Can You Invest Only in ETFs? Pros and Cons Explained

As regular readers of MillionDollarJourney know, we are big fans of Exchange Traded Funds (ETFs) which are one of the fastest growing products in the market. Were it not for the fact that financial firms and advisors have less incentives to sell ETFs than other investments such as mutual funds (that provide them with annual fees), the growth would probably be even more spectacular. Having said that, ETFs don't always have the best performance, and are sometimes outperformed significantly by...| Million Dollar Journey

Safe Retirement Withdrawal Rate Strategies in Canada - Financial Independence Hub

By Kyle Prevost Special to Financial Independence Hub The concept of a safe withdrawal rate (and the 4% rule) is a key planning tool for Canadians of all ages. After all, if you don’t have a general withdrawal plan, how can you know how much you need to save in the first place? If […]| Financial Independence Hub

Nest Wealth Review 2026 - Is It Safe & Worth Using?

What is Nest Wealth? In late January 2024, the digital finance company Nest Wealth was acquired by Objectway of Italy. Not much seems to have changed with this new acquisition. Nest Wealth was founded in 2014 with the goal of providing “digital wealth solutions for everyone.” In the case of Nest Wealth, “everyone” includes not only individual investors like you or me, but also: Financial institutions Financial advisors and planners Employers who operate group RRSPs and more Nest Wealt...| Million Dollar Journey

Safe Withdrawal Rates in Canada (for any Retirement Age) - Financial Independence Hub

By Kyle Prevost, MillionDollarJourney Special to the Financial Independence Hub So you have been reading Million Dollar Journey (MDJ) for years, have used your Canadian online broker account to DIY-invest your way to a solid nest egg. You’ve got a TFSA, and RRSP, and maybe even a non-registered account – full of good revenue-generating assets. […]| Financial Independence Hub

Best Investments During a Recession in Canada

Is a recession coming and what should you do? How to prepare for a Canadian recession.| Million Dollar Journey

Withdrawing From RRSP/TFSA to Fund Early Retirement in Canada

Moving from the accumulation stage of my professional career, to withdrawing investments in early retirement was more difficult than I would have predicted a few years ago. For those who haven’t been following me since I started writing Million Dollar Journey back in 2005, I have slowly-but-surely detailed my rise from a very average net worth, to building an investment portfolio that allowed me to reach complete financial independence. Here are some of the key articles that I’ve written ...| Million Dollar Journey

Simple Low Cost Diversified ETF Portfolios Examples 2026

We've been writing about low-cost ETFs in Canadian index portfolios since 2008. Below is our 2026 update. ETFs, or exchange-traded funds, first entered the Canadian market over a decade ago. From day one, they impressed us as an excellent tool to help you build a low-cost, diversified portfolio. As time has passed, ETF providers have created tools that make index investing easier than ever. All-in-one ETFs, or “portfolio ETFs” mean that you’ll never have to worry about rebalancing you...| Million Dollar Journey

Best Options Trading Sites in Canada 2026

Options are one of the best ways to capitalize on market trends and enhance profitability - if you get your prediction right. While buying options has a limited downside on a per contract basis, it is also one of the “best” ways to lose your money in the market - or as WSJ put it “More Men are Addicted to the Crack Cocaine of the Stock Market”. Options trading is not for the faint of heart, and shouldn’t be used by novice traders. Honestly, the average Canadian investor has no need ...| Million Dollar Journey

RESP in Canada - Rules, Contributions & Investments

An RESP, or Registered Education Savings Plan, is a registered tax-deferred investment account designed to help pay for a child’s education. In other words, RESPs are the best possible way to pay for your child’s eventual college and/or university bills! RESPs are eligible for government grants (re: Free Money) of up to $7,200. In this post, we’ll fill you in on all the basics of RESPs, from how (and where) to set up an RESP, and how to maximize your RESP contributions. What is an RES...| Million Dollar Journey

Building a Million Dollar RRSP Starting Late (30s,40s,50s)

When I initially wrote this article about building RRSP wealth in your 30s, 40s, and 50s, my goal was to create an easy visual that illustrates just how much you would have to begin saving today if you wanted to be a millionaire “tomorrow” (when you retired). Five years later, the data stands up pretty well. I’m happy to say that my personal RRSP is well on the way to million-dollar status! Now, the more relevant question might be, do you actually need a million dollar RRSP to retire? W...| Million Dollar Journey

Top 6 Canadian Tech Stocks to Buy in 2025

While Canadian technology stocks have seen impressive growth over the last decade - particularly during the pandemic—they remain a relatively small slice of the Toronto Stock Exchange. We have a lot of great Canadian dividend stocks, Canadian bank stocks, Canadian energy stocks, Canadian utility stocks, etc. But tech stocks account for just 8-9% of our publicly traded market, according to the FTSE Canada All-Cap Index. To put that into perspective, the financial sector dominates at around...| Million Dollar Journey

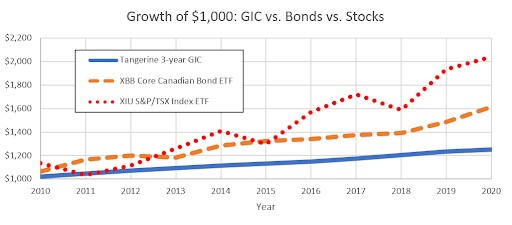

Best Fixed Income Investing Options In Canada 2025

For income-oriented Canadian investors the choice between a Bond (or Bond ETF), a GIC, or a high interest savings account has become more important than ever. With interest rates at historic lows (for a little while longer anyway) choosing the best option for the “safe, low risk investing” part of our portfolio can make a big difference! Read on to find our picks for the best Bond ETF, the best GIC rates in Canada, and our pick for top Canadian high interest savings account. Best Cana...| Million Dollar Journey

Best Low Risk Investments in Canada With High Returns 2025

With so many threats to our economy in 2025 many Canadian investors are looking for low risk investments. Personally, I recommend that if you plan on using your cash within the next five years, it’s worth sticking to investments covered by the Canadian Deposit Insurance Corporation (CDIC). High-interest savings accounts and GICs (Guaranteed Investment Certificates) fall under this umbrella. They’re not flashy, but they’re safe. On the other hand, if you’re looking to build your nest e...| Million Dollar Journey

Best Long-Term investments in Canada for 2025

Long-term investing is one of the most powerful ways to grow your wealth. As the name implies, long-term investing means that an investor buys an asset with the intent to hold it for some time. The time frame can be years or even decades. Over time, long-term investing has the potential to produce excellent returns due to the magic of compound interest. While this strategy might not appeal to everyone, especially those with a high risk tolerance, it has historically proven to be an effectiv...| Million Dollar Journey

Best High Interest Saving Accounts Canada 2025

With GIC rates shrinking as quickly as Canada’s economic prospects, finding the best Canadian high interest savings account in 2025 is more important than ever. The combination of best interest rates, flexible payment options, and no-fees or transactions is what separates our favourite savings accounts from the rest of the pack. A quick reminder that while HISAs are perfect for low risk investments they’re not really appropriate for long-term investing. The math is pretty consistent in re...| Million Dollar Journey

Top 4 Canadian REIT ETFs to Buy in 2025

A Real Estate Trust (REIT) ETF is the most straightforward way to invest in real estate without becoming a landlord yourself or spending time researching the 30+ individual REITs on the Toronto Stock Exchange. This article will give you all the details about REIT ETFs: What they are and how they diversify your portfolio How they’re different from Real Estate Trusts (REITs) How to recognize good REIT ETFs Which Canadian REIT ETFs are the best picks for 2025 Top REIT ETFs in Canada: Quick...| Million Dollar Journey

Index Investing in Canada - Pros, Cons & Best Options 2025

If you’ve been circling the idea of index investing, and fully committing to a passively-managed portfolio - but find yourself in paralysis-analysis mode - then unfortunately you have plenty of company. A lot of folks get stuck in the pre-game - unsure where to begin, thinking they don’t have enough money to get started, or feeling like they need a finance degree in order to select a fund. Here’s the good news: you don’t need to be an expert, and you don’t need to be rich. You jus...| Million Dollar Journey

Foreign Withholding Taxes on ETFs & How it Affects Fees

Because I’ve written a lot about the Best Canadian ETFs and the top dividend ETFs, I tend to get a lot of questions and comments asking me about the MER and taxes on ETFs that hold equities from other countries. Obviously when you’re asking those types of in-depth questions you already understand the value of index investing, and instant diversification. Personally, I like to balance my love of Canadian dividend stocks, with non-Canadian ETFs to get super-convenient international exposure...| Million Dollar Journey

Best Canadian Pipeline Stocks To Buy in 2025

It’s no secret that we’re big fans of Canadian dividend stocks here at MDJ, and while we have given some shine to Canadian energy stocks over the last couple of years, we have always just sort of tossed the Canadian pipeline stocks in alongside those big energy producers. The fact is the Canadian pipeline stocks - often described as “mid-stream” due to their place in the supply chain - actually offer superior dividend cash flow relative to their energy producer cousins. Their busine...| Million Dollar Journey

Safe Withdrawal Rates in Retirement For Canadians

The concept of a safe withdrawal rate (and the 4% rule) is a key planning tool for Canadians of all ages. After all, if you don’t have a general withdrawal plan, how can you know how much you need to save in the first place? If you have been reading MDJ for years, you already have an idea of how to use a Canadian online broker account to DIY-invest your way to a solid nest egg. Now you’re planning for retirement (whether it’s 20+ years away or next year) and you’re wondering how to ...| Million Dollar Journey

Top All-in-One ETFs in Canada 2025 - Returns & Fees Compared

Canada’s all-in-one ETFs (also called portfolio ETFs) have been the single most important investment product innovation since I’ve started writing about this stuff nearly two decades ago. The Vanguard, iShares, and BMO all-in-one ETFs are the perfect marriage of index investing strategy, convenience, asset allocation math, and behavioural safeguards. These ETFs - which are actually a collection of smaller ETFs - are so diverse that they actually include several of the Best ETFs in Canada,...| Million Dollar Journey

Stocktrades ETF Insights Review 2025

Stocktrades.ca's ETF insight tool review - is it worth the price & What can it help you with.| Million Dollar Journey

Best Short Term Investments in Canada (May 2025)

With interest set to fall, the best short term investments in Canada continue to evolve as we move toward the second half of 2025. As recently as 18 months ago, we were still seeing 5%+ GIC options, but now, I’d argue that high interest savings account options give you the best bang for your buck. The EQ Everyday Banking Account is currently the best combination of a risk-free, automatic 4% return, combined with full liquidity and instant access to your cash. A couple other short term inves...| Million Dollar Journey

Income Splitting In Canada - 13 Best Tax Saving Strategies

Income splitting is a tax-saving strategy that divides a stream of income between family members (usually two spouses). The goal is to apportion as much of the higher-earning family member’s income to other family members, in an effort to get that higher-earning spouse into a lower tax bracket. Some economists and policy wonks have made the argument that income taxation should be applied to the family unit as a whole, and thus negate the need for fancy income splitting accounting altogether...| Million Dollar Journey

Desjardins (Disnat) Online Brokerage Review 2025

What is Desjardins Online Broker? When it comes to Canadian online brokers, Desjardins Online Brokerage isn’t typically one of the first names that comes to mind. That being said, in the spirit of providing a full selection of broker reviews, our MDJ editorial team looked under the hood of one of Canada’s original discount brokerages. Desjardins is best-known among those living in Quebec and Ontario; however, it’s also active in western Canada as well. It often goes by the name “Disna...| Million Dollar Journey

Questrade Review 2025 - Pros, Cons, Fees & Promo

Is Questrade Safe & Secure? One of the most common questions that I have gotten in the comments below is: Is investing my money through a Questrade online brokerage account safe? Is Questrade as safe as RBC, TD, CIBC, ScotiaBank, and BMO?- MDJ reader The answer: Yes! Questrade is fully regulated by two key financial oversight bodies in Canada: the Canadian Investment Regulatory Organization (CIRO) and the Canadian Investor Protection Fund (CIPF). These aren’t just formalities - they’re fu...| Million Dollar Journey