Return on Invested Capital - Learn How to Calculate & Use ROIC

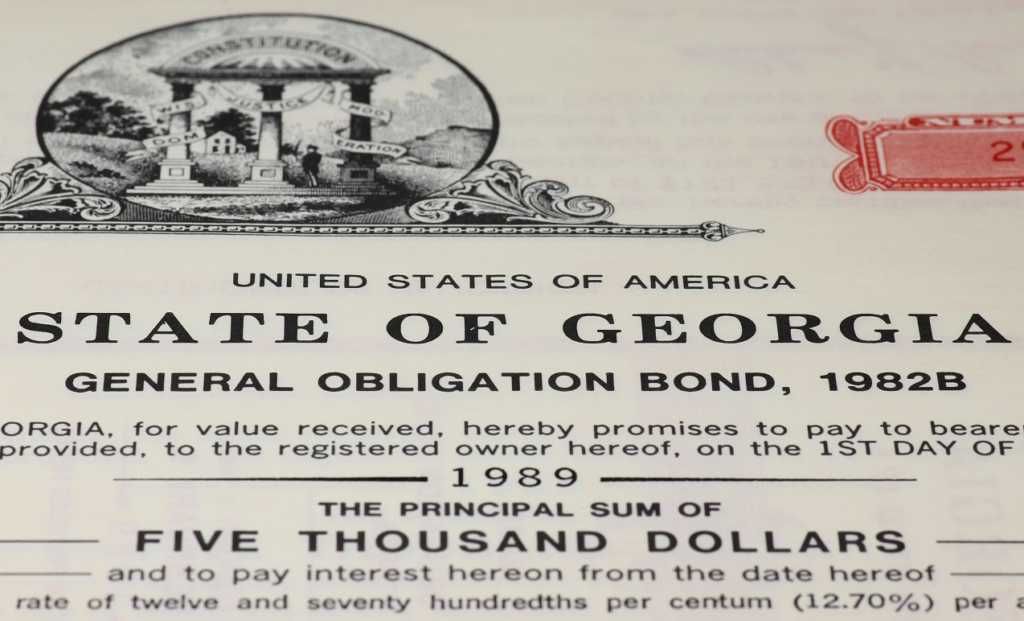

Return on Invested Capital (ROIC) is a profitability or performance measure of the return earned by those who provide capital, i.e., bondholders and stockholders.| Corporate Finance Institute