Vanguard vs. iShares All-in-One ETFs | Million Dollar Journey

All-in-one ETFs are giving robo advisors a run for their money with their ease of use and low fees. All-in-one ETFs contain multiple ETFs, which means in one single purchase, you are essentially getting an entire well-balanced and hugely diversified portfolio at the tap of a button. There are many Canadian all-in-one ETFs to choose from, and Vanguard and iShares are some of the best. They top our list because of their diversification, automatic rebalancing, good mix of stocks and bonds, and...| Million Dollar Journey

The Best Way to Convert CAD to USD: 3 Low Cost Methods

Any Canadian who’s traveled to (or ordered something from) the US knows about converting CAD to USD. It’s never fun to watch every dollar of your hard-earned money suddenly turn to $0.75 (or less!), and with additional foreign exchange fees, it can really add up. And exchange rates aren’t going anywhere. The cost of one US dollar has remained above $1.25 CAD since 2018. At the time of writing (mid-2023), $1 USD costs $1.34 CAD. The bright side is that anyone already holding USD or loo...| Million Dollar Journey

Can You Invest Only in ETFs? Pros and Cons Explained

As regular readers of MillionDollarJourney know, we are big fans of Exchange Traded Funds (ETFs) which are one of the fastest growing products in the market. Were it not for the fact that financial firms and advisors have less incentives to sell ETFs than other investments such as mutual funds (that provide them with annual fees), the growth would probably be even more spectacular. Having said that, ETFs don't always have the best performance, and are sometimes outperformed significantly by...| Million Dollar Journey

Best Canadian ETFs For U.S Equities - Low Fees & High Return

A reader recently emailed me about my thoughts on the best US Dollar USD ETFs vs CAD ETFs when it comes to getting portfolio exposure to the American market. You may already know that I’m a fan of index investing using the best ETFs available. Whether that’s all-in-one ETFs, Canadian dividend ETFs, or in this case, if you’re looking to overweight American equities specifically - the best US market ETFs in CAD. What it essentially boils down to is the following: 1) Is the underlying ETF...| Million Dollar Journey

Best USD Bank Accounts For Canadians 2026

Choosing the best USD bank account in Canada isn’t about convenience - it’s also about control. Control over when you convert your money. Control over how often you pay foreign exchange fees. And, in many cases, control over hundreds of dollars a year that quietly disappear through spreads and “small” bank charges most people never think about. If I’m being honest, I’m not exactly thrilled about propping up the US economy these days. (I’m writing this in January 2026, and let’...| Million Dollar Journey

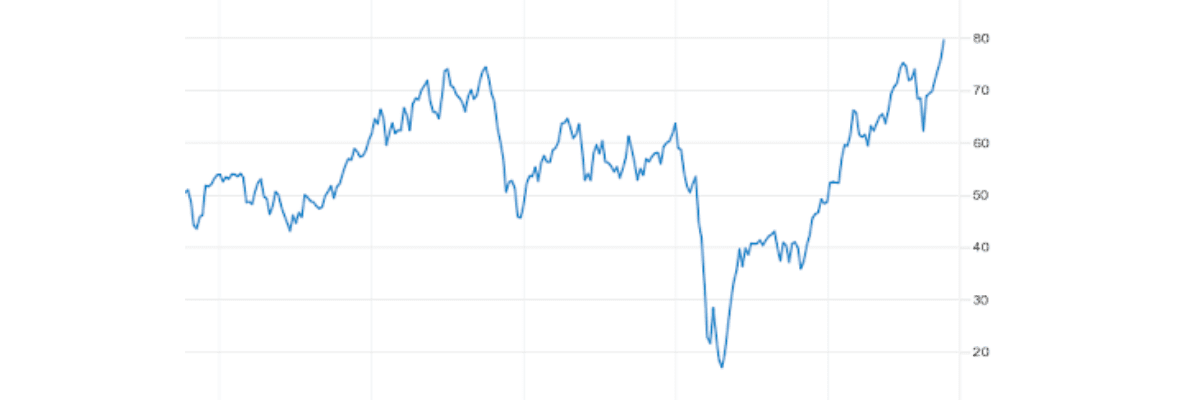

Volatility Index - How To Trade The VXX & VIX

On this article we'll be looking at how and when to invest in VIX and VXX, aka: the Volatility Index. We’ll tackle how to buy and sell VIX and VXX, whether it deserves a spot in your portfolio, and what exactly the VIX and VXX even are! While investing in the VIX or VAX is more technical than the typical questions we try to answer, we’ll break into chunks and describe exactly what a Volatility Index is, what the VIX and VXX indicate, what are the differences between the two, and how do y...| Million Dollar Journey

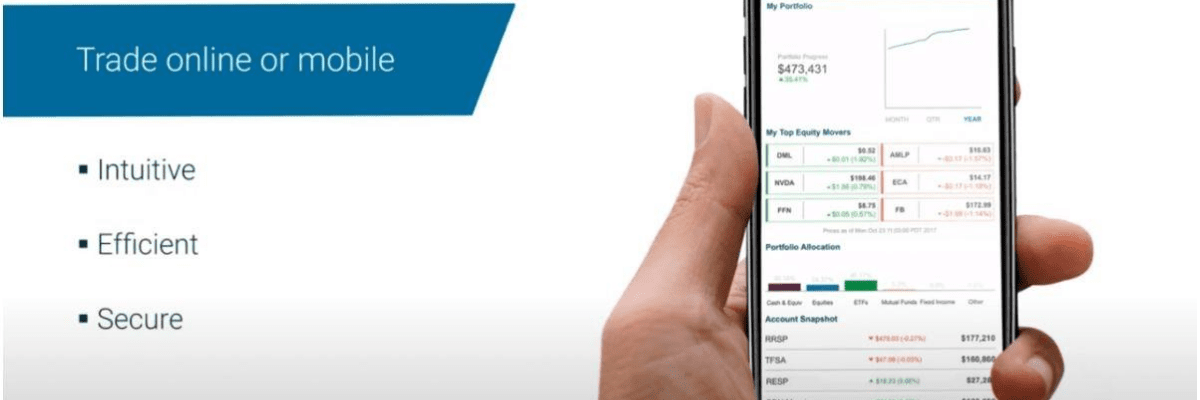

Interactive Brokers Canada Review 2026

What is Interactive Brokers? Interactive Brokers Canada is part of the parent company Interactive Brokers Group, Inc., which has been around for nearly 50 years and boasts consolidated equity capital of $19.5 billion. Its mission has always been to develop technology to help traders maximize their potential. Interestingly, way back in 1983 they were one of the pioneers of using technology to give their traders an upper hand. They introduced the first handheld computers used for trading. Since...| Million Dollar Journey

Alterna Bank Review 2026

We review Alterna Bank - a Canadian online bank. What do they offer and is it any good?| Million Dollar Journey

Laurentian Bank Review 2025

Complete review of Laurentian Bank of Canada. How do their rates and services compare to the top banks in Canada?| Million Dollar Journey

Best Credit Unions in Canada for 2026

In today’s financial landscape, Canadians have no shortage of financial institutions to choose from. There’s a growing number of online banks, as well as traditional big banks, and also a variety of credit unions. While it’s often the big banks that have the most notoriety, today we are going to explore the best credit unions in Canada. Our overview of Canada’s credit unions will explain the key features that set credit unions apart from other types of financial institutions, offer ...| Million Dollar Journey

Top 12 High Yield Stocks in Canada 2026

Many people love investing in dividend stocks for their predictable income stream. One of our most popular articles is our best Canadian dividend stocks list. Many investors are looking in particular for the best high yield Canadian stocks, so each year we provide the updated list below. You may notice we haven’t picked the stocks with the absolute highest dividend payouts and may be curious why we wouldn’t simply load up on those. Well, different investors have different goals. Some in...| Million Dollar Journey

Safe Retirement Withdrawal Rate Strategies in Canada - Financial Independence Hub

By Kyle Prevost Special to Financial Independence Hub The concept of a safe withdrawal rate (and the 4% rule) is a key planning tool for Canadians of all ages. After all, if you don’t have a general withdrawal plan, how can you know how much you need to save in the first place? If […]| Financial Independence Hub

Norbert's Gambit - Save on USD to CAD Conversions

If you’re looking to save money on foreign exchange, you’re in luck. There is a simple and effective way to convert your CAD to USD so you can make US stock purchases. It’s called Norbert’s Gambit, and it can save you hundreds of dollars on trading fees. Smart investors know that investing in US stocks is a great way to diversify your portfolio. The good news is, your favorite Canadian Online Brokerage will make it easy to do by conveniently converting CAD to USD for you when you want...| Million Dollar Journey

Wealthsimple Crypto Review 2025

What is Wealthsimple Crypto? Wealthsimple Crypto is a crypto trading platform managed through Wealthsimple Trade. It features completely self-directed trading with commission-free buying and selling (sort of, keep reading to learn more). Investors can begin with any amount, even if it’s only $1. Wealthsimple Crypto’s list of available cryptocurrencies has expanded exponentially over its first year and keeps growing. As of January 2023, Wealthsimple Crypto has over 50 kinds of cryptocurren...| Million Dollar Journey

Safe Withdrawal Rates in Canada (for any Retirement Age) - Financial Independence Hub

By Kyle Prevost, MillionDollarJourney Special to the Financial Independence Hub So you have been reading Million Dollar Journey (MDJ) for years, have used your Canadian online broker account to DIY-invest your way to a solid nest egg. You’ve got a TFSA, and RRSP, and maybe even a non-registered account – full of good revenue-generating assets. […]| Financial Independence Hub

Scotia iTRADE Review 2025 - Pros, Cons, Fees & More

What is Scotia iTRADE? In 2008, Scotia iTRADE was launched when Scotiabank acquired E*Trade Canada and promptly rebranded it. This purchase was a smart move as it essentially doubled the online client base of Scotiabank overnight. Scotia iTRADE initially gained popularity among active day traders because of its discounted flat rate commissions for active traders. However, while they still offer discounted rates, these have increased from $1.25+ per trade to $4.99+ per trade, aligning them wit...| Million Dollar Journey

CIBC Investor's Edge Review 2025

What Is CIBC Investor's Edge? If you are already a CIBC customer, you might already know that it has been around for a long time, over 100 years in fact. As a result, it offers an array of choices when it comes to how you save and invest your money. It offers the basics, such as cash accounts, TFSA, RRSP, and RESP. It also offers you access to other attractive investment options like stocks, ETFs, mutual funds and bonds. Something that makes CIBC stand out is that it was the first to launch...| Million Dollar Journey

Qtrade Promo Code 2025 - $150 Free + $2,000 Cashback!

The recent 2025 Qtrade Promo Offer Code is one of the main reasons we have them at the top of Best Canadian Online Broker rankings. Every year the DIY brokerages put their best foot forward during the first few months of the year because they know it’s when Canadians pay the most attention to their finances. This is the first year I’ve seen an offer quite this good. (Last’s year’s Qtrade promo was also solid - but this one tops it for the folks with under $250,000 to invest.) To lock ...| Million Dollar Journey

RBC Direct Investing Review 2025 - Pros, Cons, Fees & More

What is RBC Direct Investing? The Royal Bank of Canada (RBC) was one of the first banks in the country to pioneer DIY investing for the everyday investor. With RBC Direct Investing, you can trade Canadian and US stocks, ETFs, mutual funds and bonds. You can fund and manage your registered investment accounts (TFSA, RRSP, RRIF, RESP and more) and access a variety of investing tools to help you make informed decisions. If you already have an account with RBC, then opening an RBC Direct Investin...| Million Dollar Journey

Withdrawing From RRSP/TFSA to Fund Early Retirement in Canada

Moving from the accumulation stage of my professional career, to withdrawing investments in early retirement was more difficult than I would have predicted a few years ago. For those who haven’t been following me since I started writing Million Dollar Journey back in 2005, I have slowly-but-surely detailed my rise from a very average net worth, to building an investment portfolio that allowed me to reach complete financial independence. Here are some of the key articles that I’ve written ...| Million Dollar Journey

Smith Manoeuvre Tax Deductible Investing: 2025 Guide

When I first wrote about the Smith Manoeuvre (18 years ago!) - a method to transform your mortgage into a tax-deductible loan - I never imagined it would become one of our most popular topics, racking up hundreds of comments. Even though I kicked off my own Smith Manoeuvre at practically the worst time in the last half-century (back in 2007), it still turned out pretty well for me. As we move into 2025, it’s becoming clear that high mortgages might be coming down a bit, the days of ultra-lo...| Million Dollar Journey

Simple Low Cost Diversified ETF Portfolios Examples 2026

We've been writing about low-cost ETFs in Canadian index portfolios since 2008. Below is our 2026 update. ETFs, or exchange-traded funds, first entered the Canadian market over a decade ago. From day one, they impressed us as an excellent tool to help you build a low-cost, diversified portfolio. As time has passed, ETF providers have created tools that make index investing easier than ever. All-in-one ETFs, or “portfolio ETFs” mean that you’ll never have to worry about rebalancing you...| Million Dollar Journey

Best Options Trading Sites in Canada 2026

Options are one of the best ways to capitalize on market trends and enhance profitability - if you get your prediction right. While buying options has a limited downside on a per contract basis, it is also one of the “best” ways to lose your money in the market - or as WSJ put it “More Men are Addicted to the Crack Cocaine of the Stock Market”. Options trading is not for the faint of heart, and shouldn’t be used by novice traders. Honestly, the average Canadian investor has no need ...| Million Dollar Journey

Wealthsimple Trade Review 2025 - Pros, Cons & Promo

What is Wealthsimple Self-Directed Investing (Formerly Wealthsimple Trade)? Wealthsimple self-directed investing is an online brokerage that lets you buy individual stocks and other assets. It’s part of the Wealthsimple ecosystem – a financial company (primarily owned by the massive Quebec-based conglomerate Power Corp) that has over 3 million customers and oversees $100+ billion in assets. Wealthsimple itself kicked off in 2014, while the self-directed platform officially made its debut ...| Million Dollar Journey

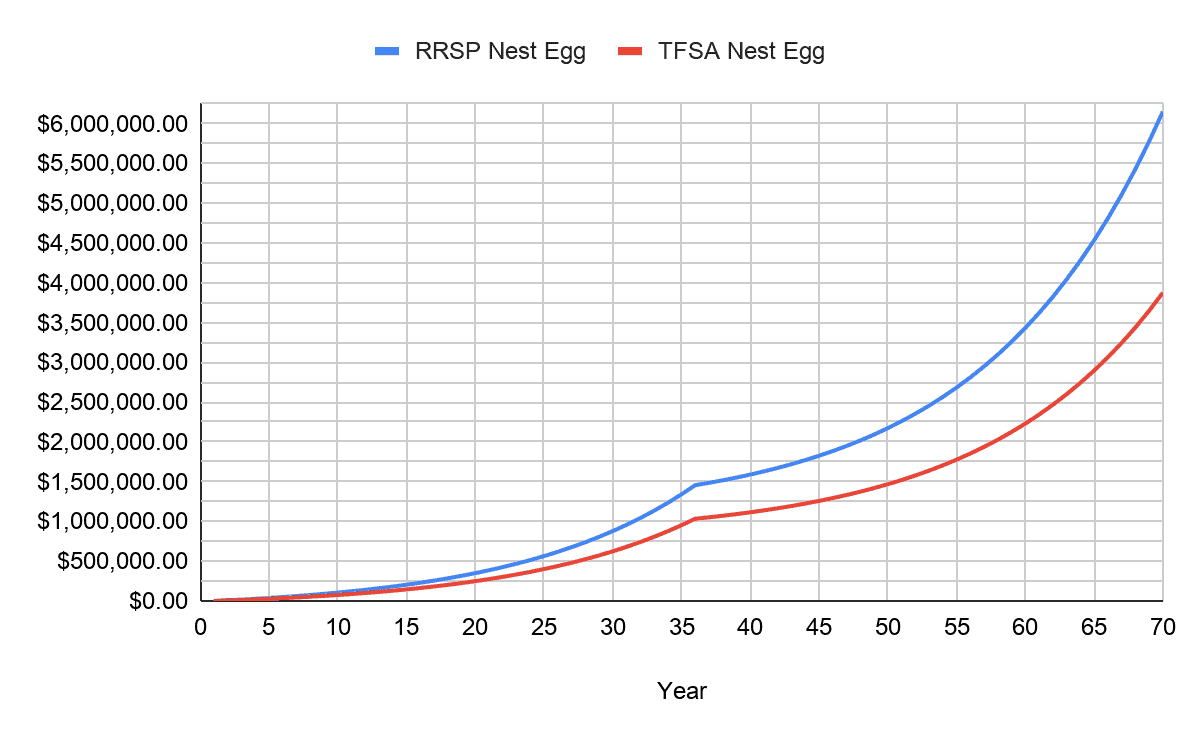

TFSA vs RRSP - Which One is Better in 2024?

Canadians have fantastic options when it comes to registered accounts. Registered accounts are beneficial for many reasons, the main reason being that they are tax advantaged. Tax advantage accounts are those that allow you to grow your money tax-free or allow you to defer paying taxes until later. However, all registered accounts are not created equal, and before you invest, you want to read our detailed TFSA vs RRSP guide to better understand what these two registered accounts can do for yo...| Million Dollar Journey

National Bank Direct Brokerage Review 2025 - No Trading Fees!

NBDB has made changes over the last two years to make their fee structure competitive among other discount brokers, and have now dropped their commission fees altogether for those trading on their online platform. It seems as though they have taken customer feedback to heart and made improvements to make those customers want to stay as well as attract new ones. In 2019 they were ranked dead last, 8 out of 8, by J.D. Power, but merely one year later in 2020, they moved up considerably to 4th o...| Million Dollar Journey

RESP in Canada - Rules, Contributions & Investments

An RESP, or Registered Education Savings Plan, is a registered tax-deferred investment account designed to help pay for a child’s education. In other words, RESPs are the best possible way to pay for your child’s eventual college and/or university bills! RESPs are eligible for government grants (re: Free Money) of up to $7,200. In this post, we’ll fill you in on all the basics of RESPs, from how (and where) to set up an RESP, and how to maximize your RESP contributions. What is an RES...| Million Dollar Journey

FHSA Canada - First Home Savings Account Explained

With the government having launched the First Home Savings Account (FHSA) in 2023, more first-time home buyers should really be looking to take advantage of the tax-free benefits of the FHSA in 2024. The idea is obviously to make it easier for Canadians to buy their first home. In addition to the more straightforward benefits, there are a couple of unique ways that you can use your FHSA account. It’s also important to get the details right (especially when combining your FHSA with a partner...| Million Dollar Journey

Wealthsimple Review 2025 - Pros, Cons, Fees & Promo

What is Wealthsimple? Wealthsimple was founded back in 2014 by Michael Katchen, Brett Huneycutt and Rudy Adler. I gotta say that I really liked the company more in its first few years than in its current iteration. For the first five years of its existence, Wealthsimple was solely focused on the product that is now known as Wealthsimple Managed Investing. Some people called this a “robo advisor,” others called it a “automated wealth manager” – whatever you wanted to call it, Wealths...| Million Dollar Journey

Top 6 Canadian Tech Stocks to Buy in 2025

While Canadian technology stocks have seen impressive growth over the last decade - particularly during the pandemic—they remain a relatively small slice of the Toronto Stock Exchange. We have a lot of great Canadian dividend stocks, Canadian bank stocks, Canadian energy stocks, Canadian utility stocks, etc. But tech stocks account for just 8-9% of our publicly traded market, according to the FTSE Canada All-Cap Index. To put that into perspective, the financial sector dominates at around...| Million Dollar Journey

How To Invest in Commodities in Canada 2025

If you have been like many investors and sticking with an easy, passive all-in-one ETF, but looking to try out something a bit more active, investing in commodities in Canada could be just the thing to scratch that itch. Commodities are consumer products such as energy, metals and agriculture tend to fare particularly well in times of high inflation. As inflation rates continue to rise worldwide, we can expect commodities to continue to surpass stock returns. So, now is the perfect time to co...| Million Dollar Journey

TFSA Contribution Room 2024 - TFSA Rules and Limits

There’s an overwhelming amount of investment advice out there. While some of it requires careful research and planning, some tips -like contributing to a TFSA - are simply smart moves that should be acted on as soon as possible. Why? Two powerful words: tax-free. Tax-free is not something you hear about every day, which is why we’re here to help you start contributing to your TFSA as soon as possible to maximize both your savings and investment earning potential. If you turned 18 on or be...| Million Dollar Journey

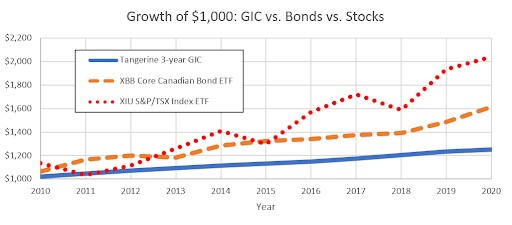

Best Fixed Income Investing Options In Canada 2025

For income-oriented Canadian investors the choice between a Bond (or Bond ETF), a GIC, or a high interest savings account has become more important than ever. With interest rates at historic lows (for a little while longer anyway) choosing the best option for the “safe, low risk investing” part of our portfolio can make a big difference! Read on to find our picks for the best Bond ETF, the best GIC rates in Canada, and our pick for top Canadian high interest savings account. Best Cana...| Million Dollar Journey

Best Stock Trading Apps In Canada For 2025

As someone who’s been DIY investing online for nearly two decades, it has been fascinating to watch Canada’s stock trading apps evolve. When I first launched Million Dollar Journey, your choices for online trading were slim. The big banks ran the show, fees were steep, and the apps were clunky at best. Placing a trade from your phone was borderline impossible. Obviously things look a whole lot different today. Fintech disruptors have forced the big players to up their game, giving investo...| Million Dollar Journey

Best Low Risk Investments in Canada With High Returns 2025

With so many threats to our economy in 2025 many Canadian investors are looking for low risk investments. Personally, I recommend that if you plan on using your cash within the next five years, it’s worth sticking to investments covered by the Canadian Deposit Insurance Corporation (CDIC). High-interest savings accounts and GICs (Guaranteed Investment Certificates) fall under this umbrella. They’re not flashy, but they’re safe. On the other hand, if you’re looking to build your nest e...| Million Dollar Journey

Best Long-Term investments in Canada for 2025

Long-term investing is one of the most powerful ways to grow your wealth. As the name implies, long-term investing means that an investor buys an asset with the intent to hold it for some time. The time frame can be years or even decades. Over time, long-term investing has the potential to produce excellent returns due to the magic of compound interest. While this strategy might not appeal to everyone, especially those with a high risk tolerance, it has historically proven to be an effectiv...| Million Dollar Journey

Questrade vs Wealthsimple - Which is Better in 2026?

Many Canadian DIY investors end up comparing Wealthsimple vs Questrade as they’re two of the biggest names in the game. Both brokerages built their reputations by hammering home the same message (largely through savvy Youtube campaigns): Canadians pay way too much at the big banks. Toss in free trades, easy-to-use platforms, and a race to zero-commission trading, and it’s easy to see why they’ve attracted millions of accounts. But here’s the part most comparison articles skip over: Ev...| Million Dollar Journey

Best Canadian Dividend ETFs 2025 (And Why I Don't Like Them)

Having written about dividend investing in Canada for close to twenty years, I regularly hear from readers wondering whether the best Canadian dividend ETFs are a better value than trying to do the research and select from the best dividend stocks in Canada. It’s clear that Canadian investors have a soft spot for reliable, tax-efficient dividend income. Getting those steady quarterly payouts deposited into your account can do wonders for investor discipline and long-term planning. In most c...| Million Dollar Journey

Top 4 Canadian REIT ETFs to Buy in 2025

A Real Estate Trust (REIT) ETF is the most straightforward way to invest in real estate without becoming a landlord yourself or spending time researching the 30+ individual REITs on the Toronto Stock Exchange. This article will give you all the details about REIT ETFs: What they are and how they diversify your portfolio How they’re different from Real Estate Trusts (REITs) How to recognize good REIT ETFs Which Canadian REIT ETFs are the best picks for 2025 Top REIT ETFs in Canada: Quick...| Million Dollar Journey

Index Investing in Canada - Pros, Cons & Best Options 2025

If you’ve been circling the idea of index investing, and fully committing to a passively-managed portfolio - but find yourself in paralysis-analysis mode - then unfortunately you have plenty of company. A lot of folks get stuck in the pre-game - unsure where to begin, thinking they don’t have enough money to get started, or feeling like they need a finance degree in order to select a fund. Here’s the good news: you don’t need to be an expert, and you don’t need to be rich. You jus...| Million Dollar Journey

Top 11 Cash & Money Market ETFs in Canada For 2025

Due to all of the tariff talk, there has been a lot of interest in Canada’s Best Cash ETFs and other low risk investments lately. You might also know these exchange traded funds as HISA ETFs (high interest savings account ETFs). Cash ETFs aren’t exactly the same thing as money market ETFs - but when it comes to most people’s portfolios, the reasons for buying them are very similar. They are both examples of fixed income (as opposed to stocks/equities) and are less volatile than many oth...| Million Dollar Journey

Investing in Canadian REITs 2025 - Pros, Cons & Comparison

Investing in Canadian Real Estate Investment Trusts (REITs) offers a convenient way to add real estate exposure to your portfolio - without making major lifestyle changes. While buying a rental property and becoming a landlord is one option, it’s not for everyone. If you don’t have the time, energy, or cash/capital to manage physical real estate, Canadian REITs can be an attractive alternative. They allow you to invest in real estate through small, manageable amounts—no tenants or prope...| Million Dollar Journey

Top 6 Canadian Utility Stocks For 2025

There is a reason why so many of Canada’s best utility stocks are also on our overall list of best dividend stocks in Canada: They are natural oligopolies/monopolies, meaning that can pass along increasing costs almost instantly, and have really solid yields for income-seeking investors. This combination makes them a natural fit for Canadian investors looking for inflation hedge stocks. Some people consider Canadian utility stocks “boring” compared to high volatility “get rich/poor qu...| Million Dollar Journey

Free Stock Trading in Canada 2025 - Best Brokers & Promos

The best free stock trading apps in Canada are giving DIY investors more control than ever. With no trading fees eating away at returns, it’s never been easier to build your own portfolio and keep more of what you earn. That said, let’s be clear - 'free trading app” doesn’t mean there are no costs at all. While some platforms have eliminated commissions on stock and ETF trades, there are always ways brokerages make money, whether through currency conversion fees, foreign exchange spre...| Million Dollar Journey

Safe Withdrawal Rates in Retirement For Canadians

The concept of a safe withdrawal rate (and the 4% rule) is a key planning tool for Canadians of all ages. After all, if you don’t have a general withdrawal plan, how can you know how much you need to save in the first place? If you have been reading MDJ for years, you already have an idea of how to use a Canadian online broker account to DIY-invest your way to a solid nest egg. Now you’re planning for retirement (whether it’s 20+ years away or next year) and you’re wondering how to ...| Million Dollar Journey

What is a Spousal RRSP? Our 2025 Guide

You likely already know that investing in an RRSP is one of the best, most tax efficient ways to save for retirement. The good news is that if you or your common-law partner or spouse have unequal incomes, you can open and contribute to a spousal RRSP account. In doing so, you can maximize the benefits of an RRSP account for you and your spouse, no matter if one of you is not earning an income or earning much less. Read on to learn more about how a spousal RRSP account works, what the tax i...| Million Dollar Journey

Top All-in-One ETFs in Canada 2025 - Returns & Fees Compared

Canada’s all-in-one ETFs (also called portfolio ETFs) have been the single most important investment product innovation since I’ve started writing about this stuff nearly two decades ago. The Vanguard, iShares, and BMO all-in-one ETFs are the perfect marriage of index investing strategy, convenience, asset allocation math, and behavioural safeguards. These ETFs - which are actually a collection of smaller ETFs - are so diverse that they actually include several of the Best ETFs in Canada,...| Million Dollar Journey

Canadian Dividend Kings List: 50+ Years Dividend Increase!

Investing in Canadian Dividend Kings (sometimes known as Dividend Aristocrats) tends to come back into fashion when bond yields and GIC rates start to go down. With safer assets generating so little income, dependable dividend payers begin to look more and more attractive. So it’s no surprise that these solid blue chip stocks outperformed the rest of the market over the second half of 2024. Of course, staying committed to dividends can be a challenge when stocks like Nvidia are soaring. The...| Million Dollar Journey

Top 49 ETFs in Canada for August 2025

When I first started writing about Canadian personal finance twenty years ago, my list of the best ETFs in Canada could fit on a napkin. There were no Canadian all-in-one ETFs, no catchy tickers, and definitely no slick marketing campaigns. ETFs were basically niche tools used by hardcore index investors and a handful of spreadsheet-loving DIY types. Fast-forward to today, and the landscape has completely changed. While I still hold a solid chunk of Canadian dividend stocks in my portfolio, l...| Million Dollar Journey

Qtrade vs Wealthsimple - 2025 Comparison & Analysis

If you’ve been searching for the best rated discount brokerages in Canada, it’s likely that the Wealthsimple vs. Qtrade debate has popped up on your radar quite a few times. They are both good options for DIY investors looking for an easy to use and low-cost way to invest, but they definitely have some major differences you’ll want to know about before deciding which one is best for you. We’ll be breaking it down for you in this article by looking at Qtrade and Wealthsimple’s fees, ...| Million Dollar Journey

Desjardins (Disnat) Online Brokerage Review 2025

What is Desjardins Online Broker? When it comes to Canadian online brokers, Desjardins Online Brokerage isn’t typically one of the first names that comes to mind. That being said, in the spirit of providing a full selection of broker reviews, our MDJ editorial team looked under the hood of one of Canada’s original discount brokerages. Desjardins is best-known among those living in Quebec and Ontario; however, it’s also active in western Canada as well. It often goes by the name “Disna...| Million Dollar Journey

BMO Investorline Review 2025 - Account Types, Fees + Promo

Is BMO Investorline Safe and Trusted? In a word, YES. As one of Canada’s oldest and most trusted companies (founded in 1817) the Bank of Montreal is as safe, trusted, and legit as you can get. InvestorLine has been around longer than the internet - BMO introduced self-directed trading way back in 1988 before moving online in 2000. That’s an impressive history! BMO InvestorLine is IIROC regulated and CIPF insured. They use 128-bit encryption and multi-factor user authentication to keep y...| Million Dollar Journey

Questrade vs Qtrade - Who's The Best Canadian Broker 2025?

When I first launched Million Dollar Journey in 2006 and started writing about Canadian online brokers, the Qtrade vs. Questrade rivalry was already heating up. Fast forward nearly two decades, and not only has the rivalry intensified, but these two platforms have also solidified their positions as the leaders of Canada’s brokerage scene (leaving the big bank brokerages even further behind). As a DIY investor for the last 20 years, I’ve had firsthand experience with over a dozen brokerage...| Million Dollar Journey

Questrade Review 2025 - Pros, Cons, Fees & Promo

Is Questrade Safe & Secure? One of the most common questions that I have gotten in the comments below is: Is investing my money through a Questrade online brokerage account safe? Is Questrade as safe as RBC, TD, CIBC, ScotiaBank, and BMO?- MDJ reader The answer: Yes! Questrade is fully regulated by two key financial oversight bodies in Canada: the Canadian Investment Regulatory Organization (CIRO) and the Canadian Investor Protection Fund (CIPF). These aren’t just formalities - they’re fu...| Million Dollar Journey

Top 10 Online Brokers in Canada 2025

As we look ahead to summer and the second half of 2025, it’s time for an updated look at the Best Online Brokerages in Canada. With RRSP season in the rearview mirror – and what might be shaping up to be another round of “tariff season” drama ahead – now’s the time to lock in the easy DIY investing wins. I’ve been writing about Canadian online brokers for nearly 20 years, and the changes in the space have been massive. Fees have plunged, platforms are smoother than ever, and com...| Million Dollar Journey

Top 10 Canadian Dividend Stocks To Buy - January 2026

As we start a new year, our January 2026 Best Canadian Dividend Stocks list needed a refresh. Last year was an excellent year for all Canadian stocks, with the TSX finishing up around 30%. Canadian dividend stocks specifically finished up around 20% (plus a 4% dividend) depending on which dividend stock index you use as a benchmark. The 2025 standout performer was TD Bank. The bank stock absolutely destroyed the index, with a smoking-hot 50%+ total return. When I first started recommending T...| Million Dollar Journey