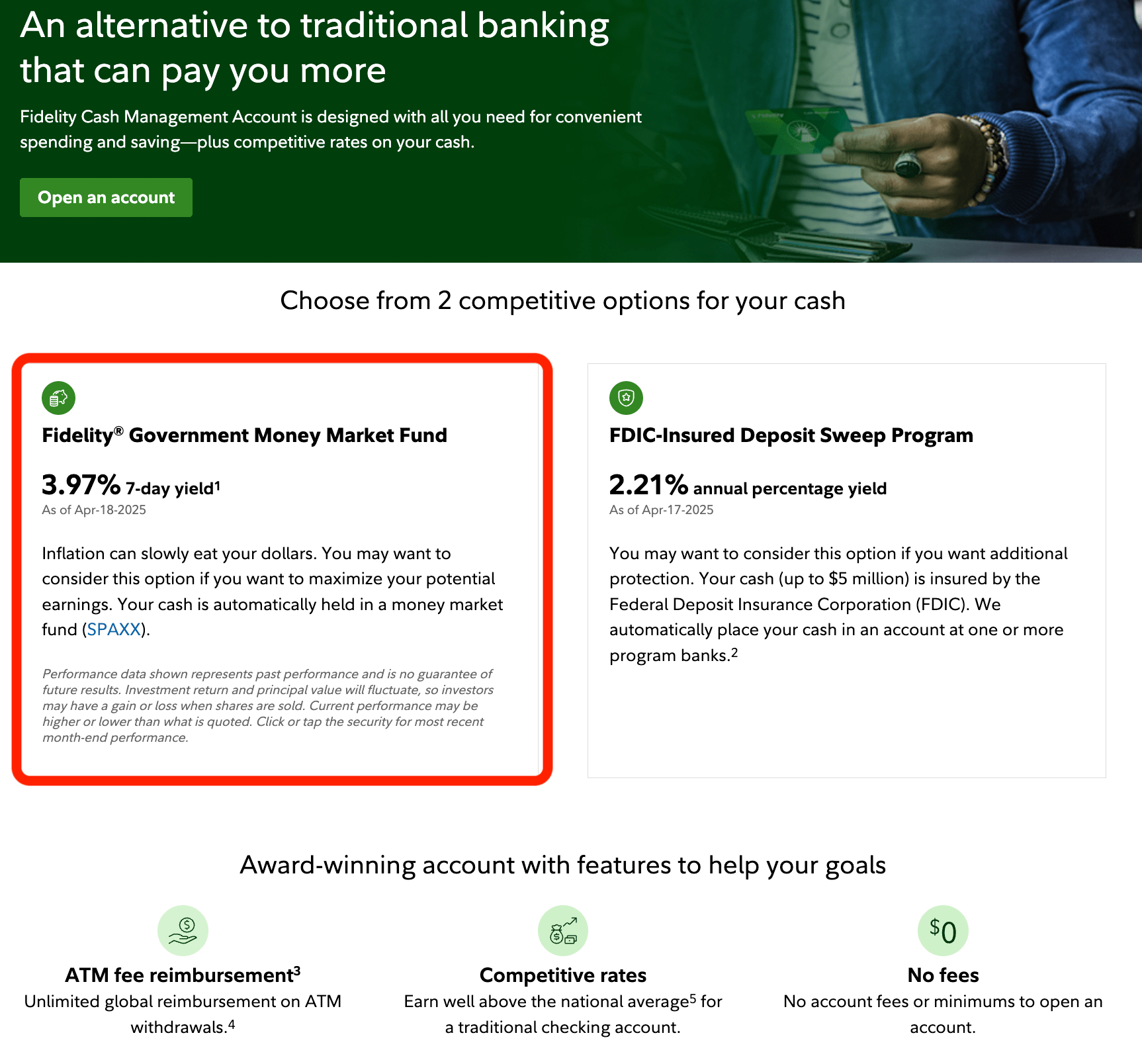

The Ultimate Guide to Fidelity’s Cash Management Account (CMA)

I’ve used Fidelity’s Cash Management Account (CMA) as my primary “checking,” “savings,” and “cash management account” for over six years. I recommend this setup to my students. I recommend it to my children. I recommend it to you.| Frugal Professor