How Your Industry Impacts Interchange Rate | Clearly Payments

The industry you are in has an impact on your payment processing fees and interchange rates. This is how to navigate those credit card fees.| Credit Card Processing and Merchant Account

How Merchants Can Dispute a Chargeback - Credit Card Processing and Merchant Account

How merchants can dispute a chargeback and the process to get your funds back after a customer issues a chargeback for your business.| Credit Card Processing and Merchant Account

How Does Credit Card Processing Work in Canada - Credit Card Processing and Merchant Account

Learn how credit card processing works in Canada, including authorization, settlement, fees, key players, and how merchants can reduce costs.| Credit Card Processing and Merchant Account

Comparison and List of Payment Acquirers, ISOs, and Aggregators

Comparison and list of payment processors: Acquirers, Independent Sales Organizations (ISOs or MSPs), and Aggregators (PSPs or PayFacs)| Credit Card Processing and Merchant Account

Card Brands vs Card Networks in Payment Processing - Credit Card Processing and Merchant Account

This gives an overview of card brands and card networks in credit card processing, like Visa, MasterCard, and AMEX, with statistics.| Credit Card Processing and Merchant Account

The Difference Between an Acquirer and ISO in Payment Processing

The Difference Between Payment an Acquirer and ISO in credit card payment processing and the merchant accounts they provide.| Credit Card Processing and Merchant Account

What is an ISO and How do They Work in Payments?

What is an ISO (Independent Sales Organization) in payments and credit card processing, how they work, and their revenue.| Credit Card Processing and Merchant Account

What is AML and KYC in Payments?

Anti-Money Laundering (AML) and Know-Your-Customer (KYC) in payments and credit card processing are crucial safeguards. Here's how it works.| Credit Card Processing and Merchant Account

Chargeback Statistics in Credit Card Processing

Chargeback statistics for credit card processing including common reasons and chargeback rates by industry and country in payments.| Credit Card Processing and Merchant Account

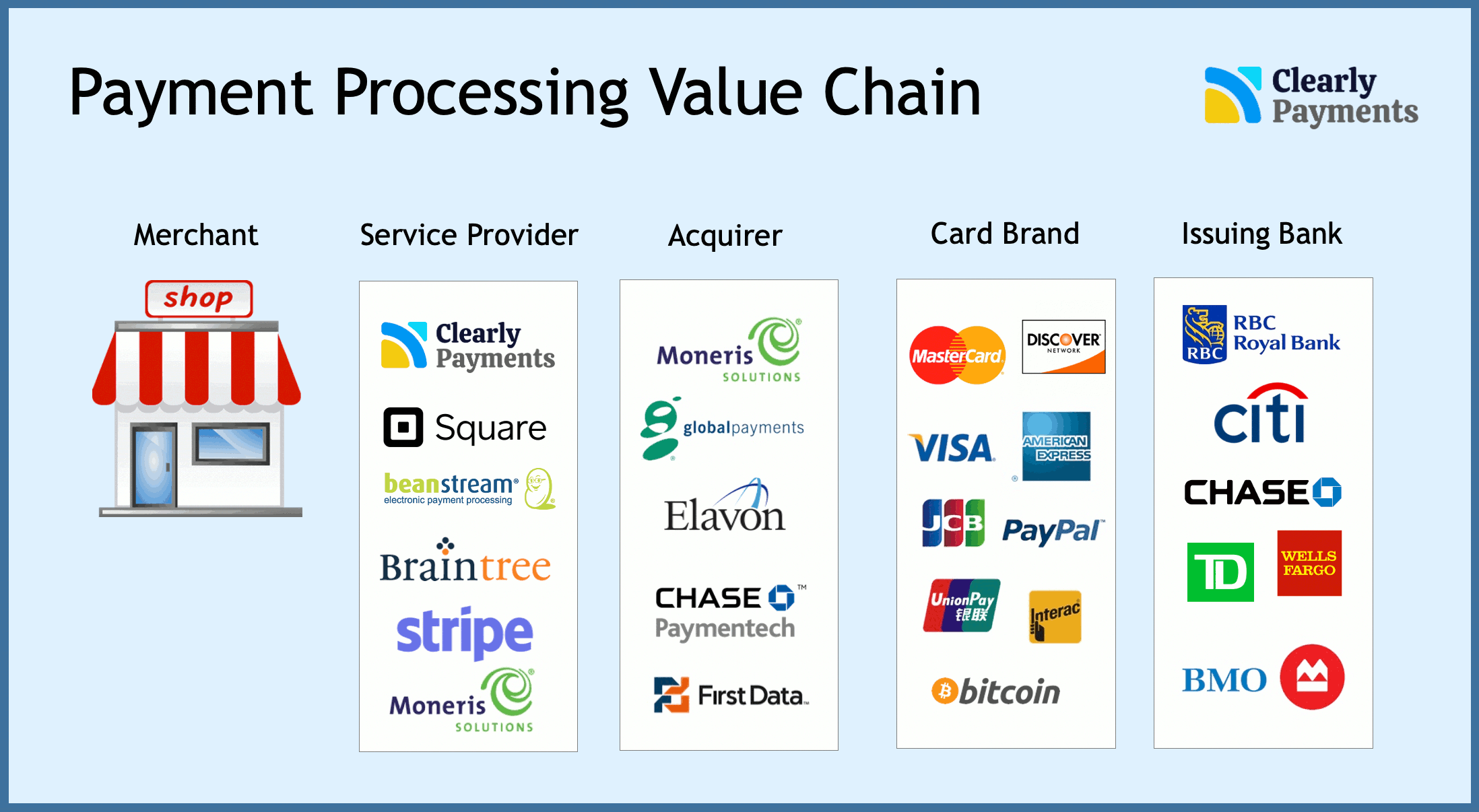

Credit card and payment processing industry overview - Credit Card Processing and Merchant Account

Industry overview for credit card processing and merchant services. This covers who makes money and companies involved in payment processing.| Credit Card Processing and Merchant Account

What is a Payment Processor?

What is a payment processor and how they enable payments: credit cards, debit cards, electronic funds transfers, & digital wallets, and more.| Credit Card Processing and Merchant Account

An Overview of Interchange Rates and Payment Processing in the EU

This article covers credit card interchange rates in the European Union (the EU), fees, regulations, and the payment processing landscape.| Credit Card Processing and Merchant Account