How Do You Pay Back Student Loans? | Loan Repayment

Discover how student loan repayment works. Get actionable tips on paying back your student loans efficiently. Explore your options now!| Debt.org

Charge-Offs | Understanding Full Payment vs. Settlement

Confused about charge-offs? Learn the pros and cons of paying in full versus settling to enhance your finances. Discover your path to credit recovery!| Debt.org

Debt Relief Programs: Explore Your Options and Make a Plan

Discover the pros and cons of the best debt relief option for your needs - from professional debt management to doing it yourself - and get out of debt.| Debt.org

Can You Consolidate Accounts with Debt Collectors?

Do you have multiple debts with collection agencies? Understand your options and how to successfully consolidate these accounts.| Debt.org

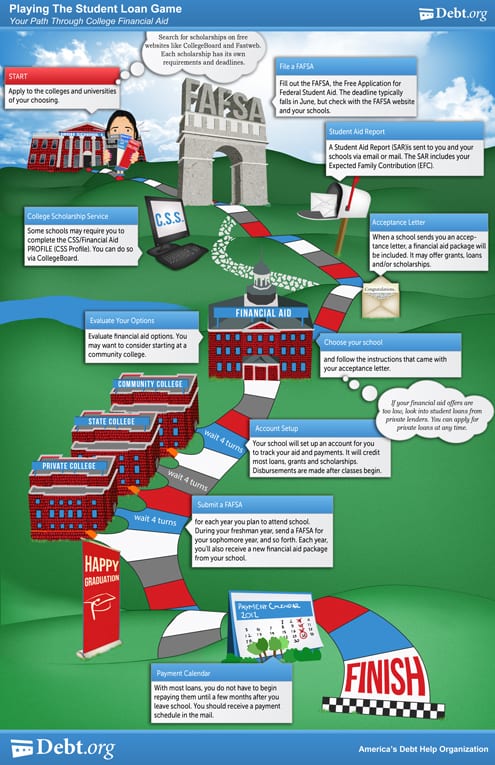

Financial Aid Process - Securing Student Loans

The financial aid process can be a long and stressful one, but starting it well-equipped can streamline the journey.| Debt.org

Forbearance & Deferment Are Options If You Cant Afford Loan Payments

Forbearance and deferment are options available to student borrowers who are unable to repay their student loans.| Debt.org

How To Dispute A Credit Card Charge | Debt.org

Found an error on your statement? Discover how to dispute a charge effectively. Follow these steps to get your money back today!| Debt.org

Consumer Financial Protection Bureau - Programs & Customer Complaints

The Consumer Financial Protection Bureau is a new federal agency created to protect consumers of financial products and services.| Debt.org

Use Real Estate to Take Control of Debt – Home Equity Loan & Refinance

Home loans and refinancing can help you pay off other debts, but it still takes discipline to keep from falling back into a cycle of debt.| Debt.org

What Does Charged-Off Mean for Your Credit Score?

Charge-offs negatively affect your credit score. Learn what you can do to remove a charge-off & avoid damaging your credit rating further.| Debt.org

Paying Your Debts While Unemployed – Finding New Sources of Income

Unemployment can severely reduce your ability to repay debts and usually requires a reassessment of your financial situation and budget.| Debt.org

Why You Should Never Pay a Collection Agency

It can be intimidating when a collections agency contacts you to recoup debts. Here's what you need to know before paying them what they demand.| Debt.org

Understanding Credit | Does Debt Settlement Hurt Your Score?

Struggling with debt? Find out if debt settlement hurts your credit. Get insights into credit scores, debt management, and recovery options. Click for more!| Debt.org

The Federal Consumer Credit Protection Act & How it Protects You

Consumer rights sound like it would be a given in America, but it wasn’t until the 1960’s that the government first acted to protect consumers. It started| Debt.org

Credit Reports: How Often Does Your Credit Score Update?

Your credit score doesn’t update instantly. Learn how often your credit score updates & when credit bureaus report credit score changes.| Debt.org

Identity Theft: What is is and How to Prevent it

Identity theft can happen to anyone. Learn what identity theft is, the different types, how to tell if you have been a victim & how to prevent your personal information from being stolen.| Debt.org

Credit & Consumer Rights - 5 Credit Laws You Should Know

Federal laws protect personal credit & financial records which establishes security for consumers. Learn more about your rights as a credit consumer.| Debt.org

How to Find Out All My Debts

Learn how to find and identify all of the debts you owe, how to pay off your debts, and what to do if the debt is in collections.| Debt.org

Credit Unions - Benefits, Types & Regulations

Credit unions are nonprofits that offer members a cheaper price on financial services than some banks. Learn the advantages & disadvantages of credit unions.| Debt.org

What Credit Score Do You Need To Buy a House?

Lenders use credit scores to determine your financial capability to repay a loan. Find out credit score minimums for different types of home loans.| Debt.org

How Long Does Bankruptcy Stay on Your Credit Report?

Bankruptcy stays on your credit report for 7-10 years depending on which bankruptcy you file. Learn how long each type of bankruptcy affects your credit.| Debt.org

Credit Scoring Models: FICO, VantageScore & More

Credit scoring models are used to help evaluate the creditworthiness of consumers. Learn about FICO, VantageScore and other scoring models.| Debt.org

Loan Defaults– Getting Rid of Debt when Defaulting on Your Loans

What are the penalties for defaulting on a loan? How you can get rid of debt even while defaulting on your obligations.| Debt.org

What Happens If You Stop Paying Credit Card Bills? | Debt.org

If you stop making credit card payments you can face serious consequences like fines, lawsuits and debt collector harassment. Learn more with Debt.org.| Debt.org

How To Lower the Interest Rate on Your Credit Card

Learn effective strategies to lower your credit card interest rates today. Start saving by negotiating better terms with your lender!| Debt.org

Stafford Student Loans: What You Need To Know

New Stafford Loans were not issued after July 2010 - but millions of Americans still owe money on them. Learn about the nuances of this type of student loan.| Debt.org

Debt Settlement for Credit Card Debt: How the Process Works

Debt settlement is the process of negotiating a settlement in order to reduce debt. Learn about the debt settlement process and debt settlement companies.| Debt.org

Fair Credit Reporting Act: Know Your Consumer Rights

The Fair Credit Reporting Act protects consumers’ personal financial documents and prohibits unfair actions by big companies and credit reporting agencies.| Debt.org

Chapter 13 Bankruptcy: What Is It & How Does It Work?

Chapter 13 bankruptcy allows you to propose a repayment plan to the court and creditors. Learn about qualifying and filing for chapter 13 bankruptcy.| Debt.org

Credit Reporting Agencies: 3 Major Credit Bureaus

There are 3 reporting bureaus that are responsible for calculating & distributing credit scores. Learn how they differ, how they operate & how to report errors.| Debt.org

Credit Card Interest: Rate Types and How to Calculate

Credit card interest rates are based on many factors & can be confusing to calculate. Learn what credit card interest is, how your rate is calculated, & tips for lowering your credit card interest rate.| Debt.org

Secured Credit Cards: What They Are & How They Help Build Credit

Secured credit cards can be a great way to gain or rebuild your credit. Learn what secured credit cards are, their advantages & disadvantages, & how to get one.| Debt.org

Payday Loans: Disadvantages & Alternatives

Payday lenders use payday loans to exploit financial need by trapping you in a debt cycle with high interest rates. Learn about the disadvantages of payday loans.| Debt.org

Can You Pay Less Than the Minimum Payment on a Credit Card?

Can you pay less than the minimum payment on a credit card? Learn the risks, steps to take, and legal options to avoid financial trouble today.| Debt.org

What Is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) provides you with access to cash based on the value of your home. Learn how they work, and the pros and cons.| Debt.org

Secured vs Unsecured Personal Loan Options

Know the different types of personal loans when applying for them. Learn the difference between secured and unsecured personal loans.| Debt.org

How to Get a Debt Consolidation Loan with Bad Credit

Ready to consolidate your debts? Find lenders who work with bad credit. Take action for financial freedom now!| Debt.org

Debt Management Programs: What You Need to Know

A Debt Management Plan is a 3-5 year payment plan with reduced interest rates facilitated by a non-profit credit counseling agency to help repay debts.| Debt.org

What You Need to Know About Medical Bills & Collections

Learn more about how medical debt in collections can impact your credit score, how to avoid medical collections, and how to pay off the debt.| Debt.org

Types of Student Loans: Federal & Private Loan Options

There are various student loan options, both private and federal, available to for you choose from based on your specific financial needs.| Debt.org

Car Repossession - How it Works & How it Affects Your Credit

If you fall behind on your car's monthly payment, your lender can take it back. Learn what car repossession is, how to avoid it, and how to get your car back.| Debt.org

How to Establish Credit: Building Your Credit Score

Visit Debt.org to learn more about how to build and establish a strong credit score.| Debt.org

Lines of Credit: Types, How They Work & How to Get Them

Lines of credit can be used for short-term emergencies or long-term projects. Learn which types may be most suitable for your situation.| Debt.org

How to Improve Your Credit Score: Tips & Tricks

Learning how to raise your credit score may mean the difference between a loan getting approved or denied. Use these tips to keep your credit score healthy.| Debt.org

Credit Counseling: How it Works & How to Select an Agency

Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you.| Debt.org