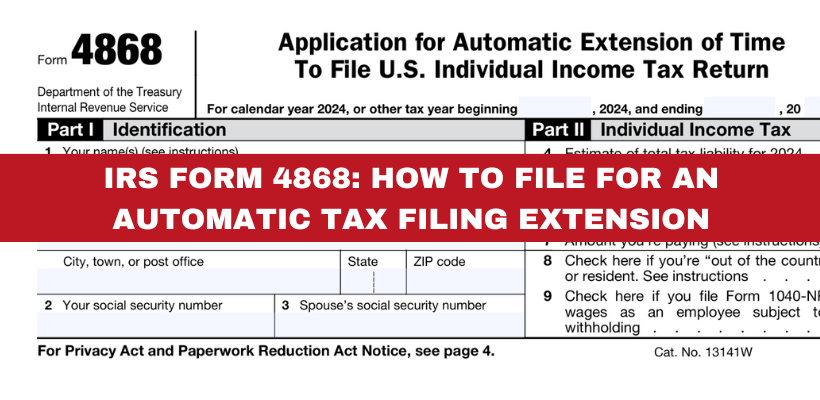

IRS Form 4868: How to File for an Automatic Tax Filing Extension - Florida Tax Solvers

Sometimes life gets busy and tax season sneaks up on you. If you need more time to prepare your federal tax return, the IRS offers a solution: IRS Form 4868,| Florida Tax Solvers