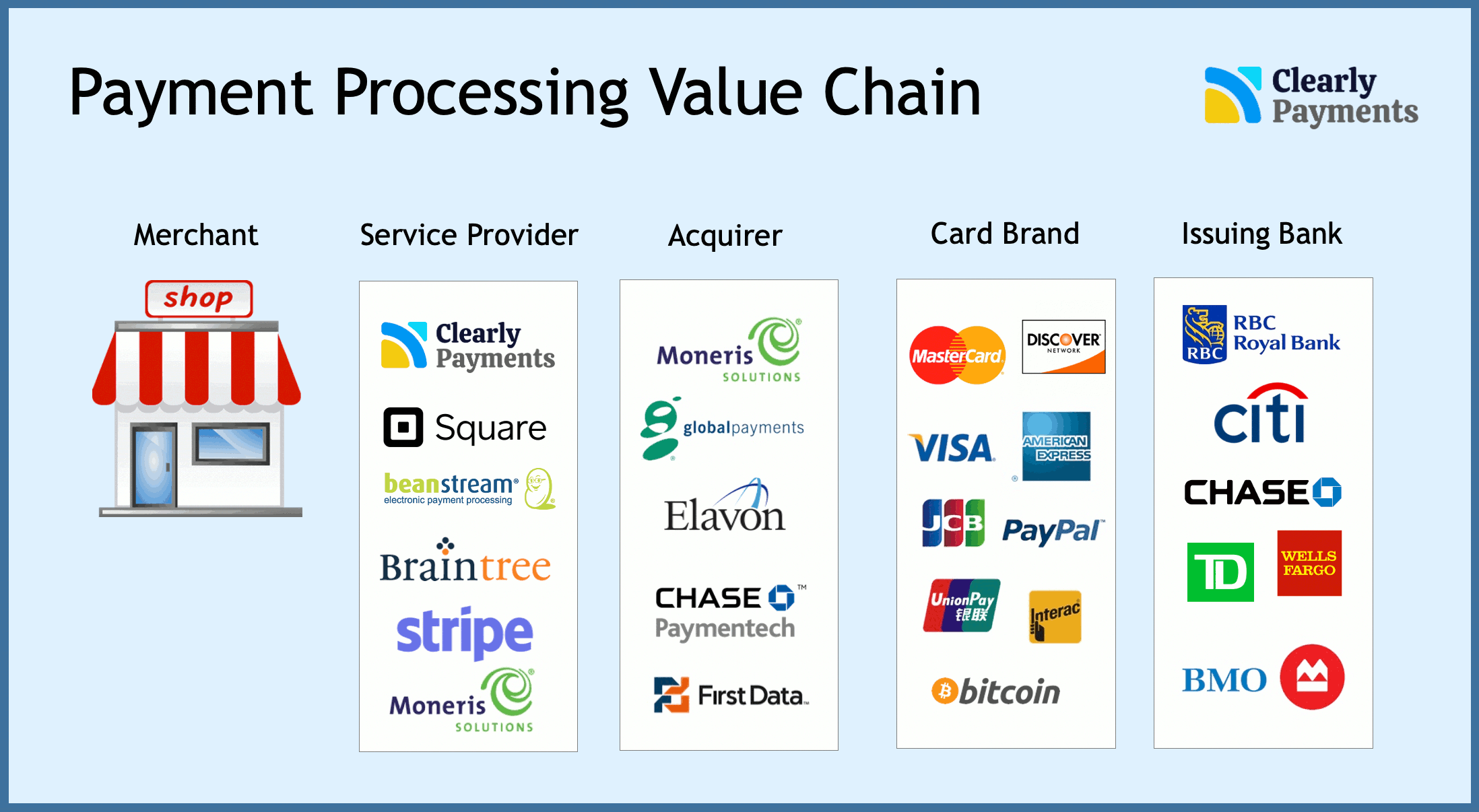

Credit card and payment processing industry overview - Credit Card Processing and Merchant Account

Industry overview for credit card processing and merchant services. This covers who makes money and companies involved in payment processing.| Credit Card Processing and Merchant Account

What is a Merchant Account? - Credit Card Processing

What is a merchant account, how they work, the fees, and how to get one so your business can process credit card payments.| Credit Card Processing and Merchant Account

The Best Way to Use Payment Data to Grow Your Business

Use payment data to grow your business with analytics. We cover the categories, the benefits, and how to capture credit card processing data.| Credit Card Processing and Merchant Account

What is an Acquiring Bank in Payments?

An acquiring bank in payment processing is a financial institution that facilitates acceptance of credit card payments for merchants.| Credit Card Processing and Merchant Account

Complete Overview on How Fees Work in Credit Card Processing

A complete overview on how fees work in credit card processing including payment processor fees, interchange rates, reducing fees, and more| Credit Card Processing and Merchant Account

An Overview of Interchange Rates and Payment Processing in the EU

This article covers credit card interchange rates in the European Union (the EU), fees, regulations, and the payment processing landscape.| Credit Card Processing and Merchant Account

How Consumer Payment Data Can be Used by Businesses

This article discusses how consumer payment data from credit card transactions can help businesses grow. Here's how it works with statistics.| Credit Card Processing and Merchant Account

Fraud Risk by Industry in Payments

Fraud risk by industry with statistics along with top types of credit card fraud by certain industries like travel, eCommerce, and retail.| Credit Card Processing and Merchant Account

An Overview of Payment Regulation In The USA

An overview of the payment regulatory organizations (Federal Reserve, CFPB, etc), regulations, and trends of payment regulation in the USA.| Credit Card Processing and Merchant Account