Best Debt Management Companies of 2026 and How to Choose

Looking for a program to manage debt can be overwhelming. Let our list of top debt management companies help you start the journey to controlling your debt.| Debt.org

What Is Nonprofit Debt Consolidation & How Can It Help

Explore nonprofit debt consolidation options today. Save on interest and reduce payments. Start now and regain financial control!| Debt.org

How Does Debt Relief Work? Types of Debt Relief

There are many debt relief options available to consumers. Learn about your options & how certified counselors can help design the perfect debt relief plan.| Debt.org

Debt Collection Scams & Scare Tactics

Did you know that there are things that debt collectors are not allowed to do? Learn about the best ways to deal with debt collectors to avoid falling prey to scams & scare tactics.| Debt.org

Bankruptcy Alternatives If You Can’t Afford It or Don’t Qualify

Learn what alternatives are available if you don't qualify for bankruptcy or can’t afford bankruptcy and how to get out of debt without filing for bankruptcy.| Debt.org

Debt.org - America's Debt Help Organization

America's Debt Help Organization - Your Source for Information on Debt Consolidation, Settlement, Student Loans, Bankruptcy and Mortgages.| Debt.org

How to Save Money Each Month [The Basics to Stacking Your Cash]

Want to learn how to save money each month? Here's the basic steps and tips you should take to put more money back in your pockets and savings account.| Invested Wallet

Loan Agreement Terms & How to Write a Loan Contract

Loan agreements ensure both lenders and borrowers know the terms of a loan. Learn what should be included in loan agreements and how to write one.| Debt.org

Can I Still Use My Credit Card After Debt Consolidation?

Generally, you can still use your credit cards after consolidation. Learn more about how to consolidate credit card debt without closing your accounts.| Debt.org

Personal Loans For Debt Consolidation [Pros and Cons]

Personal loans for debt consolidation can lower interests and reduce monthly payments. Learn if debt consolidation with a personal loan is right for you.| Debt.org

Can You Consolidate Debt Into a First-Time Mortgage?

Learn about the pros and cons of consolidating your debt into a new mortgage and whether it's the best debt relief option for you.| Debt.org

Charge-Offs | Understanding Full Payment vs. Settlement

Confused about charge-offs? Learn the pros and cons of paying in full versus settling to enhance your finances. Discover your path to credit recovery!| Debt.org

Can Bankruptcy Clear All My Debt?

No, bankruptcy cannot clear all of your debt. There are restrictions on certain types of debt. Learn more about bankruptcy, discharges, & options from Debt.org.| Debt.org

Debt Relief Programs: Explore Your Options and Make a Plan

Discover the pros and cons of the best debt relief option for your needs - from professional debt management to doing it yourself - and get out of debt.| Debt.org

Can You Consolidate Accounts with Debt Collectors?

Do you have multiple debts with collection agencies? Understand your options and how to successfully consolidate these accounts.| Debt.org

Debt Relief vs. Bankruptcy: Pros, Cons & Key Differences

Compare debt relief and bankruptcy options. Learn the pros, cons, and key factors to choose the best path for your financial situation.| Debt.org

Financial Help for Widows: Government Programs & Managing Debt

Government programs, charities and nonprofits, and professional financial services can help widows with debt management and financial planning.| Debt.org

DIY Debt Settlement: Steps & What You Need to Know

Learn steps to help successfully negotiate your own debt settlement, how it compares to working with a company, risks, and alternatives to help you decide.| Debt.org

Pros and Cons of Filing Bankruptcy: Is it a Good Idea? | Debt.org

Bankruptcy can provide relief from debt, but it will affect your credit score and ability to apply for credit. Weigh the pros and cons of bankruptcy before you file.| Debt.org

Debt Settlement vs. Debt Consolidation Pros & Cons

Debt Settlement can reduce what you owe. Debt Consolidation combines multiple loans into one at a lower interest rate. Both can help save you money.| Debt.org

Understanding Debt Settlement | Is It a Good Idea for You?

Considering debt settlement? Get a balanced view of its benefits and risks, understand the process, and assess if it aligns with your financial goals.| Debt.org

Best Ways to Consolidate Debt: What're Your Options?

Learn the different pros and cons of the best debt consolidation options available to help you get out of debt and improve your financial wellbeing.| Debt.org

Use Real Estate to Take Control of Debt – Home Equity Loan & Refinance

Home loans and refinancing can help you pay off other debts, but it still takes discipline to keep from falling back into a cycle of debt.| Debt.org

Garnishment Process – Creditors Taking Wages to Pay Off Debts

How does the garnishment process work? Is it legal? What is and isn't allowed when a 3rd party is forced to withhold money to pay a debt.| Debt.org

What Does Charged-Off Mean for Your Credit Score?

Charge-offs negatively affect your credit score. Learn what you can do to remove a charge-off & avoid damaging your credit rating further.| Debt.org

Peer to Peer Lending - Types & Advantages

Peer-to-Peer lending connects borrowers with independent lenders. Learn about the advantages & disadvantages along with how P2P lending works.| Debt.org

Filing For Bankruptcy Twice: Can You Do It & Is It a Bad Idea?

Depending on the situation, you can file bankruptcy twice. Learn when you can & can’t file for bankruptcy twice, including restrictions, timelines, & alternatives.| Debt.org

Cash Out Refinancing: Pros, Cons, & Alternatives

If you need money, it makes sense that you may consider a cash out refinance on your home. Learn what you need to know to make the right decision for you.| Debt.org

Discover Personal Loans & Debt Consolidation Review (2025)

Discover is a digital bank offering consumers personal loans for debt consolidation, and its loans come with enticingly low interest rates.| Debt.org

Avant Personal Loans & Debt Consolidation Review (2025)

Avant offers debt consolidation loans for consumers who have been denied from traditional funding sources.| Debt.org

Understanding Credit | Does Debt Settlement Hurt Your Score?

Struggling with debt? Find out if debt settlement hurts your credit. Get insights into credit scores, debt management, and recovery options. Click for more!| Debt.org

Debt Settlement Fees: How Much Will It Cost You?

Need clarity on debt settlement fees? Get detailed info on types, impacts, and negotiation strategies. Act now to take control of your debt relief plan!| Debt.org

How To Avoid Interest on Credit Card

Explore proven methods to avoid interest on your credit cards. Find out how to save money and achieve financial freedom with our expert insights.| Debt.org

Credit Unions - Benefits, Types & Regulations

Credit unions are nonprofits that offer members a cheaper price on financial services than some banks. Learn the advantages & disadvantages of credit unions.| Debt.org

Debt Help & Advice - Strategies for Tackling Debt

Simple tips for how to avoid debt and how to get out of debt, provided by the experts at Debt.org, America's Debt Help Organization.| Debt.org

How to Pay Off a Mortgage Early | Debt.org

Paying off your mortgage early can save you money on interest. Learn how to pay off a mortgage early with these financial strategies.| Debt.org

Nonprofit Debt Settlement: What Is It? & How It Works

Nonprofit Debt Settlement, a program offered by credit counseling agencies, allows consumers to eliminate credit card debit for less than they owe.| Debt.org

How Long Does Bankruptcy Stay on Your Credit Report?

Bankruptcy stays on your credit report for 7-10 years depending on which bankruptcy you file. Learn how long each type of bankruptcy affects your credit.| Debt.org

Loan Defaults– Getting Rid of Debt when Defaulting on Your Loans

What are the penalties for defaulting on a loan? How you can get rid of debt even while defaulting on your obligations.| Debt.org

Benefits of Balance Transfer: Save Money & Reduce Debt

Learn how balance transfers on credit cards can help you reduce debt. Discover how lower interest rates save money and start managing your credit card debt!| Debt.org

Can You Get A Balance Transfer Card With Bad Credit?

Find balance transfer offers for bad credit and manage your debt effectively. Learn about credit unions, secured cards, and more. Start improving today!| Debt.org

Credit Card Debt Consolidation: 7 Ways to Simplify Debt

Credit card debt consolidation combines your debt into simple payments, making it easier to pay off your balances. Learn how it works & where to start.| Debt.org

Medicare: Understanding Health Insurance for Seniors

The different parts of Medicare can help pay for medical costs incurred by the elderly. Learn about the options to help with your medical debt and health insurance.| Debt.org

Credit Card Debt Relief: How to Get Help With Credit Card Debt

Getting out of credit card debt can be difficult. Learn about your credit card debt relief options and where to find help to free you from your credit card debt.| Debt.org

LendingClub Review - Personal Loans 2025 | Debt.org

LendingClub is one of the most reputable destinations for online personal loans, usually a great method to borrow for a special need or credit. Learn more.| Debt.org

What Happens If You Stop Paying Credit Card Bills? | Debt.org

If you stop making credit card payments you can face serious consequences like fines, lawsuits and debt collector harassment. Learn more with Debt.org.| Debt.org

How To Lower the Interest Rate on Your Credit Card

Learn effective strategies to lower your credit card interest rates today. Start saving by negotiating better terms with your lender!| Debt.org

Can You Pay off a Credit Card With Another Credit Card?

Can you pay off a credit card with another credit card? Discover how balance transfers and cash advances work. Learn the methods, risks, and alternatives!| Debt.org

What Is the Snowball Method and How Does It Work?

The snowball method works by paying off your debt from smallest to largest. Learn how to be debt-free with the snowball method.| Debt.org

How to Get Out of Debt: 7 Tips on Getting Out of Debt Fast

There are a handful of strategies to help you get out of debt. It’s important to understand your financial situation to choose the best debt pay off strategy for you.| Debt.org

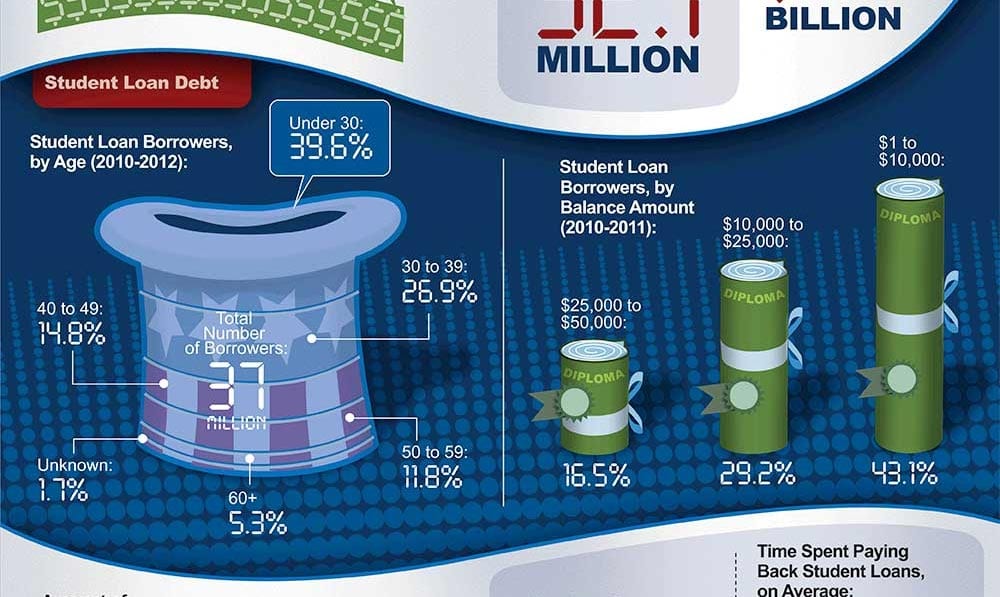

Student Loan Consolidation - Federal & Private Education Loans

Student loan can be one of the largest expenses an adult experiences after graduating college. Learn about the different ways to consolidate student loans, the differences between federal & private student loan consolidation, repayment plan options, & forgiveness.| Debt.org

What is an Upside Down Car Loan & How Do You Avoid It?

Upside-down car loans happen when you use a loan to make a down payment. Get out of an upside-down car loan with these tips & avoid them in the future.| Debt.org

Chapter 13 Bankruptcy: What Is It & How Does It Work?

Chapter 13 bankruptcy allows you to propose a repayment plan to the court and creditors. Learn about qualifying and filing for chapter 13 bankruptcy.| Debt.org

5 Best Ways To Get Rid of Debt

Getting out of debt can seem like an uphill battle but it doesn't have to be. Learn the 11 most common mistakes people make and how to avoid them.| Debt.org

Banks, Credit Unions & Savings Institutions - What Are The Differences

There are several options for people who want to get out of debt, borrow or save money. These include banks, credit unions and other savings institutions.| Debt.org

Loans & Credit: Personal Credit & Loan Options

Different types of consumer loans & lines of credit provide options for consumers and businesses to better manage their financial situation & repay debts.| Debt.org

Unsecured Debt – Types and Solutions

Unsecured debt like credit card debt is any owed amount that is not tied to assets, and it is typically eligible for debt settlement.| Debt.org

Can You Pay Less Than the Minimum Payment on a Credit Card?

Can you pay less than the minimum payment on a credit card? Learn the risks, steps to take, and legal options to avoid financial trouble today.| Debt.org

What Is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) provides you with access to cash based on the value of your home. Learn how they work, and the pros and cons.| Debt.org

What Is a Balance Transfer Credit Card & How Do They Work?

Learn about balance transfer credit cards, how they work, how to apply, and if you should get a balance transfer card to help pay off your credit card debt.| Debt.org

How to Get a Debt Consolidation Loan with Bad Credit

Ready to consolidate your debts? Find lenders who work with bad credit. Take action for financial freedom now!| Debt.org

Debt Management Programs: What You Need to Know

A Debt Management Plan is a 3-5 year payment plan with reduced interest rates facilitated by a non-profit credit counseling agency to help repay debts.| Debt.org

What You Need to Know About Medical Bills & Collections

Learn more about how medical debt in collections can impact your credit score, how to avoid medical collections, and how to pay off the debt.| Debt.org

Medical Debt Consolidation: Should You Do It?

Learn how medical debt consolidation works to simplify repayment, how to consolidate medical bills, options to consolidate medical debt, and alternatives.| Debt.org

Medical Debt - Debt Relief, Healthcare, Insurance & Medicare

Medical debt is a leading cause of personal bankruptcy in the US. Learn about the different strategies for dealing with medical debt & medical debt relief options.| Debt.org

Car Repossession - How it Works & How it Affects Your Credit

If you fall behind on your car's monthly payment, your lender can take it back. Learn what car repossession is, how to avoid it, and how to get your car back.| Debt.org

How To Use Personal Loans To Build Credit

A personal loan is one option to build credit - but there are risks attached. Understand the benefits, downsides and alternatives.| Debt.org

Lines of Credit: Types, How They Work & How to Get Them

Lines of credit can be used for short-term emergencies or long-term projects. Learn which types may be most suitable for your situation.| Debt.org

Debt Collectors: Debt Collection Agency Laws & Practices

Need help with debt collectors? Learn about the difference between creditors & debt collectors, the process of collection & arbitration, & your rights as a consumer| Debt.org

Credit Cards: Types of Debt & How Credit Cards Work

Credit cards are a type of revolving debt that can be very helpful when used properly but can also cause serious debt problems.| Debt.org

How to Improve Your Credit Score: Tips & Tricks

Learning how to raise your credit score may mean the difference between a loan getting approved or denied. Use these tips to keep your credit score healthy.| Debt.org

Bankruptcy: How It Works and Consequences

Facing overwhelming debt? Discover how bankruptcy can offer a fresh start. Understand your options and take the first step towards relief today.| Debt.org

Credit Counseling: How it Works & How to Select an Agency

Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you.| Debt.org

Best Credit Counseling Agencies & Companies for 2025

Explore the five best credit counseling agencies, and learn about what makes these companies the top-rated credit counselors in the industry.| Debt.org