Congress Should Not Leave Children Out of Possible Year-End Tax Deal – ITEP

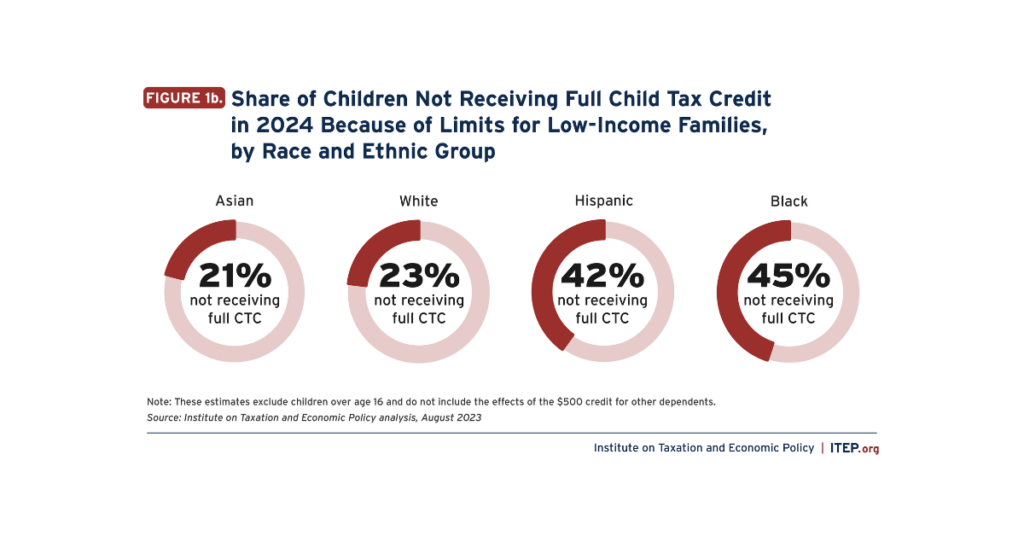

If lawmakers believe it’s worthwhile to extend corporate tax breaks, then it would be entirely unreasonable for them to not conclude the same about tax provisions that help low-income children.| ITEP