Imagine you are super-excited about some new technology that’s enabled by the internet, say, Google, and instead of investing in Google, i.e. buying Google stock, you start buying AT&T stock. Or let’s say Facebook just came out, and it’s the hottest thing. Everyone wants Facebook. So instead of investing in Facebook stock, you start buying AT&T stock. It’d be just weird, right? But that’s what seems to be happening in the crypto space.| Wonderings of a SAT geek

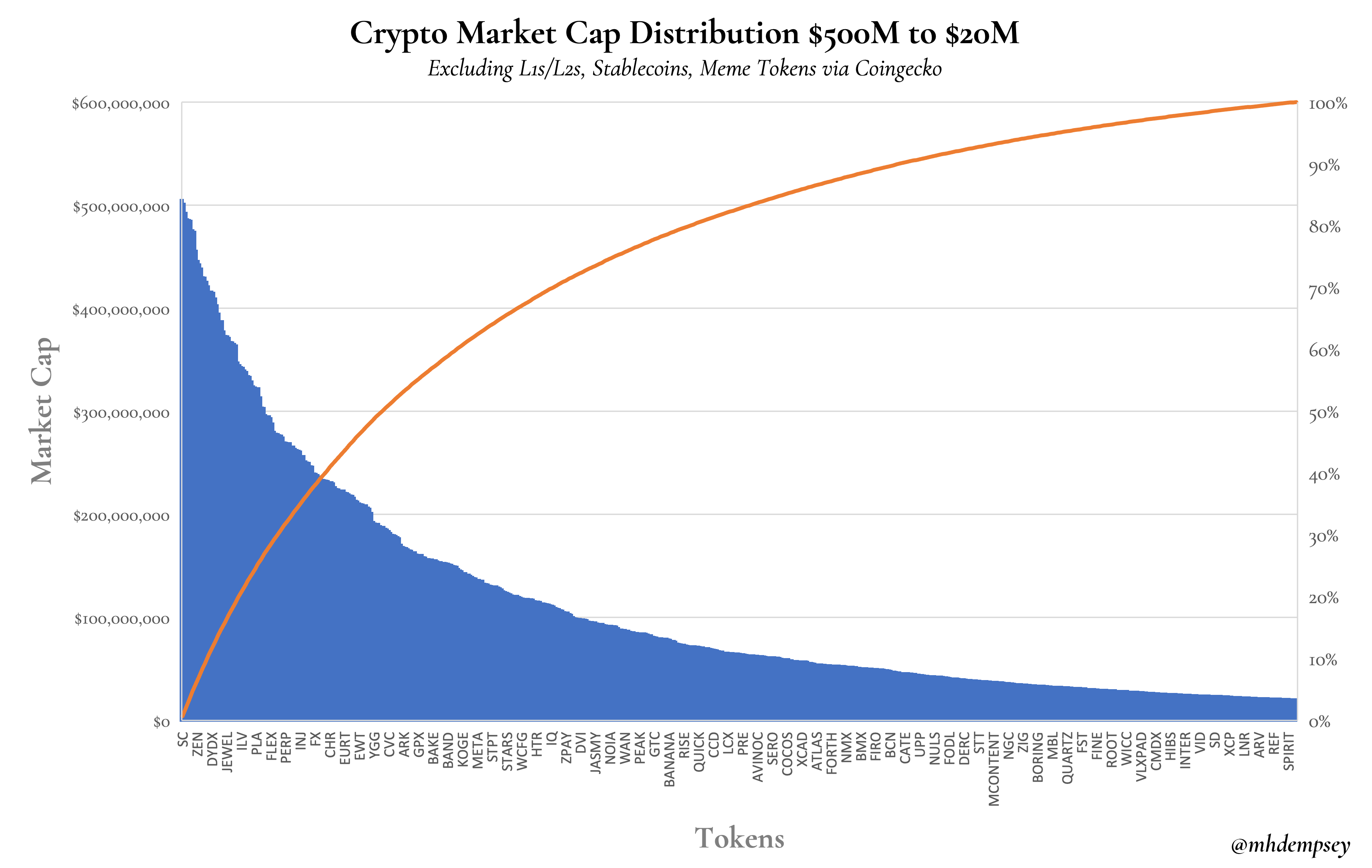

Power laws rule everything around us. This is a core principal of what we have largely come to learn in a world dominated by this narrative, which has also helped proliferate the concept of Asymmetric Upside. Within traditional tech/Web2, due to the compounding nature of moats (most notably network effects) and duopolistic markets, it is […]| Michael Dempsey: Blog

Big Web companies tend to expand their platforms and monopolize information by locking users into proprietary interfaces. Cryptonetworks, on the other hand, tend to provide single services, and can’t “own” the interface because they don’t control the data. Specialization helps because the more decen| Placeholder