Stop Financing Groceries: There’s a Better Way - Los Angeles and all of Southern California Bankruptcy Attorney Law Firm | Borowitz & Clark

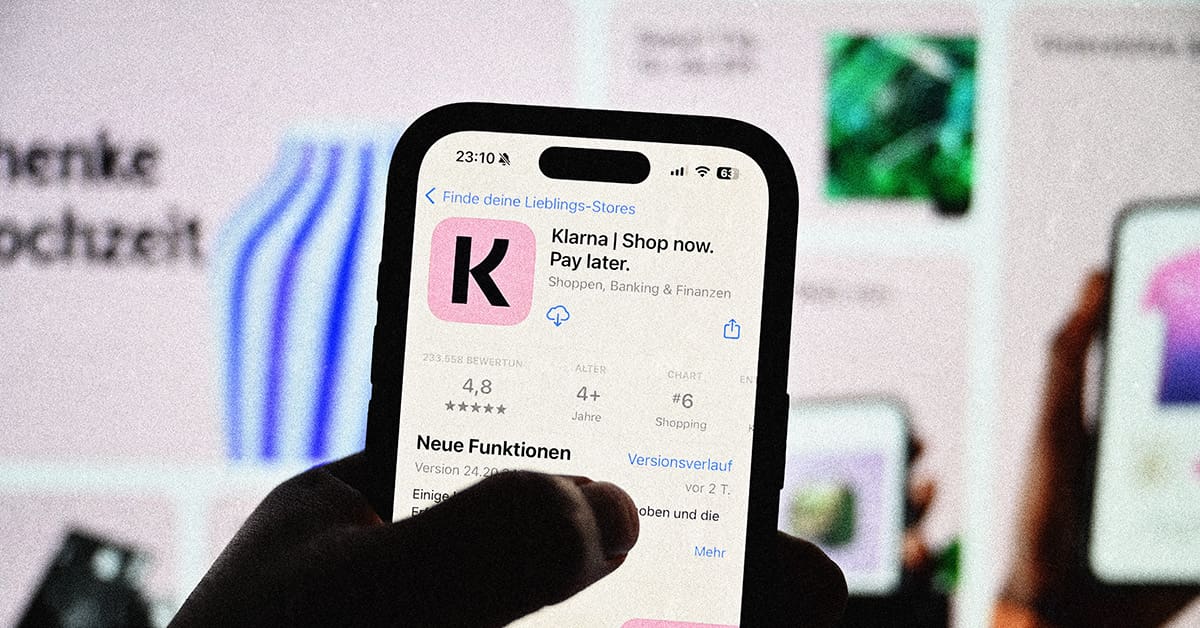

Online buy now, pay later (BNPL) shopping options made their appearance in the early 2010s, and mainly offered a way to purchase larger-ticket items such as electronics, retail furniture, and other goods the purchaser might otherwise not have been able to buy on the spot. The plans worked a lot like the old-fashioned layaway plans in department stores, with two important differences: you got the product right away, and you paid a premium for the privilege.| Los Angeles and all of Southern California Bankruptcy Attorney Law Firm | Bor...