Rebuilding Credit After Bankruptcy - Debt.org

Rebuilding credit after bankruptcy can seem impossible. Learn how long bankruptcy affects your credit & ways to improve your credit score after bankruptcy.| Debt.org

Is An Interest-Only Mortgage Right For You? | Debt.org

Thinking about an interest-only mortgage? Understand how they work, the advantages and disadvantages, and more.| Debt.org

Personal Loans For Debt Consolidation [Pros and Cons]

Personal loans for debt consolidation can lower interests and reduce monthly payments. Learn if debt consolidation with a personal loan is right for you.| Debt.org

How to Build Credit with a Credit Card | Debt.org

It is possible to use credit cards to boost your credit score and reach your financial goals. Learn essential tips to improve your credit.| Debt.org

How To Dispute A Credit Card Charge | Debt.org

Found an error on your statement? Discover how to dispute a charge effectively. Follow these steps to get your money back today!| Debt.org

How to Buy a House With Bad Credit | Mortgages for Bad Credit

There are options available for those with low credit scores to buy a home. Learn about your options and how to obtain a mortgage loan you can afford.| Debt.org

Buying a House – Securing a Mortgage, Buying & Insuring a Home

Recent economic troubles have changed the U.S. housing market, but for most of us who are buying a house, the traditional rules and cautions still apply.| Debt.org

Debt Settlement vs. Debt Consolidation Pros & Cons

Debt Settlement can reduce what you owe. Debt Consolidation combines multiple loans into one at a lower interest rate. Both can help save you money.| Debt.org

Best Ways to Consolidate Debt: What're Your Options?

Learn the different pros and cons of the best debt consolidation options available to help you get out of debt and improve your financial wellbeing.| Debt.org

Veteran & Military Financial Assistance & Debt Relief Options

Struggling with debt? Discover veteran debt assistance options like debt consolidation and financial counseling. Take action to secure your financial future!| Debt.org

What Does Charged-Off Mean for Your Credit Score?

Charge-offs negatively affect your credit score. Learn what you can do to remove a charge-off & avoid damaging your credit rating further.| Debt.org

Downsizing Your Home To Reduce Debt - Requirements & Challenges

If you own your home, switching to a smaller or less-expensive house could be the trick to solve your debt problems.| Debt.org

What Is a Cash Advance on a Credit Card?

A credit card cash advance may seem like an easy way to access cash quickly - but fees and interest rates can make it an expensive option.| Debt.org

Understanding Credit | Does Debt Settlement Hurt Your Score?

Struggling with debt? Find out if debt settlement hurts your credit. Get insights into credit scores, debt management, and recovery options. Click for more!| Debt.org

Credit Reports: How Often Does Your Credit Score Update?

Your credit score doesn’t update instantly. Learn how often your credit score updates & when credit bureaus report credit score changes.| Debt.org

Can I Make a Car Payment with a Credit Card? | Debt.org

Learn more about paying your car payment with a credit card, methods to do it successfully, and the pros and cons associated with each method.| Debt.org

Credit Score Fluctuations: Why Does My Credit Report Fluctuate?

Credit score fluctuations can be difficult to understand. Learn more about why your credit score fluctuates at Debt.org.| Debt.org

What Credit Score Do You Need To Buy a House?

Lenders use credit scores to determine your financial capability to repay a loan. Find out credit score minimums for different types of home loans.| Debt.org

What Is A 30 Year Fixed-Rate Mortgage? [Pros & Cons]

30-year fixed rate mortgages are a staple of the American home buying process. Learn about the advantages and disadvantages.| Debt.org

How to Prioritize Retirement Savings vs. Debt Payoff - Affording Bills

Factors like age and financial resources must be taken into account when deciding whether to save for retirement or pay off debt.| Debt.org

Credit Scoring Models: FICO, VantageScore & More

Credit scoring models are used to help evaluate the creditworthiness of consumers. Learn about FICO, VantageScore and other scoring models.| Debt.org

Loan Defaults– Getting Rid of Debt when Defaulting on Your Loans

What are the penalties for defaulting on a loan? How you can get rid of debt even while defaulting on your obligations.| Debt.org

Benefits of Balance Transfer: Save Money & Reduce Debt

Learn how balance transfers on credit cards can help you reduce debt. Discover how lower interest rates save money and start managing your credit card debt!| Debt.org

Can You Get A Balance Transfer Card With Bad Credit?

Find balance transfer offers for bad credit and manage your debt effectively. Learn about credit unions, secured cards, and more. Start improving today!| Debt.org

How Good Is My Credit Score & What Does it Mean? – Credit Score Grader

Enter your 3-digit credit score to learn about how lenders see your credit score and what you can do to improve it.| Debt.org

Credit Card Debt Consolidation: 7 Ways to Simplify Debt

Credit card debt consolidation combines your debt into simple payments, making it easier to pay off your balances. Learn how it works & where to start.| Debt.org

How To Lower the Interest Rate on Your Credit Card

Learn effective strategies to lower your credit card interest rates today. Start saving by negotiating better terms with your lender!| Debt.org

Personal Loans for College Students in 2025: Pros and Cons

College is expensive and students often face financial hardship. Learn about personal loans for students, pros and cons, and whether they're right for you.| Debt.org

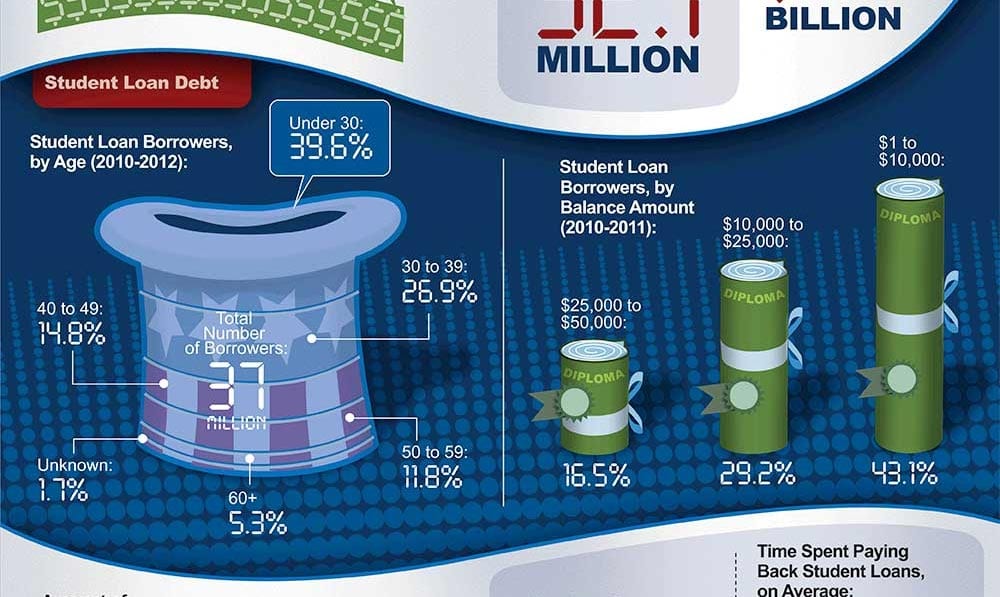

Student Loan Consolidation - Federal & Private Education Loans

Student loan can be one of the largest expenses an adult experiences after graduating college. Learn about the different ways to consolidate student loans, the differences between federal & private student loan consolidation, repayment plan options, & forgiveness.| Debt.org

10 Tips to Shopping for a Car

Here are 10 things you should know before you buy a car, including prioritizing your needs and understanding what car satisfies them.| Debt.org

Breaking Down Your FICO Score

You may know your credit score, but understanding how you are graded can be a tool to help you raise your score in the future, and avoid repeating the| Debt.org

Loans & Credit: Personal Credit & Loan Options

Different types of consumer loans & lines of credit provide options for consumers and businesses to better manage their financial situation & repay debts.| Debt.org

Unsecured Debt – Types and Solutions

Unsecured debt like credit card debt is any owed amount that is not tied to assets, and it is typically eligible for debt settlement.| Debt.org

What Is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) provides you with access to cash based on the value of your home. Learn how they work, and the pros and cons.| Debt.org

What Does Foreclosure Mean for Your Home & Your Mortgage?

Learn about foreclosures, why they happen, and how to avoid them in order to keep your mortgage above water and save yourself from losing your home.| Debt.org

What Is a Balance Transfer Credit Card & How Do They Work?

Learn about balance transfer credit cards, how they work, how to apply, and if you should get a balance transfer card to help pay off your credit card debt.| Debt.org

How to Get a Debt Consolidation Loan with Bad Credit

Ready to consolidate your debts? Find lenders who work with bad credit. Take action for financial freedom now!| Debt.org

Debt Consolidation Loans: How to Reduce Your Personal Debt

Learn about debt consolidation loans, including how to get a loan to consolidate your debt, benefits & alternatives to consolidation loans.| Debt.org

Debt Management Programs: What You Need to Know

A Debt Management Plan is a 3-5 year payment plan with reduced interest rates facilitated by a non-profit credit counseling agency to help repay debts.| Debt.org

What You Need to Know About Medical Bills & Collections

Learn more about how medical debt in collections can impact your credit score, how to avoid medical collections, and how to pay off the debt.| Debt.org

How to Establish Credit: Building Your Credit Score

Visit Debt.org to learn more about how to build and establish a strong credit score.| Debt.org

Credit Report: What’s on Your Credit History Report & Who Checks it?

Credit reports can be confusing. Learn general credit report information including when, where & how to get a credit report.| Debt.org

How To Use Personal Loans To Build Credit

A personal loan is one option to build credit - but there are risks attached. Understand the benefits, downsides and alternatives.| Debt.org

Should I Buy a New or Used Car? Financing and Interest Rates

Learn what you need to know before financing a new or used car, your auto financing options, how to apply for a car loan, & if financing is a good idea.| Debt.org

Debt Consolidation Guide: How It Works [February 2025 ]

Debt consolidation can reduce your monthly debt outgoings by rolling multiple debts into a single payment, using a debt consolidation loan or management plan.| Debt.org

Credit Explained: What is it and Why is it Important? - Debt.org

Learn what credit is, how it works, why it is important, and how to build your credit score to ensure you can buy things like homes, cars, and educations.| Debt.org