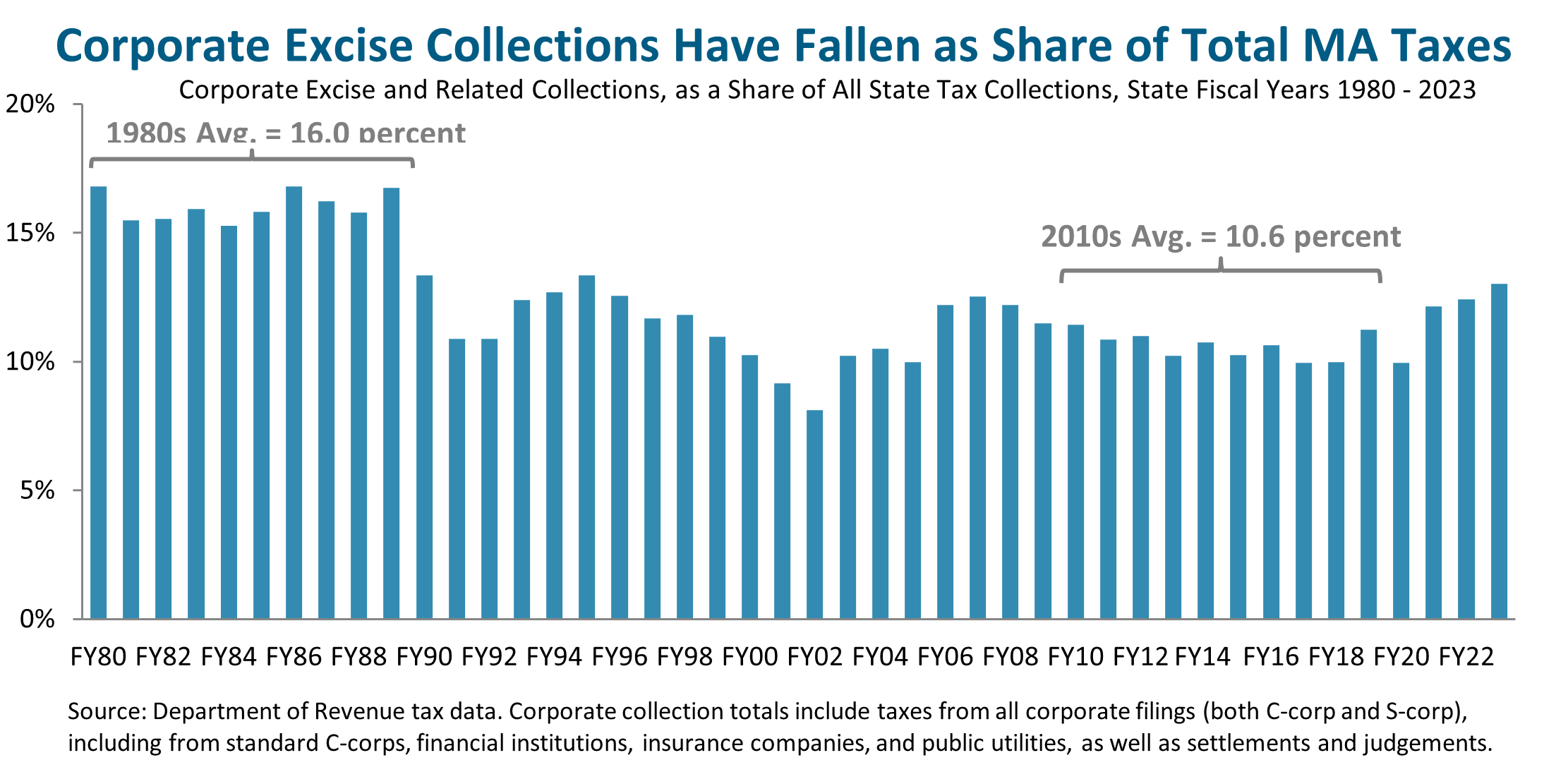

Rising Profits, Falling Tax Shares: Fixing What’s Broken - Mass. Budget and Policy Center

The share of state taxes paid by corporations has fallen markedly since the 1980s. Meanwhile, they've collected a growing share of all income generated in the U.S. Changes to corporate tax policy can improve fairness, racial equity, and state competitiveness.| Mass. Budget and Policy Center