49% of Americans Can’t Afford a $1,000 Emergency | LendingTree

If a $1,000 financial emergency hit your household tomorrow, would you be prepared? The answer for about half of Americans is no.| LendingTree

What Are Collateral Loans and How Do They Work? | LendingTree

A collateral loan is backed by something you own (which is called collateral). Lenders have the right to seize collateral if you can’t repay a loan.| LendingTree

APR vs. Interest Rate: What's the Difference? | LendingTree

Understanding an interest rate vs APR can help you choose a loan with the lowest possible costs. Here’s what you need to know.| LendingTree

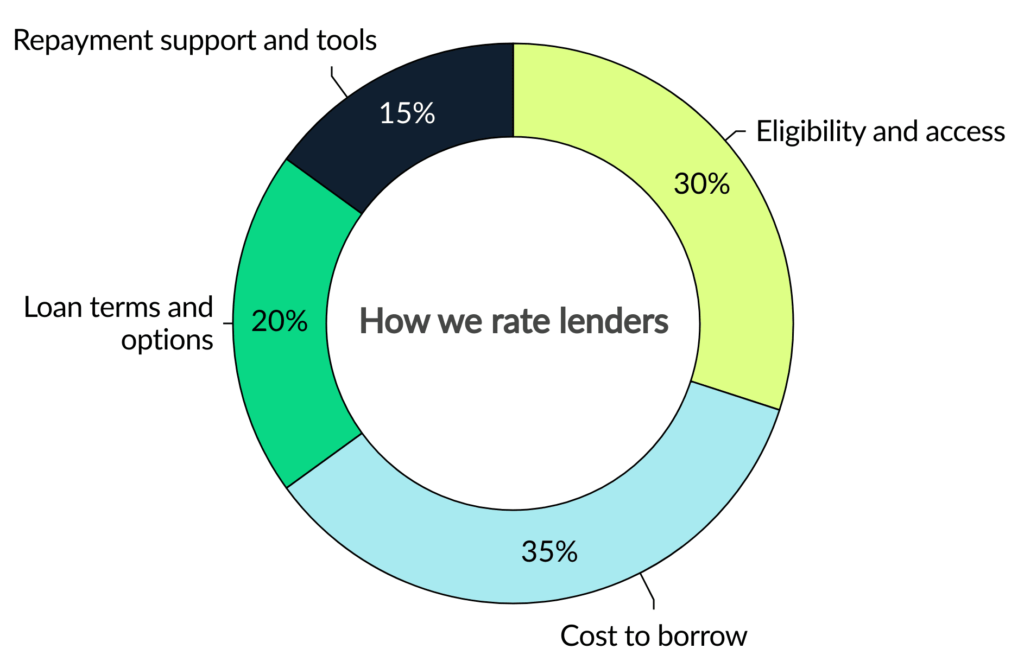

Best Online Loans in January 2026 | LendingTree

Compare direct and marketplace lenders offering online loan options for all credit types — plus rates, terms and funding speeds.| LendingTree

Best Fair Credit Loans: Our Expert Picks | LendingTree

Fair credit? You still have options. Compare personal loans with competitive rates, flexible terms and lenders that work with credit scores below 670.| LendingTree

LightStream Personal Loan Review | LendingTree

LightStream offers no-fee personal loans with competitive rates, as long as you have a robust credit score and history. Read our expert LightStream review.| LendingTree

PenFed Personal Loan Review | LendingTree

PenFed Credit Union may be a good option for those with solid credit because of its low rates and fast funding. Read our full PenFed personal loans review.| LendingTree

Family Loans: How to Approach Lending Money to Family | LendingTree

Extending a family loan to your loved ones can work if you have crystal clear communication about expectations, repayment and consequences.| LendingTree

Prosper Personal Loan Review | LendingTree

Prosper is a peer-to-peer lending platform where borrowers can apply for personal loans. Read this review to see if a Prosper personal loan is right for you.| LendingTree

Achieve Personal Loan Review | LendingTree

Achieve personal loans come with fast approval and funding. Learn more about the pros and cons in this Achieve personal loan review.| LendingTree

Upstart Personal Loans Review | LendingTree

If you have bad credit or no credit, Upstart may be for you — this lending platform considers a variety of eligibility factors instead of just your credit.| LendingTree

Best Credit Union Personal Loans in 2026 | LendingTree

Considering a personal loan from a credit union? See typical rates and terms, then compare offers with other lenders on LendingTree to find your best fit.| LendingTree

Discover Personal Loan Review | LendingTree

With its competitive interest rates, repayment assistance options and flexible loan terms, Discover could be ideal for borrowers with good-to-excellent credit.| LendingTree

How to Write a Personal Loan Agreement | LendingTree

A personal loan agreement is a contract between two parties, generally a borrower and a lender. It outlines how much is borrowed, how it’s repaid and more.| LendingTree

Upgrade Personal Loan Review | LendingTree

Read our Upgrade personal loan review for all the pros and cons, including fees and loan terms, to decide whether it’s worthwhile for you.| LendingTree

Origination Fees on Personal Loans: What To Know | LendingTree

Besides paying interest, you might be on the hook for an origination fee. Here’s how much they cost, how to avoid them and more.| LendingTree

Happy Money Personal Loans Review | LendingTree

Happy Money is a good option for consolidating credit card debt as long as you can qualify for its lowest rates. Read our full Happy Money personal loan review.| LendingTree

5 Paycheck Advance Apps With No Subscription Fees | LendingTree

Skip the ultra-high fees of a payday loan with a free paycheck advance app. Our experts picked the five best apps with no subscription fees.| LendingTree

What Is Credit Counseling? | LendingTree

Credit counseling can be a free or low-cost way out of debt. Most services are provided by nonprofit agencies.| LendingTree

What Is Credit and How Does It Work? | LendingTree

Generally speaking, credit allows you to borrow money now and pay the lender back later — usually with interest.| LendingTree

Hard Inquiry Without Permission: What to Do | LendingTree

If you think that someone’s pulled a hard inquiry of your credit without permission, you’ll want to act quickly — it could be a sign of fraud or identity theft.| LendingTree

What To Do When You Have Delinquent Debt | LendingTree

Learn what delinquency is, view a timeline for what to expect during every stage of debt delinquency, and find out how to steer your way out.| LendingTree

Chase Freedom Rise & More: Best Credit-Building Cards | LendingTree

Ready to grow your score? The Chase Freedom Rise® and other cards make it easier to build credit while avoiding fees. See LendingTree editors’ top picks for December 2025.| LendingTree

Discover it Secured & Best Secured Cards 2026 | LendingTree

No credit? Bad credit? You still have options. Our experts highlight the best secured credit cards of 2026 that build credit and report to all bureaus.| LendingTree

Can You Raise Your Credit Score By 100 Points in 30 Days? - LendingTree

While there are no shortcuts for building a solid credit score, there are steps you can take that can provide you with a quick boost in a short amount of time.| LendingTree

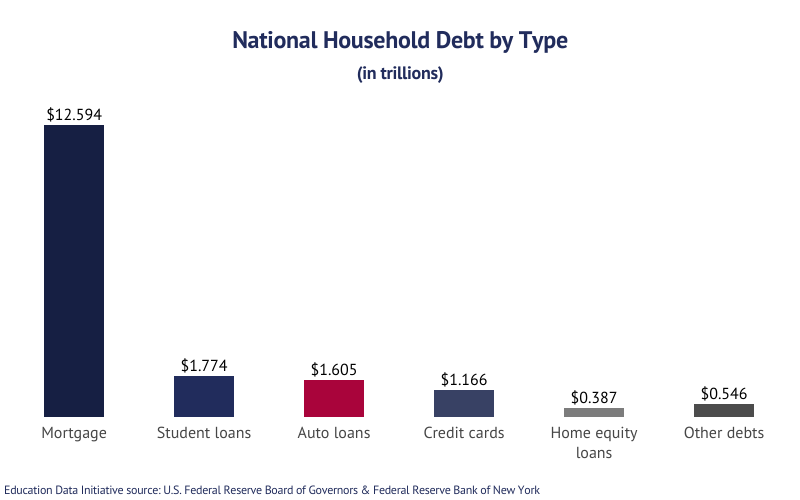

Student Loan Debt vs Credit Card & Mortgage Debt (Compared) | 2025

Discover how the nation's student loan debt compares to credit card, mortgage and auto loans on the national and individual scale.| Education Data Initiative

Personal Loan Shopping Could Save Up to $3,138 | LendingTree

Consumers with six or more offers could save up to $3,138 by shopping around for a personal loan on the LendingTree platform. Here’s how.| LendingTree

What Is an Excellent Credit Score? | LendingTree

An excellent credit score saves you money. To have excellent credit, you need a FICO Score of at least 800 or a VantageScore of at least 781.| LendingTree

What Is a FICO Score and How Is It Used? | LendingTree

You might have heard the term FICO Score — whether in a credit card commercial, on an account statement or when applying for credit. Learn about it here!| LendingTree

How to Build Credit From Scratch | LendingTree

Everyone has to start somewhere, and we’re here to show you how to build credit from scratch wisely with these and other options.| LendingTree

What Is a Credit Utilization Ratio? | LendingTree

Credit utilization ratio compares your current debt to your credit limits. Learn how to lower high utilization to protect your credit score.| LendingTree

Buy High Quality Mortgage Leads - Partner with LendingTree

We invented online mortgage marketing. We’ve built a trusted brand that converts information-seekers into genuine prospects.| LendingTree

Survey: Tackling Home Improvement Projects | LendingTree

In the past 12 months, 68% of homeowners started or completed home improvement projects, while 63% plan to begin one in the next year.| LendingTree

Best Home Improvement Loans in December 2025 | LendingTree

Home improvement loans are personal loans that you can use for home improvements and renovations. We’ve compiled the best ones and alternatives.| LendingTree

Cash-Out Refinance vs. Home Equity Loan or HELOC: Which Is Better for You? | LendingTree

A home equity loan or cash-out refi comes with a fixed interest rate and monthly payment. A HELOC has a variable rate, but more flexibility as a credit line.| LendingTree

Home Equity Loan Rates and Lenders in December 2025 | LendingTree

Compare home equity loan interest rates and learn how to get the best rate offers. Browse our picks for top home equity loan lenders and get custom quotes.| LendingTree

What Is a HELOC? Home Equity Lines of Credit Explained | LendingTree

A HELOC is a line of credit that lets you to withdraw funds when you need, borrowing against the equity in your home.| LendingTree

Affirm Loan Review | LendingTree

Affirm offers buy now, pay later (BNPL) and personal loans in the final steps of making retail purchases. You can access 0% financing with Affirm BNPL loans.| LendingTree

Klarna Buy Now, Pay Later Review | LendingTree

Klarna could be ideal for shoppers looking to break everyday purchases up into interest-free installments. Read our full Klarna buy now, pay later review.| LendingTree

Get Your Free Credit Score | LendingTree

Check your credit score and get free credit monitoring instantly. No credit card required and it won’t hurt your credit score.| LendingTree

Debt Prioritization: What Bills to Pay First | LendingTree

Our guide to debt prioritization explains how to choose what bills to pay and how to complete a repayment plan from start to finish.| LendingTree

Mortgage Calculator with Taxes, Insurance and Amortization

Use this mortgage payment calculator to find your monthly estimated mortgage payment, total mortgage cost, amortization and more.| LendingTree

How Much is a Down Payment for a House? | LendingTree

Find out how much you'll need for a down payment for a house and learn about the key requirements for low down payment programs.| LendingTree

Changing Grocery Shopping Habits Due to Inflation | LendingTree

Nearly 9 in 10 Americans are changing the way they shop to fight inflated grocery bills, according to a LendingTree survey.| LendingTree

34.3% Make Expense Sacrifices to Pay Energy Bill | LendingTree

34.3% of Americans have reported cutting back on or skipping necessary expenses at least once in the past 12 months to pay for utilities.| LendingTree