Best Debt Management Companies of 2026 and How to Choose

Looking for a program to manage debt can be overwhelming. Let our list of top debt management companies help you start the journey to controlling your debt.| Debt.org

How Does Debt Relief Work? Types of Debt Relief

There are many debt relief options available to consumers. Learn about your options & how certified counselors can help design the perfect debt relief plan.| Debt.org

Does a Chapter 13 Trustee Monitor Income? | Debt.org

Learn about the role and responsibilities of Chapter 13 Bankruptcy Trustees, whether they can monitor your income, and how to work with trustees.| Debt.org

Is An Interest-Only Mortgage Right For You? | Debt.org

Thinking about an interest-only mortgage? Understand how they work, the advantages and disadvantages, and more.| Debt.org

Debt Relief Programs: Explore Your Options and Make a Plan

Discover the pros and cons of the best debt relief option for your needs - from professional debt management to doing it yourself - and get out of debt.| Debt.org

Can I Use a Reverse Mortgage To Pay Off Debt? | Debt.org

Learn the advantages and disadvantages of using a reverse mortgage to pay off existing debts, how they work, and what can spend the money on.| Debt.org

Best Ways to Consolidate Debt: What're Your Options?

Learn the different pros and cons of the best debt consolidation options available to help you get out of debt and improve your financial wellbeing.| Debt.org

Credit Counseling for Mortgages & Housing

Learn how you can use credit counseling to guide you through mortgages, reverse mortgages, pre-purchase counseling, rental assistance and avoid delinquency.| Debt.org

Government Programs and Financial Assistance for Mental Health

Learn more about financial programs designed to support people with short and long-term mental health difficulties to stay out of debt and live a better life.| Debt.org

Can I Make a Car Payment with a Credit Card? | Debt.org

Learn more about paying your car payment with a credit card, methods to do it successfully, and the pros and cons associated with each method.| Debt.org

Nonprofit Debt Settlement: What Is It? & How It Works

Nonprofit Debt Settlement, a program offered by credit counseling agencies, allows consumers to eliminate credit card debit for less than they owe.| Debt.org

How Long Does Bankruptcy Stay on Your Credit Report?

Bankruptcy stays on your credit report for 7-10 years depending on which bankruptcy you file. Learn how long each type of bankruptcy affects your credit.| Debt.org

Credit Card Debt Consolidation: 7 Ways to Simplify Debt

Credit card debt consolidation combines your debt into simple payments, making it easier to pay off your balances. Learn how it works & where to start.| Debt.org

What Happens If You Stop Paying Credit Card Bills? | Debt.org

If you stop making credit card payments you can face serious consequences like fines, lawsuits and debt collector harassment. Learn more with Debt.org.| Debt.org

How to Stop Paying Credit Cards Legally & Get Rid of Debt

Struggling with credit card debt? Learn how to erase credit card debt without paying the full amount owed with these credit card debt forgiveness tactics.| Debt.org

Personal Loans for College Students in 2025: Pros and Cons

College is expensive and students often face financial hardship. Learn about personal loans for students, pros and cons, and whether they're right for you.| Debt.org

Student Loan Forgiveness and Debt Relief | Debt.org

Learn more about the Biden Administrations' recent efforts to forgive student debt, legal roadblocks, and other avenues to obtain student debt relief.| Debt.org

Debt Consolidation Loans: How to Reduce Your Personal Debt

Learn about debt consolidation loans, including how to get a loan to consolidate your debt, benefits & alternatives to consolidation loans.| Debt.org

Medical Debt Consolidation: Should You Do It?

Learn how medical debt consolidation works to simplify repayment, how to consolidate medical bills, options to consolidate medical debt, and alternatives.| Debt.org

How to Improve Your Credit Score: Tips & Tricks

Learning how to raise your credit score may mean the difference between a loan getting approved or denied. Use these tips to keep your credit score healthy.| Debt.org

Bankruptcy: How It Works and Consequences

Facing overwhelming debt? Discover how bankruptcy can offer a fresh start. Understand your options and take the first step towards relief today.| Debt.org

Credit Counseling: How it Works & How to Select an Agency

Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you.| Debt.org

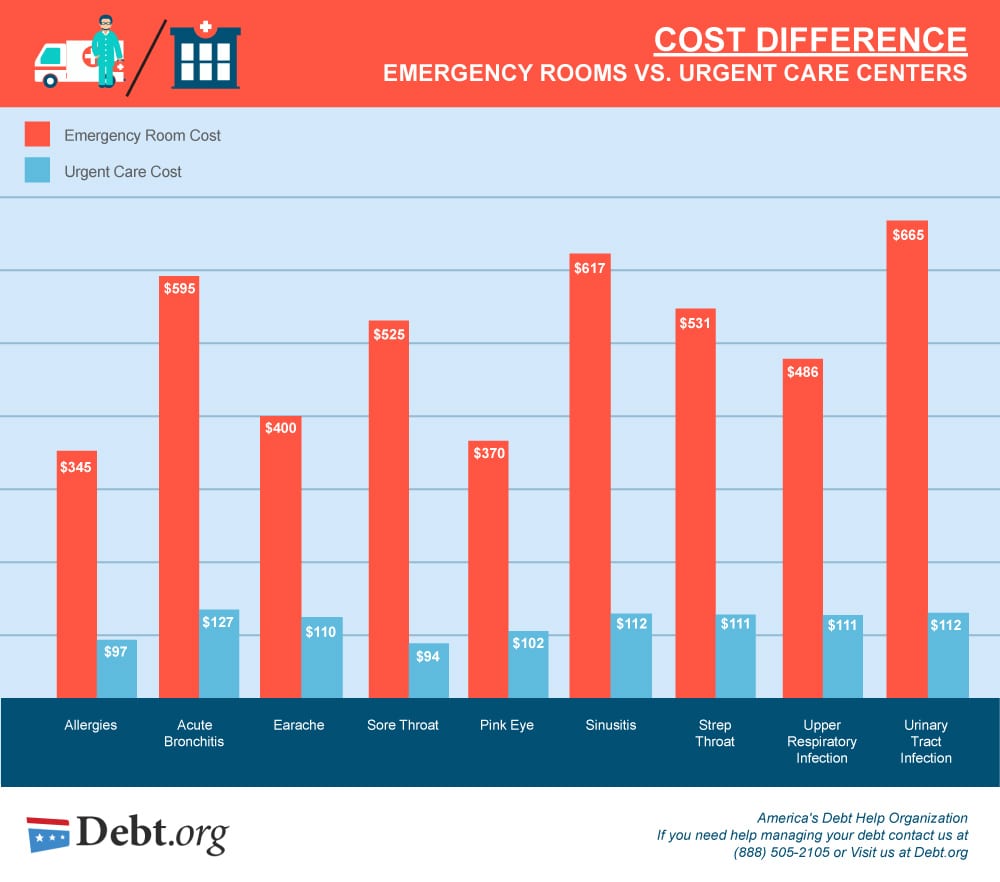

Urgent Care vs Emergency Room Costs, Differences and Options

Deciding between Urgent Care vs Emergency Room? Find the fastest, most effective care for your needs. Click now to understand the best choice for you!| Debt.org