CANSLIM Investing Decoded: A Data-Driven Performance Test

CANSLIM is an active investment strategy that utilizes specific screening criteria such as earnings, market leadership, product innovation, institutional ownership, and stock price trends. These key criteria play a vital role in the process of stock selection.| Liberated Stock Trader

I Tested 20 Finance & Investing Magazines: Here's the Top 10

The best financial magazines are The Economist for global finance and politics, Bloomberg Business Week for investing insights, TASC magazine for stock traders, and Barrons for financial planning.| Liberated Stock Trader

Ben Graham's Defensive Stock Strategy: A Modern Guide

The best way to find defensive stocks is by using Benjamin Graham's timeless rules for the defensive investor: Stability, earnings, dividends, price-to-book ratio, and the price-to-Graham number.| Liberated Stock Trader

39 Value Stock Criteria All Smart Investors Need [Tested]

The essential screening criteria to find great value stocks are intrinsic value, margin of safety, the PEG ratio, price to Graham number, and earnings power value.| Liberated Stock Trader

Tickeron AI & Portfolio Tools Lab-Test & Benchmarks 2026

My experience with Tickeron highlights an exceptional AI-powered investing platform that seamlessly integrates trading bots, portfolio management, and advanced chart pattern recognition.| Liberated Stock Trader

8 Researched Steps to a Balanced, Profitable Portfolio 2026

This eight-step process for building a stable, diversified stock portfolio draws on years of analyst and academic research, providing many practical examples.| Liberated Stock Trader

Debt-to-EBITDA Decoded: Key to Smart Investing

The Debt-to-EBITDA ratio assesses a company's ability to pay off its debt. It compares a company's total debt to earnings before interest, taxes, depreciation, and amortization (EBITDA).| Liberated Stock Trader

Money Market Mastery: Ultimate Guide To Cash Investing

Money markets play a crucial role in greasing the wheels of economic activity, ensuring a smooth flow of funds from those who have it to those who need to borrow it. Investors can use money markets to protect capital from inflation.| Liberated Stock Trader

Market Leaders: Best Stocks Across 11 Key Sectors

Our ten-year research reveals the best stock market sectors outperforming the S&P 500 are Technology +381%, Consumer Cyclical +181%, and Healthcare +34%. These three sectors significantly beat the market averages.| Liberated Stock Trader

Mastering High, Low & Negative Beta in Stock Trading

Beta is a financial ratio measuring volatility for individual stocks or portfolios. It quantifies the anticipated fluctuation in stock price in relation to overall market movements. A beta greater than 1.0 implies that the stock is more volatile than the broader market, whereas a beta below 1.0 indicates a stock with lower volatility.| Liberated Stock Trader

Sortino Ratio: Reduce Risk & Boost Stock Portfolio Profits

The primary benefit of the Sortino Ratio is that it helps investors understand the risk of losing money, which is often a more significant concern than overall volatility.| Liberated Stock Trader

My Tested 2X Stock Beta Strategies To Boost Your Trades:

To calculate Beta or (β) you need to divide the variance of an equity's return by the covariance of a stock index's return.| Liberated Stock Trader

Master Leveraged ETFs: 16 Pro Trading Secrets

To successfully trade leveraged ETFs, you must understand the importance of ETF decay, liquidity, volume, fees, assets under management, and potential risks.| Liberated Stock Trader

Stock Indices Explained with Interactive Charts

A stock market index acts as a benchmark for measuring the performance of a group of stocks. These stocks are carefully chosen to represent a particular market or sector, and their collective performance indicates how that market or sector is doing as a whole.| Liberated Stock Trader

S&P 500 Company List by Market Cap [Up-to-Date]

Our regularly updated S&P 500 companies list shows you what companies are currently in the S&P 500 index and provides the ticker symbol, their industry sector, and market capitalization.| Liberated Stock Trader

Dollar-Cost Averaging: A Long-term Wealth Buiding Strategy

Dollar cost averaging is an investment strategy that divides the total investment amount across periodic purchases, reducing risks from lump-sum investments and capitalizing on market price variations.| Liberated Stock Trader

Cash on Hand Explained: Cash is King for Investors

Cash on Hand is a financial metric indicating the amount of liquid capital available to an individual or business. For businesses, it includes physical currency, funds in bank accounts, and liquid assets readily convertible to cash.| Liberated Stock Trader

Use the Buffett Indicator & Profit From Market Valuation

The Buffett Indicator helps gauge stock market valuation by dividing the total market capitalization by GDP, offering a macroeconomic perspective on market value.| Liberated Stock Trader

26 Epic Stock Market Books Successful Investors Read

The best stock market books of all time are The Little Book that Still Beats the Market, A Man for All Markets, How to Make Money in Stocks, Dark Pools, Technical Analysis of the Financial Markets, and The Intelligent Investor.| Liberated Stock Trader

26 Timeless Buffett Quotes: Investing Wisdom Revealed

Warren Buffett's best investing quotes are "You might want a larger margin of safety," "Never invest in a business you don't understand," and "Don't bet on miracles."| Liberated Stock Trader

Portfolio123 Review 2025: Full Hands-on Test

My Portfolio123 testing highlights its solid stock screening, financial database, and easy integration for commission-free trading. Charting and usability can be improved, but it is good for dividend and growth investors.| Liberated Stock Trader

Tested: 6 Best Free Real-Time Stock Quote & Charts 2026

My tests show that the best free real-time quotes and live stock charts are available on TradingView, Firstrade, TC2000, and Yahoo Finance. Real-time stock quotes cost money, but these companies provide exchange data and charts for free.| Liberated Stock Trader

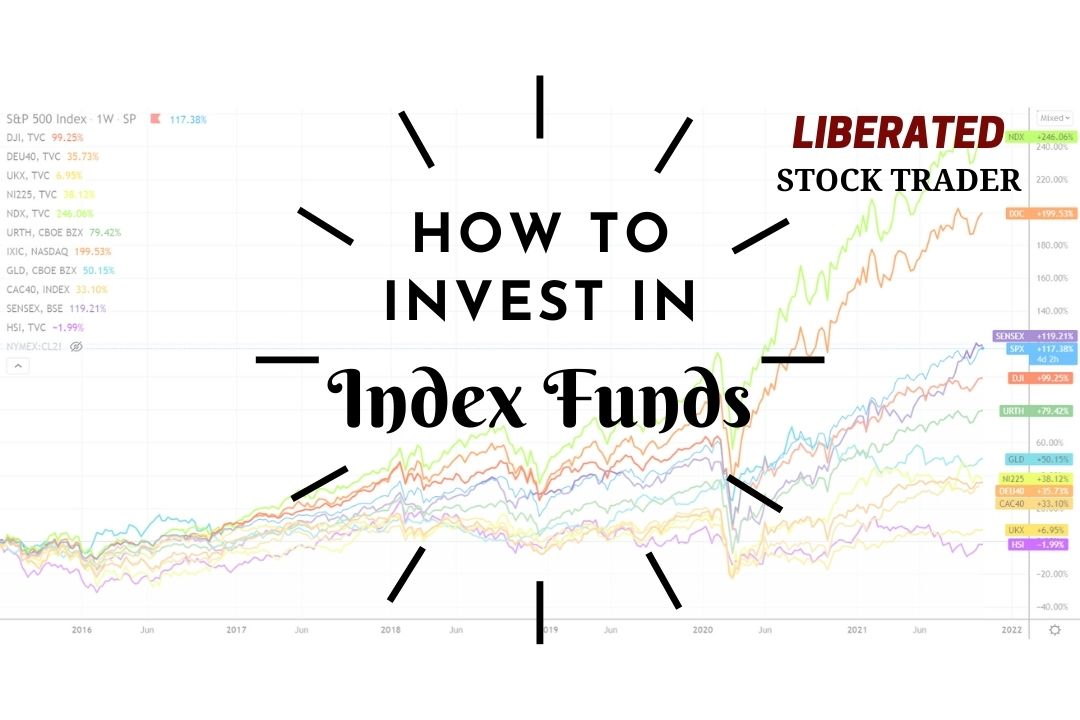

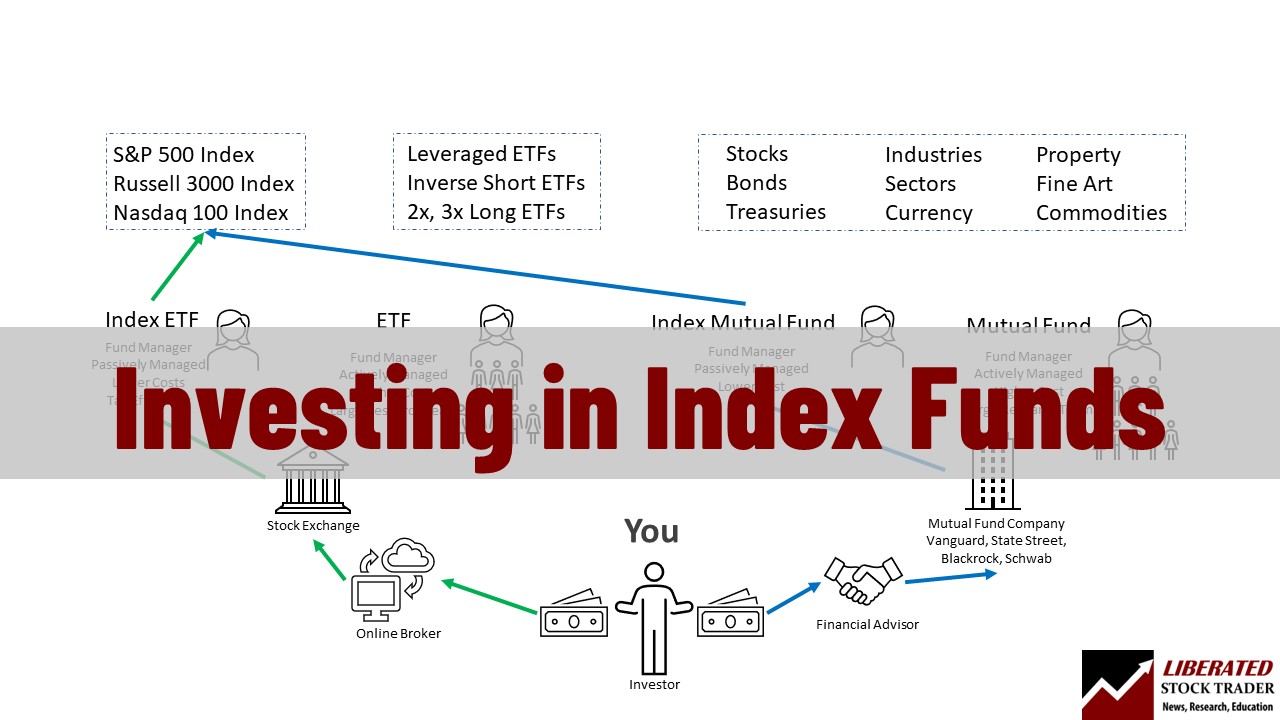

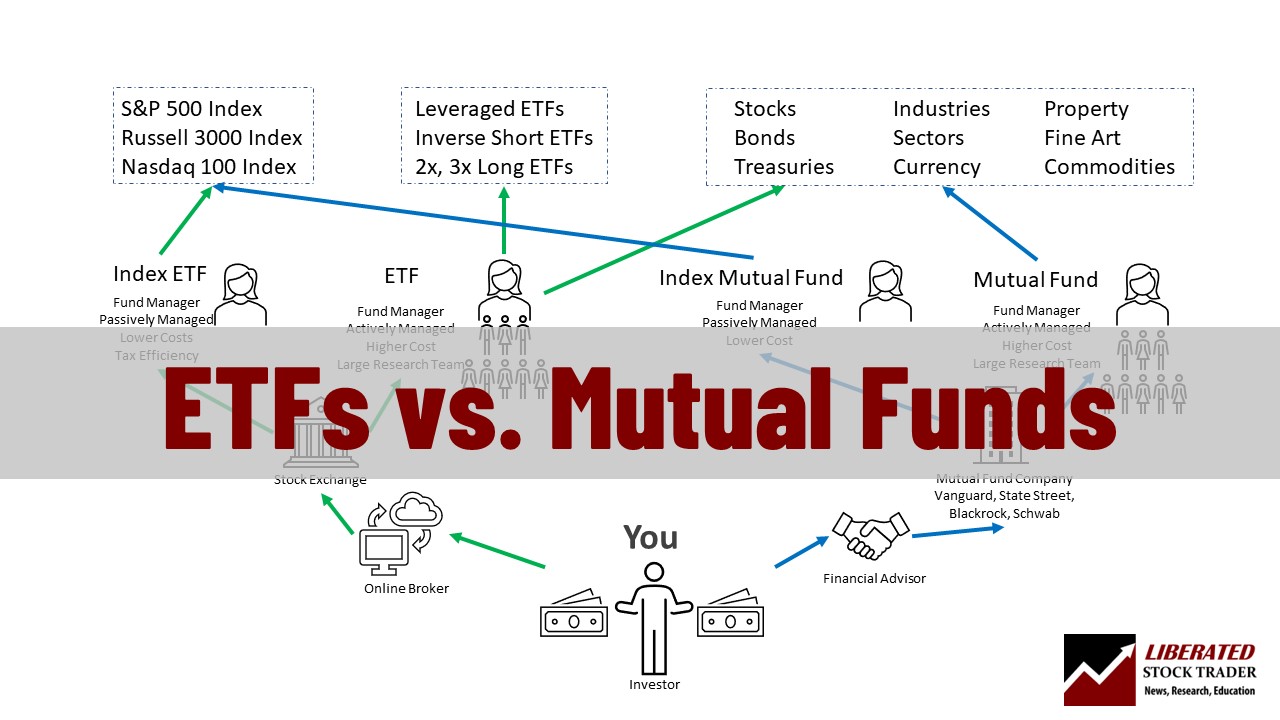

Index Fund Investing: Your Guide to Low-Cost Diversification

Investing in index funds is a great way to diversify your portfolio and reduce risk. Index funds track the performance of major stock market indices, such as the S&P 500 or Dow Jones Industrial Average. Index funds are low-cost and have been shown to outperform actively managed mutual funds in the long run.| Liberated Stock Trader

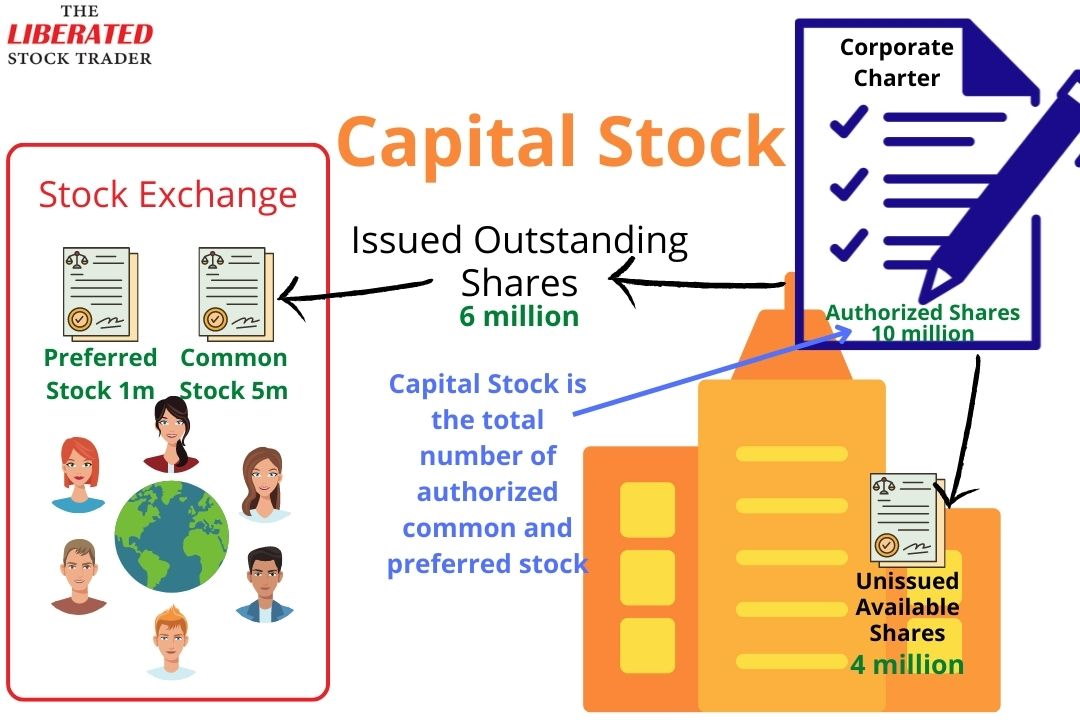

Common vs. Preferred Strategies Explained

Common stock has voting rights and price appreciation in line with market prices, whereas preferred stock does not. However, preferred stock has higher priority dividend payments and liquidity rights in case of insolvency. The downside of preferred stock is that it has no voting rights, and they are callable.| Liberated Stock Trader

Preferred Stock Dividends: An Investors Advantage Explained

Preferred stock dividends are a form of payment made to preferred stock shareholders. Preferred stock is a type of ownership in a company granting privileges such as priority over common stockholders in the event of bankruptcy or liquidation.| Liberated Stock Trader

13 Pro Tips Before Investing in Index ETFs

You can safely invest in index funds through mutual fund companies or as an index ETF directly through your broker. Investing in an index fund ETF is the most cost-effective, liquid, and efficient way to diversify your portfolio.| Liberated Stock Trader

Investment Turnover: Secret Insights to Company Financials

Investment turnover is calculated by comparing a business's revenue to the sum of its equity and debt, providing insight into the company's management's ability to deploy its financial resources.| Liberated Stock Trader

P/E Ratio Mastery: Invest Like a Wall Street Pro (Proven)

The Price to Earnings Ratio is a commonly misunderstood calculation for determining a company's relative value. The PE Ratio is only useful for comparing companies in the same industry with similar business models. It should not be used to compare radically different businesses.| Liberated Stock Trader

PEG Ratio Mastery: Unlock High-Growth Stock Picks

The Price/Earnings to Growth (PEG) ratio helps investors find growth at a reasonable price. The PEG ratio is an incredibly valuable metric calculated by dividing the Price-to-Earnings (P/E) ratio by the company's earnings growth rate.| Liberated Stock Trader

How Market Makers Work: Facilitators or Manipulators?

Market makers provide liquidity by constantly being ready to buy or sell a particular security, ensuring that trades can be executed quickly and at fair prices.| Liberated Stock Trader

How to Find High Alpha Stocks To Invest In | 2025 Guide

Alpha measures a stock, fund, or asset's performance relative to its benchmark. It is often expressed as a percentage. For example, if an investment increases in value by 10 percent but the market benchmark increases by 5 percent, then the alpha would be +5%.| Liberated Stock Trader

Qualified Dividends: Your Path to Tax-Efficient Profits

Investors need to ensure that the stocks they hold meet specific criteria set by the IRS to take advantage of qualified dividends. These criteria include holding the stock for 60 days for common stock and 90 days for preferred stock.| Liberated Stock Trader

Capital Stock: Pro Examples & Research for Investors

Capital stock, also called authorized shares or authorized capital, is the maximum number of shares a company can issue to shareholders. A corporation's charter declares the number and type of stock it can issue, so no more than this amount can be issued.| Liberated Stock Trader

Boost Income: 3 Tested High-Yield Dividend Stock Strategies

To find high-yield dividend stocks requires scanning for key criteria such as dividend yield, growth, payout ratio, and EPS. A safer and more profitable strategy will incorporate value investing criteria like margin of safety and price to sales.| Liberated Stock Trader

Great Crash of 1929: Historical Stock Market Insights

The 1929 stock market crash was caused by an equities bubble fueled by lax monetary policy and easy access to credit.| Liberated Stock Trader

Trading Stock Futures? Read Our Insider Starter Guide First!

Stock futures are derivative contracts that track the future price of a certain stock. They are agreements to buy or sell a specific stock at a predetermined price on a set date in the future.| Liberated Stock Trader

Penny Doubling Magic: 30 Days to Millions Revealed

A penny doubled for 30 days will grow into over $5.3 million, or $5,368,709.12. Doubling your penny for 36 days makes you the world's richest person with $343 billion.| Liberated Stock Trader

Mastering Value Investing: A Complete Strategy Workbook +pdf

Value investing is an investment strategy focused on buying stocks trading at a discount relative to their intrinsic or fair value. Academic research shows value investing generates lower risk and higher long-term returns than dividend and growth investing.| Liberated Stock Trader

Is Finviz Worth It In the AI Trading Era? Full Review 2025

After hands-on testing, I found Finviz to be a powerful free stock screener, swift market heatmaps and impressive stock chart pattern recognition.| Liberated Stock Trader

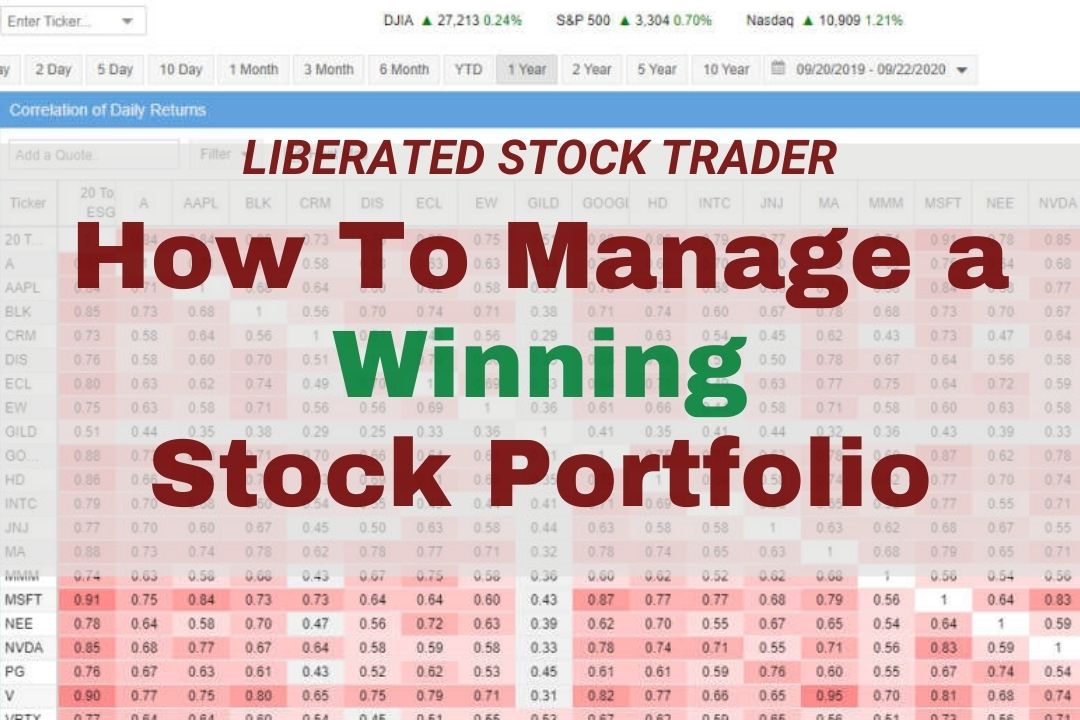

The Art of Balance: Crafting a Truly Diversified Portfolio

A well-diversified stock portfolio should have a low correlation to the broader market. This means that your portfolio won't necessarily follow suit when the broad market goes down.| Liberated Stock Trader

Compounding Power: ETFs and Mutual Funds Face Off

ETF tax efficiency, liquidity, and low costs are perfect for independent investors. If you want someone to manage your money then mutual funds.| Liberated Stock Trader

Bond Investing 2.0: Intelligent Approaches for Higher Returns

Typically stocks return 7% to 10% per year over ten years, while bonds return a lower 4-6%. Investments in bonds tend to be less volatile than stocks and, thus, provide more consistent returns.| Liberated Stock Trader

The Futures Market and Why Its Not For You (Probably)

The Futures Market is where individuals and institutions buy and sell contracts to deliver a commodity, currency, or security at an agreed-upon time. These contracts are standardized for quality, quantity, delivery dates, and settlement terms.| Liberated Stock Trader

I Tested Finviz and TradingView: Here's the Winner

TradingView scores 4.8/5.0 because it does everything well, and Finviz scores 4.3/5.0 because it lacks a community, live trading, and has inferior charts. However, Finviz excels at rapidly visualizing vast stock market data on a single screen.| Liberated Stock Trader

My 7-Year Test: TC2000 vs. TradingView. Here's the Winner

TradingView's depth of features is the key difference versus TC2000. TC2000 offers powerful charts, scanning, and stock and options trading in the USA. But TradingView enables charting, screening, backtesting, and trading stocks, forex, futures, and crypto globally.| Liberated Stock Trader

Stock Holding Periods: Research-Backed Insights

According to my research, during a bull market, investors should hold a stock for between 50 and 300 days to allow profits to develop optimally. The ideal hold time for swing traders is 45 days for an average profit of 30%.| Liberated Stock Trader

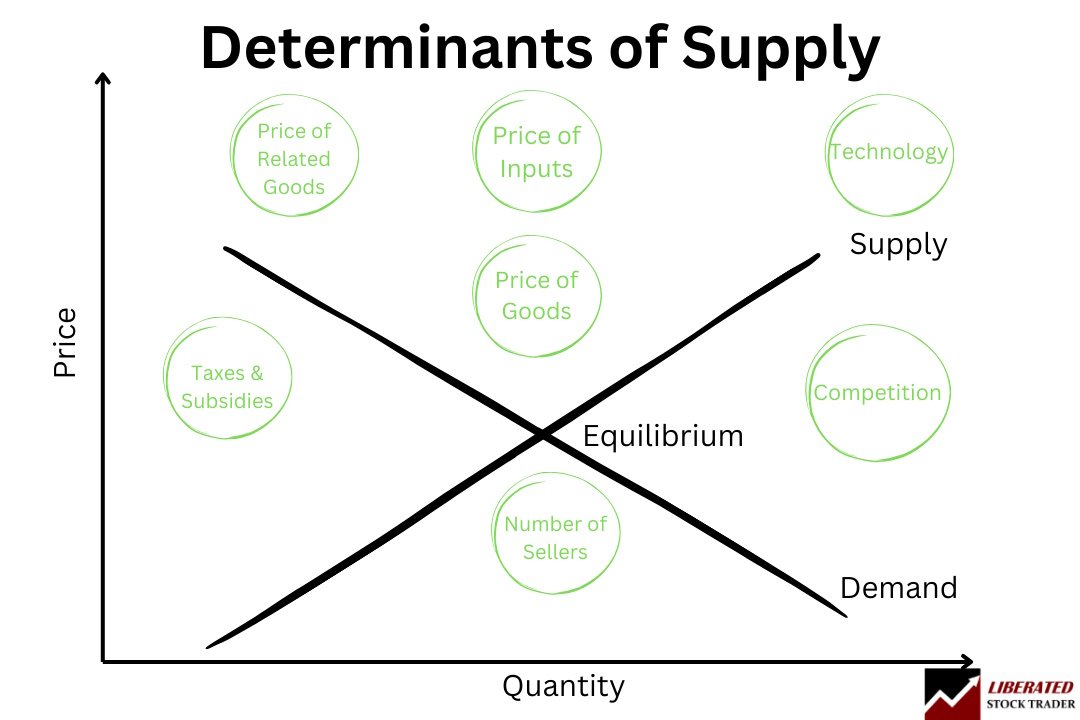

Determinants of Supply: Key Factors and Examples

The determinants of supply are crucial in economics, forming the foundation of functioning markets and the economy. Key determinants of pricing, labor, taxes, competition, suppliers, and technology cause the supply of goods and services to change.| Liberated Stock Trader

Long-Term Debt Ratio: Investor's Essential Guide

The Long-term debt ratio is a financial metric investors use to assess a company's use of long-term debt for financing its operations. A high long-term debt ratio over 25% indicates a higher investing risk, whereas a low ratio indicates a company is in better financial shape.| Liberated Stock Trader

Find Winning CAN SLIM Stocks With This Free Screener

The best CANSLIM stock screeners to accurately find growth stocks are Stock Rover for US investors and TradingView for international traders. Stock Rover has 3 pre-built CANSLIM screeners, and one is available for free.| Liberated Stock Trader

Beat the Market: 12 Legendary Investing Strategies

To consistently beat the market is difficult but not impossible. O'Neill, Greenblatt, Buffett, and Klarman are legendary investors who have beaten the market. I test the strategies and show you the best ways to implement them.| Liberated Stock Trader

101 Stock Trading Terms: Easy Guide For Smart New Investors

We explain the 101 most important stock market terms and decipher financial jargon with simple definitions and practical examples.| Liberated Stock Trader

Find Next Meme Stock: 6 Proven Short Squeeze Tactics

Our testing shows that a high short-interest float greater than 20% and a short-interest ratio (days to cover) over 19 days are the keys to finding potentially explosive short-squeeze stocks.| Liberated Stock Trader

Squeeze Strategies: How to Trade High Short Interest Stocks

Short interest is the total number of outstanding shares sold short. Our data suggests short-sell traders should look for a high short interest float over 6% and a short interest ratio (coverage) greater than 19 days to find highly profitable short squeeze scenarios.| Liberated Stock Trader

Accounts Payable Turnover: Key to Liquidity Insights

The accounts payable turnover ratio quantifies how often a company pays off its suppliers within a specific period. To calculate it, one divides the total purchases made on credit by the average accounts payable for the same period.| Liberated Stock Trader

Inside Hedge Funds: Mechanics, Performance, and Potential

A hedge fund is an investment vehicle that pools capital from high-net-worth investors and flexibly invests in a range of assets, including stocks, bonds, commodities, and derivatives.| Liberated Stock Trader

Liquid vs. Illiquid Stocks: Essential Trading Guide

Most stocks are considered liquid assets because they are traded on open exchanges. But not all stocks are liquid. Penny stocks trading on over-the-counter (OTC) exchanges can have few buyers and sellers, making them illiquid, high-risk investments.| Liberated Stock Trader

ROCE Decoded: Essential Formulas for Smart Investing

By allowing investors and analysts to measure the returns a company generates from its employed capital, ROCE serves as a magnifying glass over the business's operational effectiveness.| Liberated Stock Trader

Mastering EPS Acceleration for Maximum Portfolio Gains

The acceleration in the growth of earnings per share (EPS) is the foundation of selecting high-performing growth stocks.| Liberated Stock Trader

Dividend Yield Mastery: 3X Boost Your Income

To calculate dividend yield, divide the stock's annual dividend per share by the stock's current market price. The dividend yield increases as share prices drop, so to triple your yields, buy stock price panic crashes.| Liberated Stock Trader

Dividend Investing: A Proven DIY Guide for Long-Term Wealth

Our step-by-step guide covers four dividend strategies: high yield, safe dividends, long-term dividend growth, and dividend value stocks. It also shows you the tools and screening criteria you need to find high-quality dividend stocks.| Liberated Stock Trader

How Stock Exchanges Work: Wealth Creation Or Rich Mans Tool?

Stock exchanges are arguably the single most effective method of allocating capital, powering economic growth, and expaning the wealth of nations. But left unregulated they become a systemic risk to countries.| Liberated Stock Trader

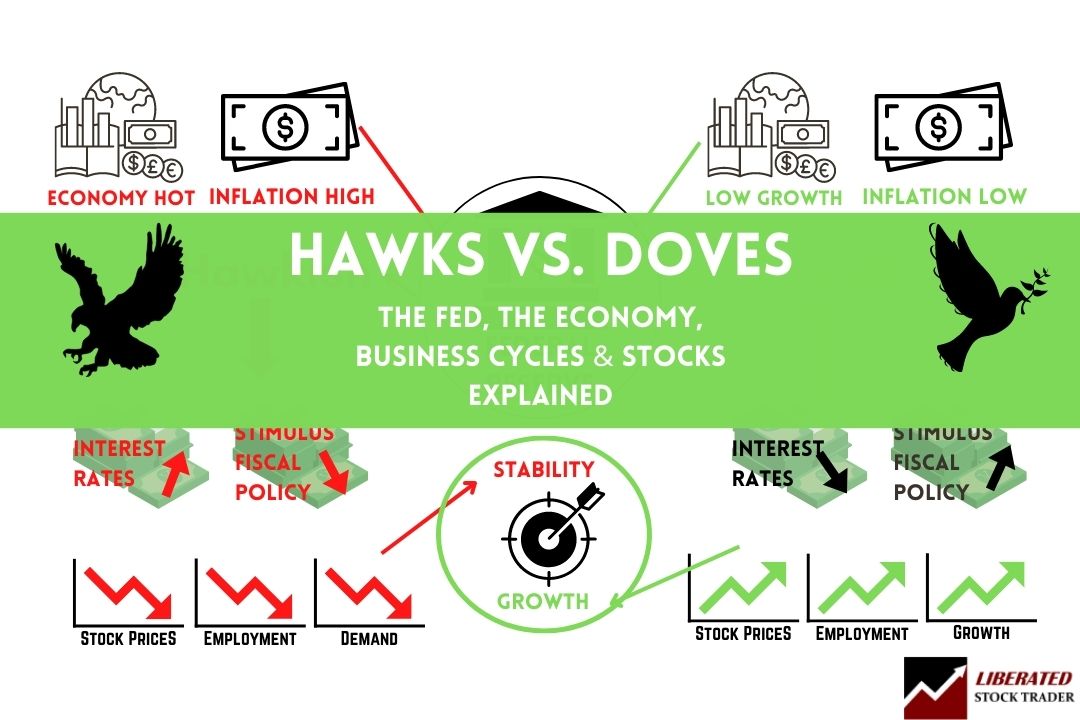

How Fed Hawks and Doves Impact Investors

Hawks and doves are distinct camps in economics regarding fiscal policy. Hawks lean toward tight monetary policy (high interest rates, low government spending), while doves prefer loose monetary policy (low interest rates, high government spending).| Liberated Stock Trader

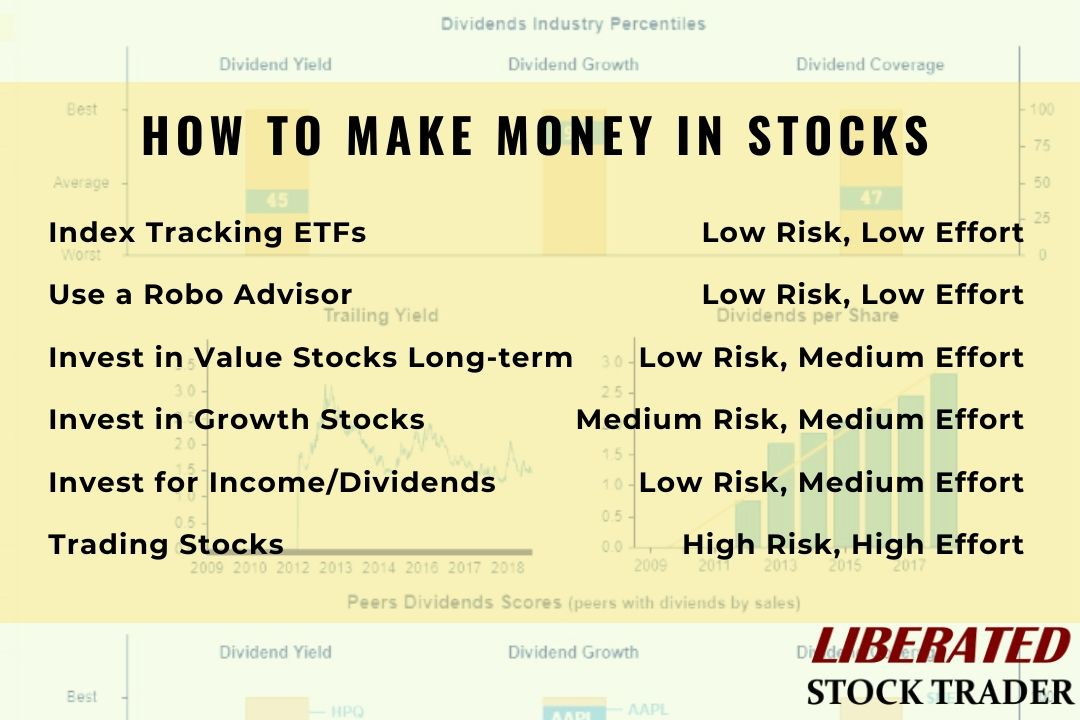

Discover 5 Time-Tested Ways to Make Money in Stocks

The five time-tested, proven ways to make money in the stock market are investing in long-term ETFs, investing in value stocks, a portfolio of growth stocks, dividends, and stock trading.| Liberated Stock Trader

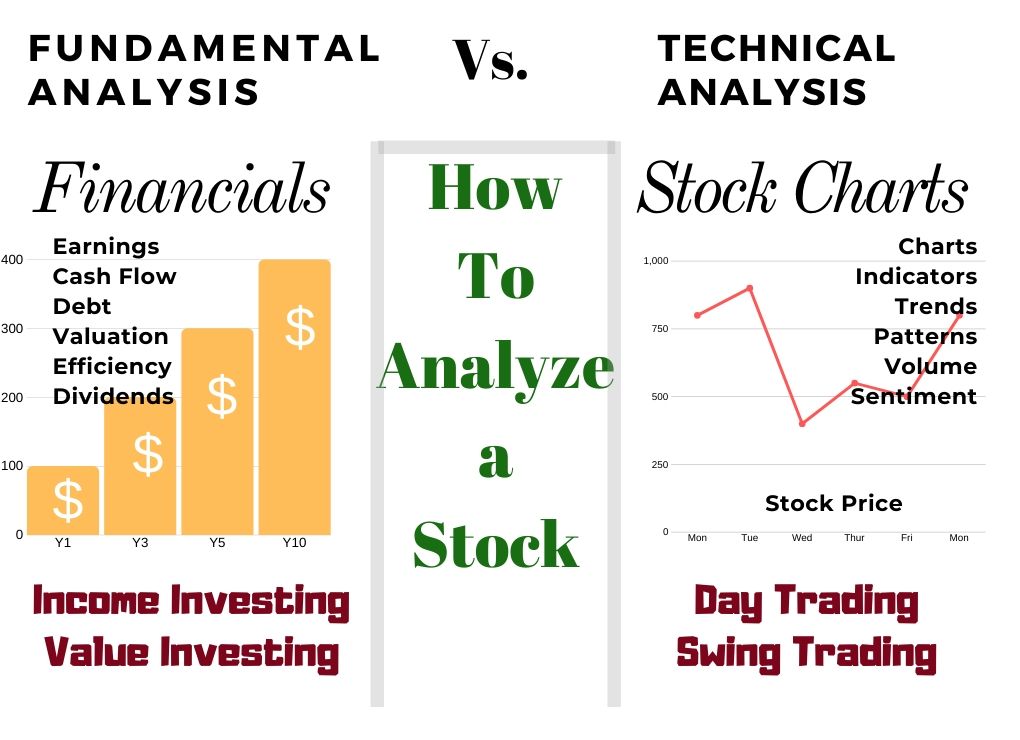

Use Technical & Fundamental Analysis For Improved Investing

There are two ways to analyze stocks. Fundamental analysis, which evaluates criteria such as PE ratio, earnings, and cash flow. Technical analysis, which involves studying charts, stock prices, volume, and indicators.| Liberated Stock Trader

Points in Stocks, Bonds, Futures & Forex: Easy Guide

A one-point move in a stock price equals a one-dollar change. When someone says a stock is down two points, its price has declined by two dollars. Points in a stock index are similar to points in a stock, but instead of referring to the actual stock price, they refer to an index's performance.| Liberated Stock Trader

Practical ROE Analysis: That Boosts Investment Returns

Return on Common Stockholder's Equity (ROCE) is a financial ratio measuring the profitability relative to the common equity shareholders have invested in a company.| Liberated Stock Trader

Economic Value Added (EVA): Investor's Essential Guide

Economic value added, or EVA is a sophisticated measure for assessing a company's financial performance and creating shareholder wealth by measuring the residual income after deducting the cost of capital.| Liberated Stock Trader

Mastering the Income Statement: Pro Investor Secrets

Investors use the income statement to understand a company's key metrics, revenue, expenses, profit, and operating costs. It is one of the most important documents investors use to understand a company's financial performance.| Liberated Stock Trader

Avoid a Dead Cat Bounce: and Save Your Trading Account

A dead cat bounce is a short-term asset price recovery after a significant volatile decline, followed by a continuation of the downtrend. Look for a short-lived rally that loses momentum quickly, often trapping bullish traders.| Liberated Stock Trader

Invest Smarter: Net Profit Ratio, Examples & Calculations

The Net Profit Ratio is a key financial ratio for better investing, telling us how efficiently a company generates profit compared to its revenue and competitors.| Liberated Stock Trader

Balance Sheet Mastery: Smart Investor's Cheat Sheet

To read a balance sheet effectively, start by focusing on three main sections: assets, liabilities, and equity. Assets represent what the company owns, liabilities show what the company owes, and equity reflects its net worth.| Liberated Stock Trader

Discover Dividend Stars: 5-Step Stock Screening Method

To find the best dividend growth stocks, we need to screen for specific criteria. Find stocks with a 10+ year history of growing dividends, a sustainable payout ratio, 5-year sales growth over 4%, and a margin of safety greater than 0.| Liberated Stock Trader

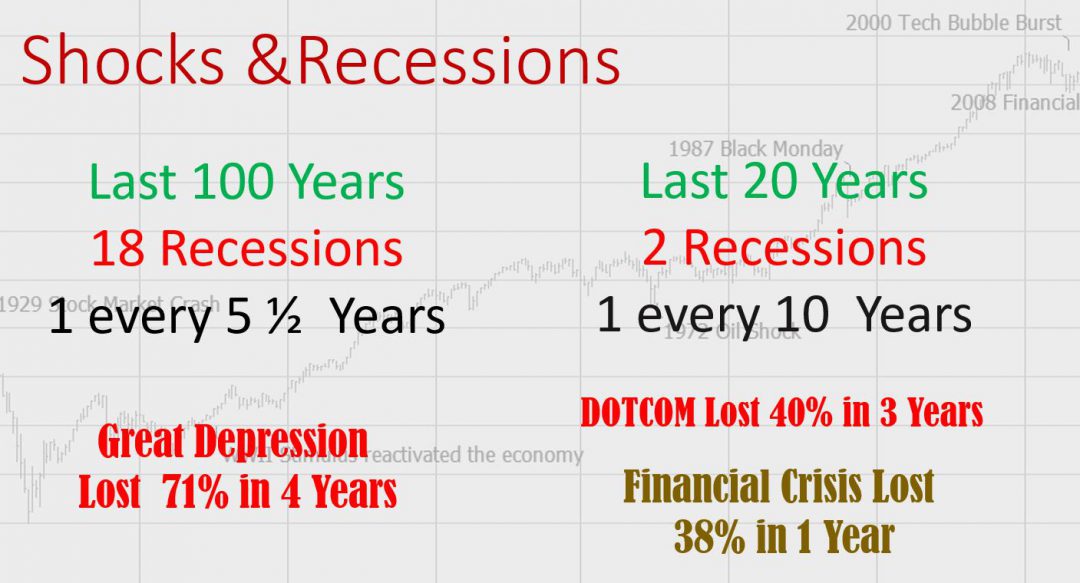

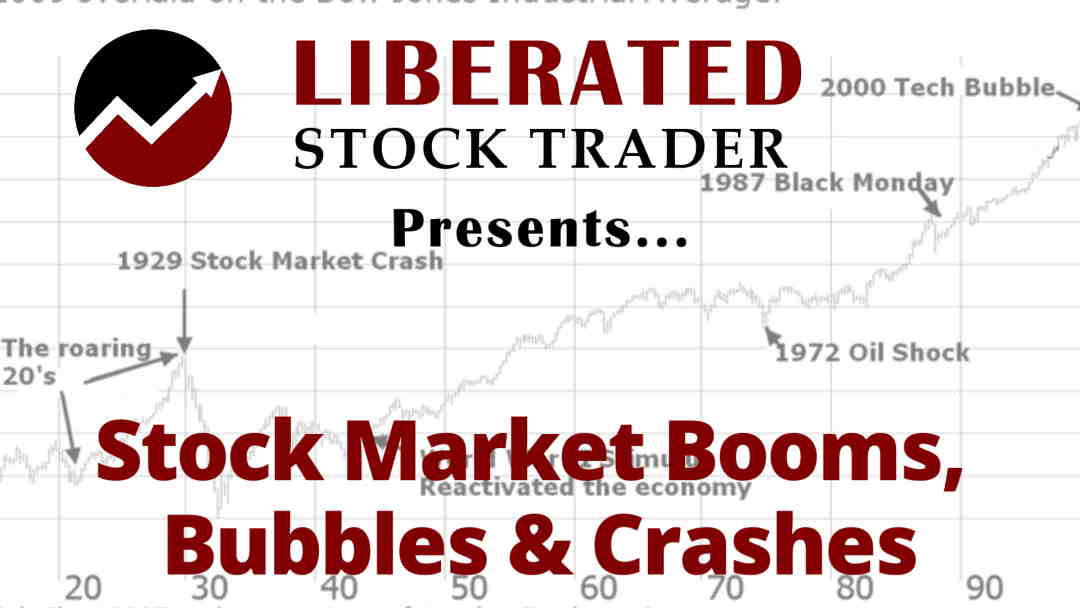

Market Crashes: Lessons Learned To Protect Your Profits

Our research shows that asset bubbles, easy access to cheap credit, weak regulation, and poor institutional risk management are the causes of crashes.| Liberated Stock Trader

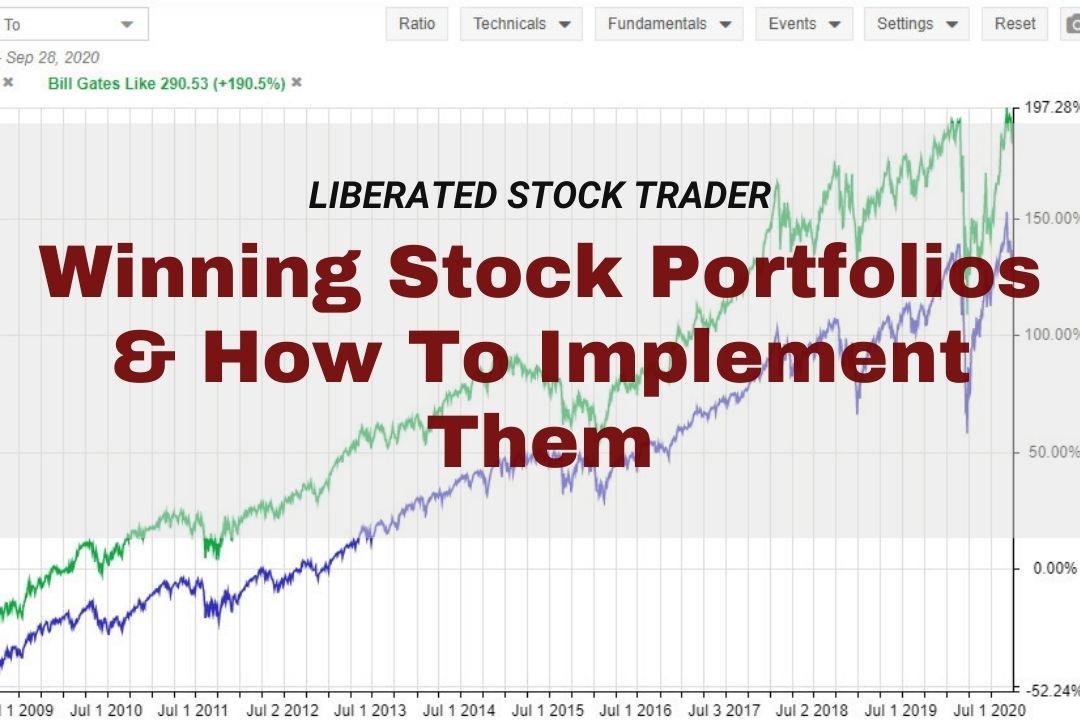

13 Winning Stock Portfolio Examples to Copy Now

Our years of performance testing reveal the world's best-performing stock portfolios are Berkshire Hathaway, CANSLIM, GreenBlatt's Magic Formula, and the FAANG portfolio. We share examples and show you how to implement them.| Liberated Stock Trader

Boost Returns: 7 Expert Stock Portfolio Management Tactics

Managing a stock portfolio entails seven crucial tasks: conducting research, analyzing performance, rebalancing holdings, assessing correlations, planning future income, optimizing tax benefits, and analyzing future performance.| Liberated Stock Trader

I Tested 10 Day Trading Platforms: Here's the Winners

According to testing, the top day trading software is TrendSpider's backtesting, scanning, and trading bots, and Trade Ideas with AI automated trading signals, and free stock trades.| Liberated Stock Trader

My 30-Year Study Shows Buy-and-Hold Investing Wins

Our research shows that long-term buy-and-hold investing leads to significant profits. Over the past 30 years, annual stock market returns have averaged 10.7%, bonds and real estate yielded 4.8%, and gold returned 6.8%.| Liberated Stock Trader

7 Ways to Uncover Quality Dividend-Paying Value Stocks

Our research combines criteria for selecting value stocks and dividend-paying stocks to create seven strategies for finding under-valued dividend stocks. We include the exact criteria to use and a step-by-step guide to implementing them into a stock screener.| Liberated Stock Trader

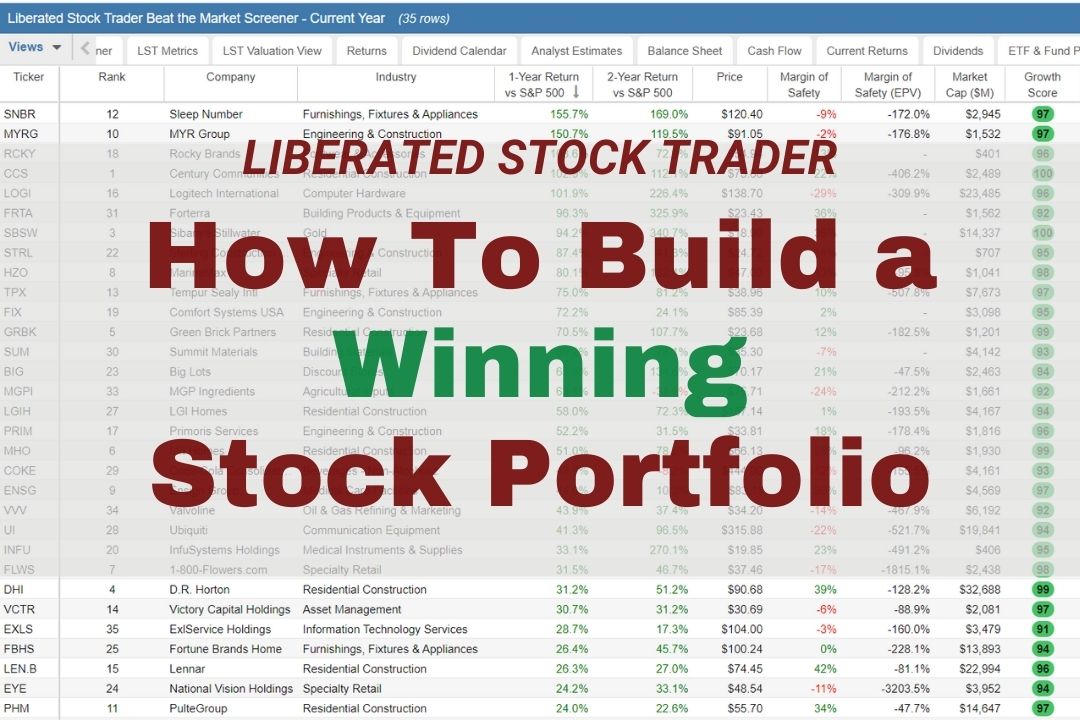

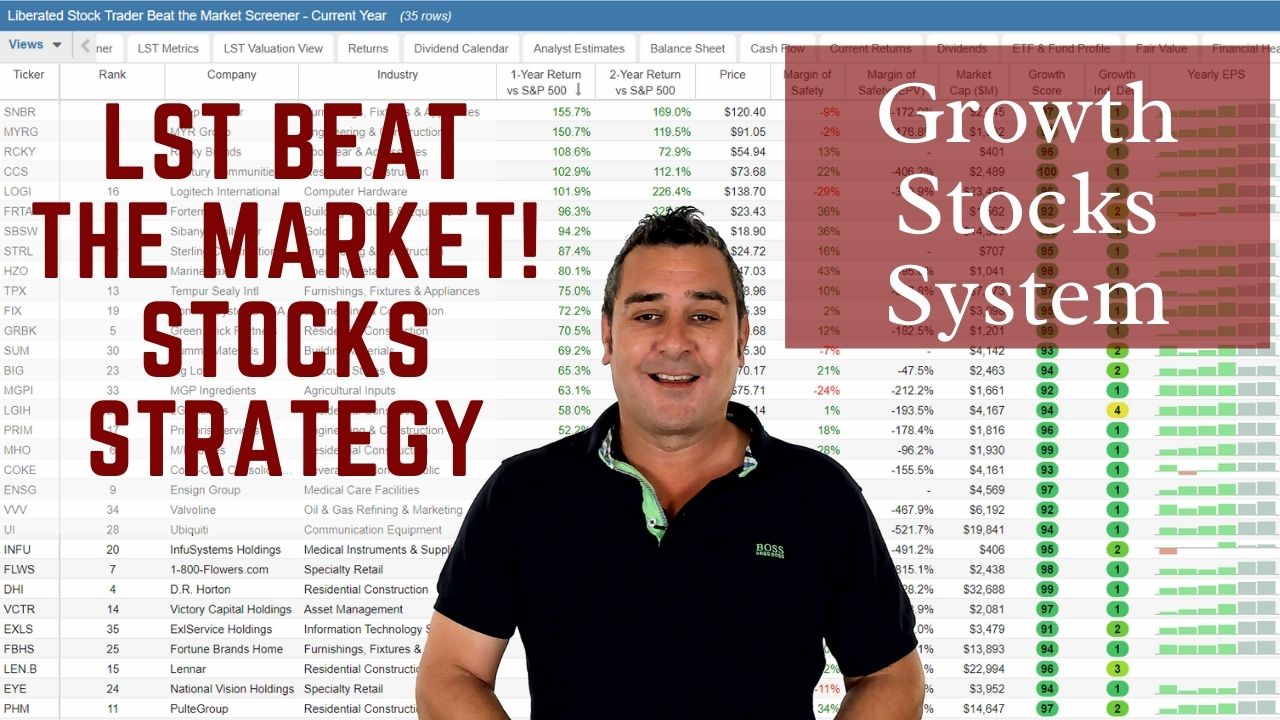

Find High-Quality Growth Stocks: Our Proven Strategy

Decades of research and testing unveiled the Liberated Stock Trader Beat the Market System. Our 9-year, backtested, and proven strategy targets 35 financially| Liberated Stock Trader

Calculate Intrinsic & Fair Value of Stocks + Excel Calculator

To calculate the intrinsic value of a stock, estimate a company's future cash flow, discount it by the compounded inflation rate, and divide the result by the number of shares outstanding. The result is a stock's fair value.| Liberated Stock Trader

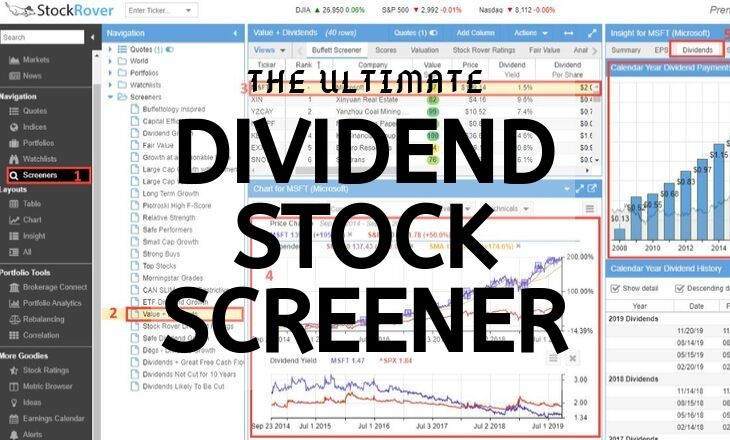

4 Ways to Find Top Dividend Stocks: Ultimate Screener Guide

Our research shows you how to create the best dividend stock screener; you must decide on a high-yield, safe, or dividend growth strategy. Next, choose our tested criteria for your screener, like payout ratio, yield, and coverage.| Liberated Stock Trader

Cash Flow Statement Explained with Examples & Ratios

Cash flow is the lifeblood of a company, and the cash flow statement shows how much money was generated and spent during a given period, which makes it invaluable for investors looking to invest in a company.| Liberated Stock Trader

Buffett's Stock Secrets: Ultimate Screening Guide

The best Buffett and Graham stock screener is Stock Rover, which provides eight fair value, intrinsic value, and forward cash flow calculations to help you build a great portfolio.| Liberated Stock Trader

Margin Trading Truths: Mastering Risk Management

Our research shows that overconfidence and a lack of a robust trading plan are the biggest reasons traders lose when trading with margin or leverage.| Liberated Stock Trader

Operating Profit Margin: Investor's Essential Guide

Operating Profit Margin, often represented as a ratio or percentage, reflects the proportion of revenue after accounting for the costs and expenses associated with a company's primary operations.| Liberated Stock Trader

IPO Investing: Starter Guide To Trading IPOs Profitably

An IPO happens when a company issues common stock or shares to the public for the first time, allowing everyday investors to buy a piece of the company. This transition from a private to a public company is a major step, opening doors to masses of low-cost finance.| Liberated Stock Trader

How to Read Stock Charts: The Key to Profitable Trading +pdf

To read stock charts you need to use stock charting software, select your chart type, configure your timeframe, determine price direction using trendlines and use indicators to estimate future prices.| Liberated Stock Trader

Stock Rover vs Finviz 5-Year Test | Rated & Ranked 2025

My comparison of Stock Rover vs. Finviz reveals that Stock Rover is best for screening, stock research, and portfolio management. Finviz is better at stock pattern recognition and heat maps. I wholeheartedly recommend Stock Rover.| Liberated Stock Trader

102 Mind-Blowing Stock Market Facts You Never Knew

Fun stock facts: Microsoft is worth more than Brazil's stock market. Microsoft, Apple, and Google are worth more than the Chinese stock market. Apple is worth more than the entire GDP of India?| Liberated Stock Trader

MetaStock R/T Review 2025: My 9-Year Experience Revealed

My MetaStock review testing reveals powerful charting, system backtesting, forecasting, and Xenith global real-time financial news for traders. It has unbeatable charts, indicators, and drawing tools, but it needs to be easier to use. It has unbeatable charts, indicators, and drawing tools, but it needs to be easier to use.| Liberated Stock Trader

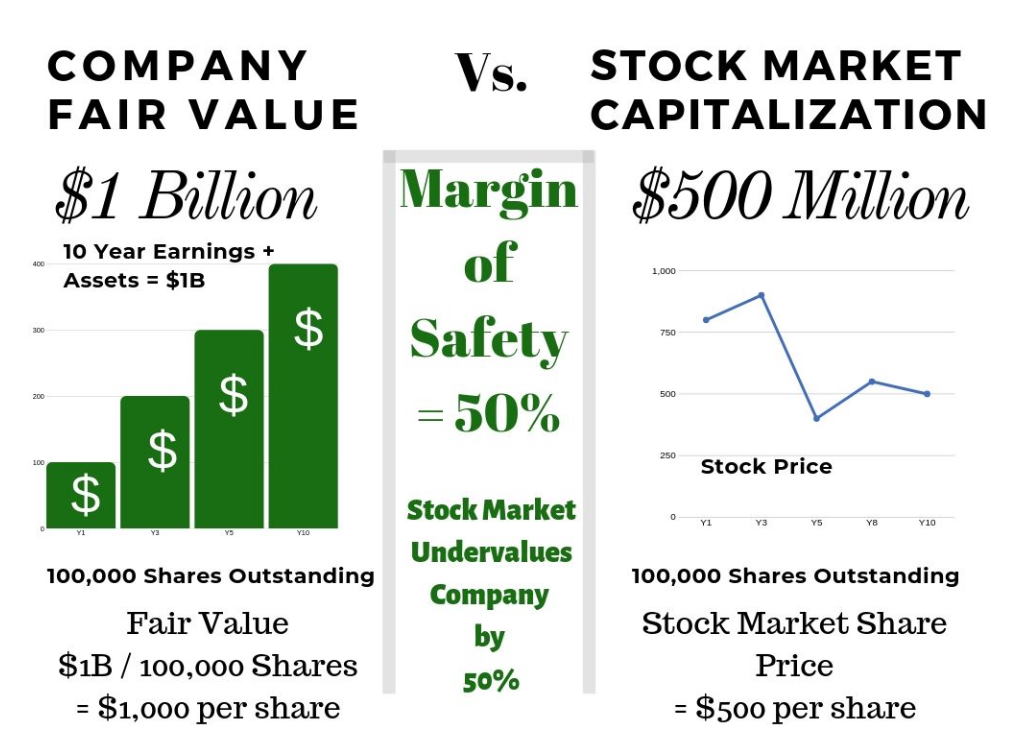

Buffett's Margin of Safety: Calculate & Invest Like the King

To calculate the margin of safety, estimate the next ten years of discounted cash flow (DCF) and divide it by the number of shares outstanding to get the intrinsic value. The difference between the intrinsic value and the stock price is the margin of safety percentage.| Liberated Stock Trader

I Tested Firstrade, Schwab & Fidelity: Here's What I Found

When Firstrade is compared to E-Trade, Schwab, and Fidelity, it becomes clear that Firstrade stands out with its wide range of commission-free stocks, ETFs, and option contracts.| Liberated Stock Trader

10 Top Technical Analysis Tools for Traders [Tested 2025]

My in-depth testing shows that TradingView, TrendSpider, and Trade Ideas are the best tools for traders, and Stock Rover is superior for investors. Each provides unique benefits, features, and price points.| Liberated Stock Trader

TradingView Review & Test: Is It Worth Using In 2025

My 2025 testing awards TradingView 4.8 stars due to its continued innovation in chart analysis, pattern recognition, screening, and backtesting. TradingView is my top recommendation for US and international traders.| Liberated Stock Trader

Top 10 Backtesting Tools of 2025 to Boost Your Trading

My research shows the best stock backtesting and auto-trade software are TrendSpider, Trade Ideas, and Tradingview. My testing process selected TrendSpider as the overall winner because it offers the most flexible, code-free, multilayer backtesting.| Liberated Stock Trader

Top 10 Stock Market News Services Full Test and Review

My test results show the best financial news services are Benzinga Pro, MetaStock R/T, Bloomberg, the Wall Street Journal, and the Economist. Each provides trustworthy stock market news for investors.| Liberated Stock Trader

Top iPhone Trading Apps: Real Results from Testing

Our research shows the three best iPhone stock apps are TrendSpider for powerful AI-automated stock chart pattern recognition, TradingView for stock charts and social, and Firstrade for free stock trades.| Liberated Stock Trader

TrendSpider Review 2025: Is AI-Powered Trading Worth It?

My testing awards Trendspider 4.8/5 stars due to its innovation. Its powerful algorithms recognize trendlines, chart patterns, and candlesticks automatically. It also has automated trading bots, real AI LLMs, and powerful point-and-click back- testing.| Liberated Stock Trader

Is Motley Fool Worth It in 2025? My Real Test Results

After four years of independent testing, I confirm Motley Fool Stock Advisor has an excellent performance track record of stock selection that outperforms the market. Motley Fool provides an impressive stock advisor service for long-term growth investors.| Liberated Stock Trader

10 Best Stock Screeners of 2025 - Full Test & Comparison

My rigorous testing shows the best free stock screeners are Stock Rover, TradingView, and Finviz. For premium screening, TrendSpider, Stock Rover, and Trade Ideas lead the pack.| Liberated Stock Trader