how I explained vol drag to a 12-year-old - Party at the Moontower

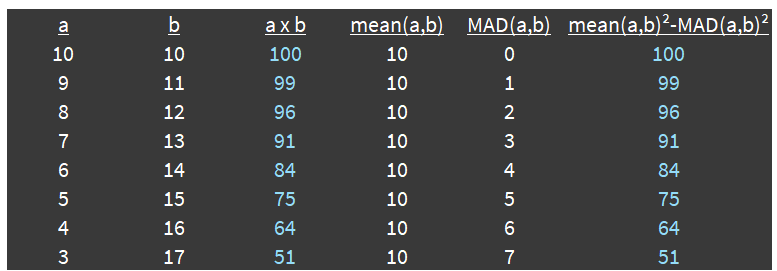

I used a pattern to explain it to my 12-year-old on our car ride on Monday. Start with: 8*8 = 64 Let’s call that a * b It feels like if we subtract 1 from a and add 1 to b multipy it should be close to 64 7*9 = 63 Close but a tad lower. What if we keep … Continue reading how I explained vol drag to a 12-year-old →| Party at the Moontower