Beta - What is Beta (β) in Finance? Guide and Examples

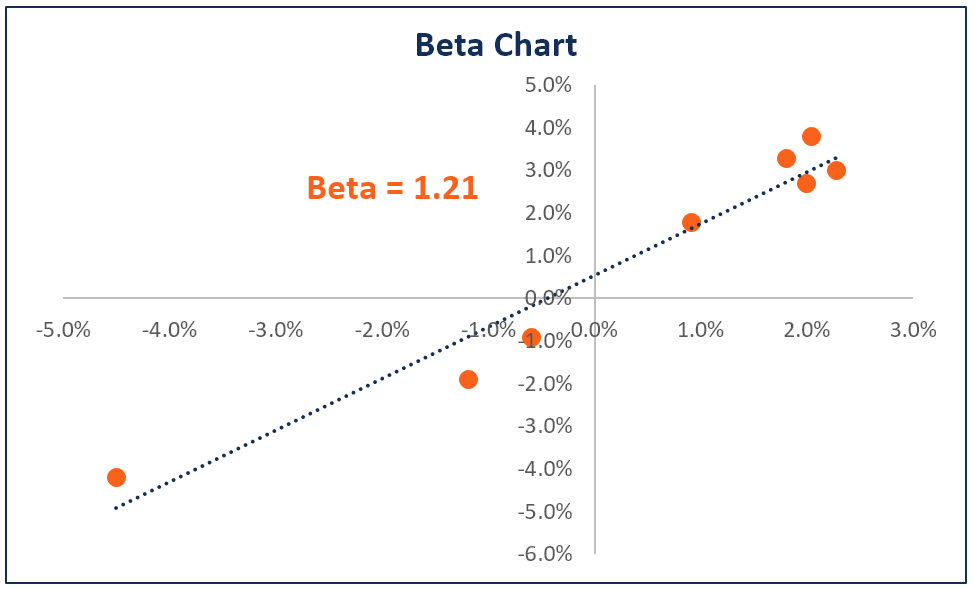

The beta (β) of an investment security (i.e., a stock) is a measurement of its volatility of returns relative to the entire market. It is used as a measure of risk and| Corporate Finance Institute