How Do You Pay Back Student Loans? | Loan Repayment

Discover how student loan repayment works. Get actionable tips on paying back your student loans efficiently. Explore your options now!| Debt.org

Pell Grants – Eligibility, Amounts & Future Funding

Federal Pell grants are need-based awards for low-income students. Although they are a key form of financial aid, their future is in doubt.| Debt.org

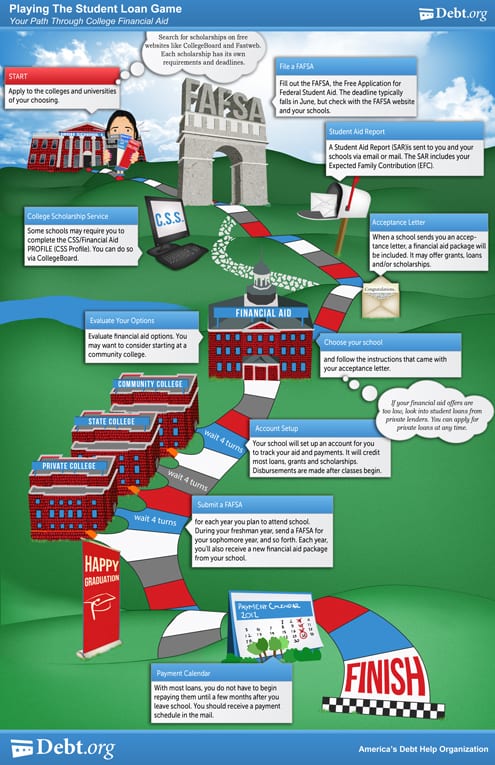

Financial Aid Process - Securing Student Loans

The financial aid process can be a long and stressful one, but starting it well-equipped can streamline the journey.| Debt.org

Forbearance & Deferment Are Options If You Cant Afford Loan Payments

Forbearance and deferment are options available to student borrowers who are unable to repay their student loans.| Debt.org

The Chapter 13 Discharge Process

Learn about the process for Chapter 13 Bankruptcy discharge, what the hardship discharge is, and what debts are not discharged in Chapter 13.| Debt.org

Paying Your Debts While Unemployed – Finding New Sources of Income

Unemployment can severely reduce your ability to repay debts and usually requires a reassessment of your financial situation and budget.| Debt.org

How to File for FAFSA (Free Application for Federal Student Aid)

The free application for federal student aid is required for almost all forms of student loans & financial aid. Learn FAFSA requirements & how to file.| Debt.org

Bankruptcy & Student Loan Discharge: Filing Student Loan Bankruptcy

Discharging student loans through bankruptcy is a difficult process but Debt.org can help you navigate your options.| Debt.org

Private Student Loans for College: Help & Interest Rates

Private student loans are another option for college students seeking financial aid to pay for their education and other college expenses.| Debt.org

Credit Unions - Benefits, Types & Regulations

Credit unions are nonprofits that offer members a cheaper price on financial services than some banks. Learn the advantages & disadvantages of credit unions.| Debt.org

Debt Help & Advice - Strategies for Tackling Debt

Simple tips for how to avoid debt and how to get out of debt, provided by the experts at Debt.org, America's Debt Help Organization.| Debt.org

Upstart Personal Loans & Debt Consolidation Review (2025)

Upstart lends personal loans to consolidate debt. Learn about the qualifications for and interest rates of Upstart loans and decide if they're right for you.| Debt.org

Stafford Student Loans: What You Need To Know

New Stafford Loans were not issued after July 2010 - but millions of Americans still owe money on them. Learn about the nuances of this type of student loan.| Debt.org

Personal Loans for College Students in 2025: Pros and Cons

College is expensive and students often face financial hardship. Learn about personal loans for students, pros and cons, and whether they're right for you.| Debt.org

Student Loan Consolidation - Federal & Private Education Loans

Student loan can be one of the largest expenses an adult experiences after graduating college. Learn about the different ways to consolidate student loans, the differences between federal & private student loan consolidation, repayment plan options, & forgiveness.| Debt.org

Best & Worst Student Loans: What Are the Best Loans for College?

Choosing the best student loans for your financial situation requires a basic understanding of the pros and cons of different loan options.| Debt.org

Loans & Credit: Personal Credit & Loan Options

Different types of consumer loans & lines of credit provide options for consumers and businesses to better manage their financial situation & repay debts.| Debt.org

Secured vs Unsecured Personal Loan Options

Know the different types of personal loans when applying for them. Learn the difference between secured and unsecured personal loans.| Debt.org

Student Loan Resources: Financial Aid & Loan Debt Management

Student loans account for over $1 trillion in debt in America. Learn to acquire, manage, pay back different types of financial aid and other student debts.| Debt.org

Car Repossession - How it Works & How it Affects Your Credit

If you fall behind on your car's monthly payment, your lender can take it back. Learn what car repossession is, how to avoid it, and how to get your car back.| Debt.org

How to Improve Your Credit Score: Tips & Tricks

Learning how to raise your credit score may mean the difference between a loan getting approved or denied. Use these tips to keep your credit score healthy.| Debt.org