Tax Consequences of Debt Settlement, Consolidation, Bankruptcy

People often aren't aware that debt forgiveness & settlements can be considered as taxable income by the IRS. Learn more about possible tax consequences.| Debt.org

Best Debt Management Companies of 2026 and How to Choose

Looking for a program to manage debt can be overwhelming. Let our list of top debt management companies help you start the journey to controlling your debt.| Debt.org

What Is Nonprofit Debt Consolidation & How Can It Help

Explore nonprofit debt consolidation options today. Save on interest and reduce payments. Start now and regain financial control!| Debt.org

Automatic Stay Bankruptcy: What is it & What Does it Do?

Once you file bankruptcy, an automatic stay will prevent further collection efforts against you. Learn what an automatic stay is and how long it lasts.| Debt.org

Mortgage Debt Forgiveness & Debt Relief

Struggling with payments on your home? Mortgage debt forgiveness can help. Learn more about the Mortgage Debt Relief Act and your options.| Debt.org

How Does Debt Relief Work? Types of Debt Relief

There are many debt relief options available to consumers. Learn about your options & how certified counselors can help design the perfect debt relief plan.| Debt.org

Bankruptcy Alternatives If You Can’t Afford It or Don’t Qualify

Learn what alternatives are available if you don't qualify for bankruptcy or can’t afford bankruptcy and how to get out of debt without filing for bankruptcy.| Debt.org

Bankruptcy Exemptions: What Assets Are Exempt in Chapter 7 & 13?

Bankruptcy exemptions allow you to protect essential property from the bankruptcy trustee who otherwise could seize it and sell it to get back the money the creditors are owed.| Debt.org

Does a Chapter 13 Trustee Monitor Income? | Debt.org

Learn about the role and responsibilities of Chapter 13 Bankruptcy Trustees, whether they can monitor your income, and how to work with trustees.| Debt.org

Bankruptcy Fraud - What Is It?

Bankruptcy fraud is a white-collar crime that can have severe consequences. Learn more about the different types and common mistakes here.| Debt.org

Mortgage Foreclosure Defense Strategies to Save Your Home

Most foreclosures go uncontested, but if you understand successful mortgage foreclosure defense strategies you may be able to save your home.| Debt.org

Freedom Debt Relief: The Pros and Cons

Freedom Debt Relief is a debt settlement company offering the opportunity to settle debts for a fraction of your balance.| Debt.org

Debt and Discrimination

The law protects you from lenders’ discriminatory practices when applying for a personal loan. credit card or mortgage.| Debt.org

Credit Counseling vs. Bankruptcy: Which Should You Choose?

If you have significant debts, you may be deciding between credit counseling & bankruptcy. Learn how to decide & how each impacts your financial standing.| Debt.org

What Happens When You File for Bankruptcy? | Debt.org

Knowing what happens when you file for bankruptcy can help you feel more prepared. Here's what to know and what to expect from life after bankruptcy.| Debt.org

How to File for Bankruptcy and Keep Your Car

File for bankruptcy without losing your car. Explore your options in Chapter 7 & 13 bankruptcy. Learn how to keep your car today!| Debt.org

What To Do When You Can’t Afford Child Support Payments

Falling behind on child support? Find out what happens if you don't pay child support and explore options to avoid serious legal trouble. Act before it's too late!| Debt.org

Debt Relief vs. Bankruptcy: Pros, Cons & Key Differences

Compare debt relief and bankruptcy options. Learn the pros, cons, and key factors to choose the best path for your financial situation.| Debt.org

Find a Reputable Bankruptcy Lawyer - What to Look For

Bankruptcy law is complicated. Learn about what to look for in a bankruptcy lawyer so you can find an attorney that can guide you through.| Debt.org

DIY Debt Settlement: Steps & What You Need to Know

Learn steps to help successfully negotiate your own debt settlement, how it compares to working with a company, risks, and alternatives to help you decide.| Debt.org

Pros and Cons of Filing Bankruptcy: Is it a Good Idea? | Debt.org

Bankruptcy can provide relief from debt, but it will affect your credit score and ability to apply for credit. Weigh the pros and cons of bankruptcy before you file.| Debt.org

What Is a Bankruptcy Discharge?

Learn about what a bankruptcy discharge is after filing, the debts that are dischargeable in bankruptcy, and what happens if the discharge is denied.| Debt.org

Debt Settlement vs. Debt Consolidation Pros & Cons

Debt Settlement can reduce what you owe. Debt Consolidation combines multiple loans into one at a lower interest rate. Both can help save you money.| Debt.org

Understanding Debt Settlement | Is It a Good Idea for You?

Considering debt settlement? Get a balanced view of its benefits and risks, understand the process, and assess if it aligns with your financial goals.| Debt.org

What To Do with Gift Cards from a Store That Is Out of Business?

Even if you have a gift card for a story that is no longer in business, you have a few options for how to get your money back.| Debt.org

Mortgage Assistance and Options to Help with Mortgage Payments

Explore your options to get help with mortgage payments like government help, charities, loan modifications, refinancing your mortgage, and counseling.| Debt.org

Garnishment Process – Creditors Taking Wages to Pay Off Debts

How does the garnishment process work? Is it legal? What is and isn't allowed when a 3rd party is forced to withhold money to pay a debt.| Debt.org

What Does Charged-Off Mean for Your Credit Score?

Charge-offs negatively affect your credit score. Learn what you can do to remove a charge-off & avoid damaging your credit rating further.| Debt.org

Child Support – Financial Laws & Responsibilities

What is the law and what are your responsibilities when it comes to child support payments?| Debt.org

Filing For Bankruptcy Twice: Can You Do It & Is It a Bad Idea?

Depending on the situation, you can file bankruptcy twice. Learn when you can & can’t file for bankruptcy twice, including restrictions, timelines, & alternatives.| Debt.org

Bankruptcy Means Test: Am I Eligible for Chapter 7 Bankruptcy?

The purpose of the bankruptcy means test is to help determine if you're eligible for Chapter 7 bankruptcy. Learn what the means test is & how it works.| Debt.org

The Chapter 13 Discharge Process

Learn about the process for Chapter 13 Bankruptcy discharge, what the hardship discharge is, and what debts are not discharged in Chapter 13.| Debt.org

Cash Out Refinancing: Pros, Cons, & Alternatives

If you need money, it makes sense that you may consider a cash out refinance on your home. Learn what you need to know to make the right decision for you.| Debt.org

Paying Your Debts While Unemployed – Finding New Sources of Income

Unemployment can severely reduce your ability to repay debts and usually requires a reassessment of your financial situation and budget.| Debt.org

Why You Should Never Pay a Collection Agency

It can be intimidating when a collections agency contacts you to recoup debts. Here's what you need to know before paying them what they demand.| Debt.org

Bankruptcy & Student Loan Discharge: Filing Student Loan Bankruptcy

Discharging student loans through bankruptcy is a difficult process but Debt.org can help you navigate your options.| Debt.org

Understanding Credit | Does Debt Settlement Hurt Your Score?

Struggling with debt? Find out if debt settlement hurts your credit. Get insights into credit scores, debt management, and recovery options. Click for more!| Debt.org

How to Manage Your Finances When Serving in the Military -- SCRA

While in the military, it may be hard to manage your money. Learn more about financial literacy, management & programs providing financial help to the military.| Debt.org

The Federal Consumer Credit Protection Act & How it Protects You

Consumer rights sound like it would be a given in America, but it wasn’t until the 1960’s that the government first acted to protect consumers. It started| Debt.org

Credit & Consumer Rights - 5 Credit Laws You Should Know

Federal laws protect personal credit & financial records which establishes security for consumers. Learn more about your rights as a credit consumer.| Debt.org

How Does Debt Affect Military Security Clearances

Debt impacts the ability to obtain a security clearance. Learn the role it plays & what resources the military offers to help you manage your money.| Debt.org

Credit Unions - Benefits, Types & Regulations

Credit unions are nonprofits that offer members a cheaper price on financial services than some banks. Learn the advantages & disadvantages of credit unions.| Debt.org

Debt Help & Advice - Strategies for Tackling Debt

Simple tips for how to avoid debt and how to get out of debt, provided by the experts at Debt.org, America's Debt Help Organization.| Debt.org

Nonprofit Debt Settlement: What Is It? & How It Works

Nonprofit Debt Settlement, a program offered by credit counseling agencies, allows consumers to eliminate credit card debit for less than they owe.| Debt.org

How Long Does Bankruptcy Stay on Your Credit Report?

Bankruptcy stays on your credit report for 7-10 years depending on which bankruptcy you file. Learn how long each type of bankruptcy affects your credit.| Debt.org

Loan Defaults– Getting Rid of Debt when Defaulting on Your Loans

What are the penalties for defaulting on a loan? How you can get rid of debt even while defaulting on your obligations.| Debt.org

Can You Get A Balance Transfer Card With Bad Credit?

Find balance transfer offers for bad credit and manage your debt effectively. Learn about credit unions, secured cards, and more. Start improving today!| Debt.org

Credit Card Debt Consolidation: 7 Ways to Simplify Debt

Credit card debt consolidation combines your debt into simple payments, making it easier to pay off your balances. Learn how it works & where to start.| Debt.org

Types of Bankruptcies Explained: Chapter 7, 11 and 13

Explore the types of bankruptcies available for individuals and businesses. Learn which option fits your situation and start your financial recovery today!| Debt.org

Chapter 7 vs Chapter 13 Bankruptcy: What’s The Difference?

Learn the differences between chapter 7 & chapter 13 bankruptcy, how to choose which option is best for you, and who to turn to for help with your choice.| Debt.org

How To Successfully Negotiate With Debt Collectors

Did you know you can negotiate with debt collectors on the amount you owe? Learn strategies and tips to successfully reduce your debt.| Debt.org

Credit Card Debt Relief: How to Get Help With Credit Card Debt

Getting out of credit card debt can be difficult. Learn about your credit card debt relief options and where to find help to free you from your credit card debt.| Debt.org

LendingClub Review - Personal Loans 2025 | Debt.org

LendingClub is one of the most reputable destinations for online personal loans, usually a great method to borrow for a special need or credit. Learn more.| Debt.org

Upstart Personal Loans & Debt Consolidation Review (2025)

Upstart lends personal loans to consolidate debt. Learn about the qualifications for and interest rates of Upstart loans and decide if they're right for you.| Debt.org

What Happens If You Stop Paying Credit Card Bills? | Debt.org

If you stop making credit card payments you can face serious consequences like fines, lawsuits and debt collector harassment. Learn more with Debt.org.| Debt.org

How to Stop Paying Credit Cards Legally & Get Rid of Debt

Struggling with credit card debt? Learn how to erase credit card debt without paying the full amount owed with these credit card debt forgiveness tactics.| Debt.org

Fair Credit Reporting Act: Know Your Consumer Rights

The Fair Credit Reporting Act protects consumers’ personal financial documents and prohibits unfair actions by big companies and credit reporting agencies.| Debt.org

What is an Upside Down Car Loan & How Do You Avoid It?

Upside-down car loans happen when you use a loan to make a down payment. Get out of an upside-down car loan with these tips & avoid them in the future.| Debt.org

What Is Chapter 7 Bankruptcy and How Does It Work?

Understand the process of Chapter 7 bankruptcy— from filing to discharge, and tips for everything in between. Get help from experts at Debt.org today.| Debt.org

Chapter 13 Bankruptcy: What Is It & How Does It Work?

Chapter 13 bankruptcy allows you to propose a repayment plan to the court and creditors. Learn about qualifying and filing for chapter 13 bankruptcy.| Debt.org

5 Best Ways To Get Rid of Debt

Getting out of debt can seem like an uphill battle but it doesn't have to be. Learn the 11 most common mistakes people make and how to avoid them.| Debt.org

Breaking Down Your FICO Score

You may know your credit score, but understanding how you are graded can be a tool to help you raise your score in the future, and avoid repeating the| Debt.org

Unsecured Debt – Types and Solutions

Unsecured debt like credit card debt is any owed amount that is not tied to assets, and it is typically eligible for debt settlement.| Debt.org

Debt Consolidation Loans: How to Reduce Your Personal Debt

Learn about debt consolidation loans, including how to get a loan to consolidate your debt, benefits & alternatives to consolidation loans.| Debt.org

Debt Management Programs: What You Need to Know

A Debt Management Plan is a 3-5 year payment plan with reduced interest rates facilitated by a non-profit credit counseling agency to help repay debts.| Debt.org

Credit Counseling for Bankruptcy: What are the Requirements?

Before filing bankruptcy, you must complete credit counseling. Learn what credit counseling involves for Chapter 7 or 13 bankruptcy.| Debt.org

Financial Relief for Healthcare | Assistance for Medical Bills

In medical bill debt? Learn about your medical financial assistance options, what happens to unpaid bills & other ways to get out of medical debt.| Debt.org

What You Need to Know About Medical Bills & Collections

Learn more about how medical debt in collections can impact your credit score, how to avoid medical collections, and how to pay off the debt.| Debt.org

Medical Debt Consolidation: Should You Do It?

Learn how medical debt consolidation works to simplify repayment, how to consolidate medical bills, options to consolidate medical debt, and alternatives.| Debt.org

Credit Cards: Types of Debt & How Credit Cards Work

Credit cards are a type of revolving debt that can be very helpful when used properly but can also cause serious debt problems.| Debt.org

Credit Explained: What is it and Why is it Important? - Debt.org

Learn what credit is, how it works, why it is important, and how to build your credit score to ensure you can buy things like homes, cars, and educations.| Debt.org

Credit Counseling: How it Works & How to Select an Agency

Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you.| Debt.org

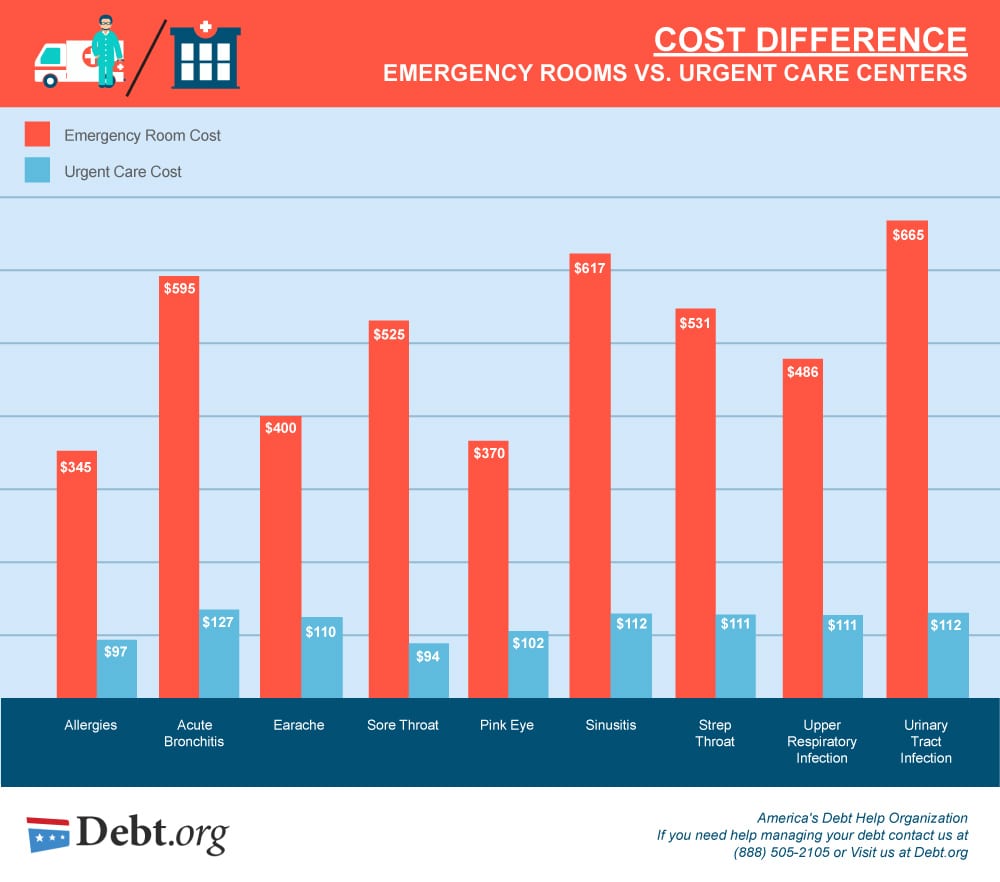

Urgent Care vs Emergency Room Costs, Differences and Options

Deciding between Urgent Care vs Emergency Room? Find the fastest, most effective care for your needs. Click now to understand the best choice for you!| Debt.org