ITEP Comments and Recommendations on Proposed Section 170 Regulation (REG-112176-18) – ITEP

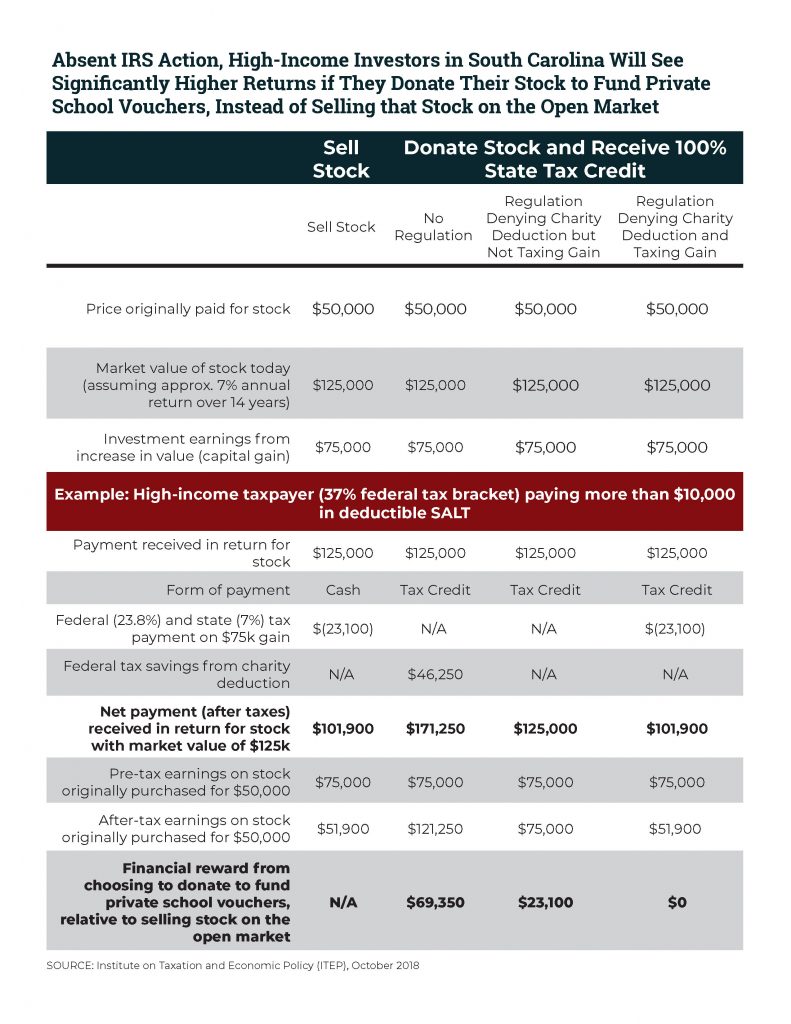

The IRS recently proposed a commonsense improvement to the federal charitable deduction. If finalized, the regulation would prevent not just the newest workarounds to the $10,000 deduction for state and local taxes (SALT), but also a longer-running tax shelter abused by wealthy donors to private K-12 school voucher programs. ITEP has submitted official comments outlining four key recommendations related to the proposed regulation.| ITEP