Dr Jacques Ludik speaking at AMLD Africa 2026 on AI & Economic Empowerment – Jacques Ludik

What if Africa’s next wave of jobs, startups and growth was powered by AI built here, for our markets? At AMLD Africa 2026, the AI & […]| jacquesludik.com

2026 Roth Catch-Up Rules: High Earners 50+

2026 Roth Catch-Up Contributions: New Rules for High Earners 50+ (Don’t Lose $11,250) Last Update: If you’re over 50 and your income is on the higher side, 2026 comes with a retirement-plan curveball. The catch-up contribution—that extra amount you’ve been allowed to put into your 401(k) once you hit 50—still exists. The big change is […] The post 2026 Roth Catch-Up Rules: High Earners 50+ appeared first on WealthKeel Advisors LLC.| WealthKeel Advisors LLC

Saving for healthcare or retirement: Which wins out? - HR Executive

Learn how healthcare costs are influencing financial decisions for Americans, with many cutting back on retirement savings.| HR Executive

Retirement Planning: More Than Money

Today's blog covers a recent Talking Benefits podcast about one recent retiree's experience and highlights some elements of retirement preparation that may not be on your radar. The post Retirement Planning: More Than Money appeared first on Word on Benefits.| Word on Benefits

2026 Budget Reset: Fix Holiday Overspending Fast

The 2026 Budget Reset Challenge: Turn Holiday Regret Into a Winning Year Early January has a certain vibe. You open your credit card app, you scroll a little too far, and your stomach does that thing. Yep, that thing. If you’re sitting there thinking, “How did I spend that much?” you’re not alone. The whole […] The post 2026 Budget Reset: Fix Holiday Overspending Fast appeared first on WealthKeel Advisors LLC.| WealthKeel Advisors LLC

Financial Resolutions to Improve Your Money Habits

Achieve your money goals with practical Financial Resolutions. Learn how to create effective systems for financial success.| WealthKeel Advisors LLC

Oregon sues insulin makers, PBMS over inflated prices

Oregon sues major insulin manufacturers over inflated insulin prices. Discover the impact of this lawsuit on patients and families.| HR Executive

Small Business Financial Resilience in 2026: Keeping Costs Down and Morale High

As 2026 approaches, small businesses face a familiar challenge: balancing tight budgets with the need to support their most valuable asset – their people. Rising costs, economic uncertainty, and evolving […] The post Small Business Financial Resilience in 2026: Keeping Costs Down and Morale High appeared first on OneDigital.| OneDigital

Secure 2.0 in 2026: What Small Businesses Need to Know Now

Secure 2.0 is here. Learn what’s now in effect, key 2026 deadlines, and how small businesses can turn compliance into an advantage.| OneDigital

End-of-Year Financial Planning: Steps That Can Strengthen Your Finances Before 2026

The final weeks of the year are a chance to review your finances, make adjustments, and prepare for the new year. A few intentional steps in November and December can […] The post End-of-Year Financial Planning: Steps That Can Strengthen Your Finances Before 2026 appeared first on OneDigital.| OneDigital

The Future of Small Business Benefits: Five Trends Shaping 2026

Small businesses are approaching workforce decisions with more intention than ever before. In 2026, employee benefits remain one of the most strategic tools small businesses have to attract and retain […] The post The Future of Small Business Benefits: Five Trends Shaping 2026 appeared first on OneDigital.| OneDigital

Holiday Budgeting: How to Stay in Control and End the Year Strong

The holiday season brings higher spending, more events, and stronger pressure to buy. Many households head into December without a plan and end up in January with bills they didn’t […] The post Holiday Budgeting: How to Stay in Control and End the Year Strong appeared first on OneDigital.| OneDigital

AI Visionary Dr. Jacques Ludik to Address Just Property Group on the Future of Real Estate

AI Visionary Dr. Jacques Ludik to Address Just Property Group on the Future of Real Estate We are proud to announce that AI pioneer and smart […]| Jacques Ludik

HOW CRITICAL IS AI FOR AFRICA’S DEVELOPMENT?

https://www.fairplanet.org/story/how-critical-is-ai-for-africas-development/ April 11, 2024 topic: Innovation tags: #AI, #Africa, #poverty, #innovation located: Zimbabwe, Egypt, Morocco, Tunisia, Rwanda, Benin, Sierra Leone, Senegal, South Africa, Mozambique, Malawi, Cameroon by: Cyril Zenda Only eight out of the 54 countries in Africa have developed […]| Jacques Ludik

AI-driven Digital Transformation to help Business and People Thrive in the Smart Technology Era

Dr Jacques Ludik’s Keynote on AI-driven Digital Transformation at the ITWeb’s BPM & Automation 2022 Keynote: AI-driven Digital Transformation to help Business and People Thrive in the Smart Technology Era Dr Jacques Ludik – jacquesludik.com Many business owners and directors view the adoption of new technologies, especially those for business process management, as too expensive […] The post AI-driven Digital Transformation to help Business and People Thrive in the Smart Technology Er...| Cortex Logic

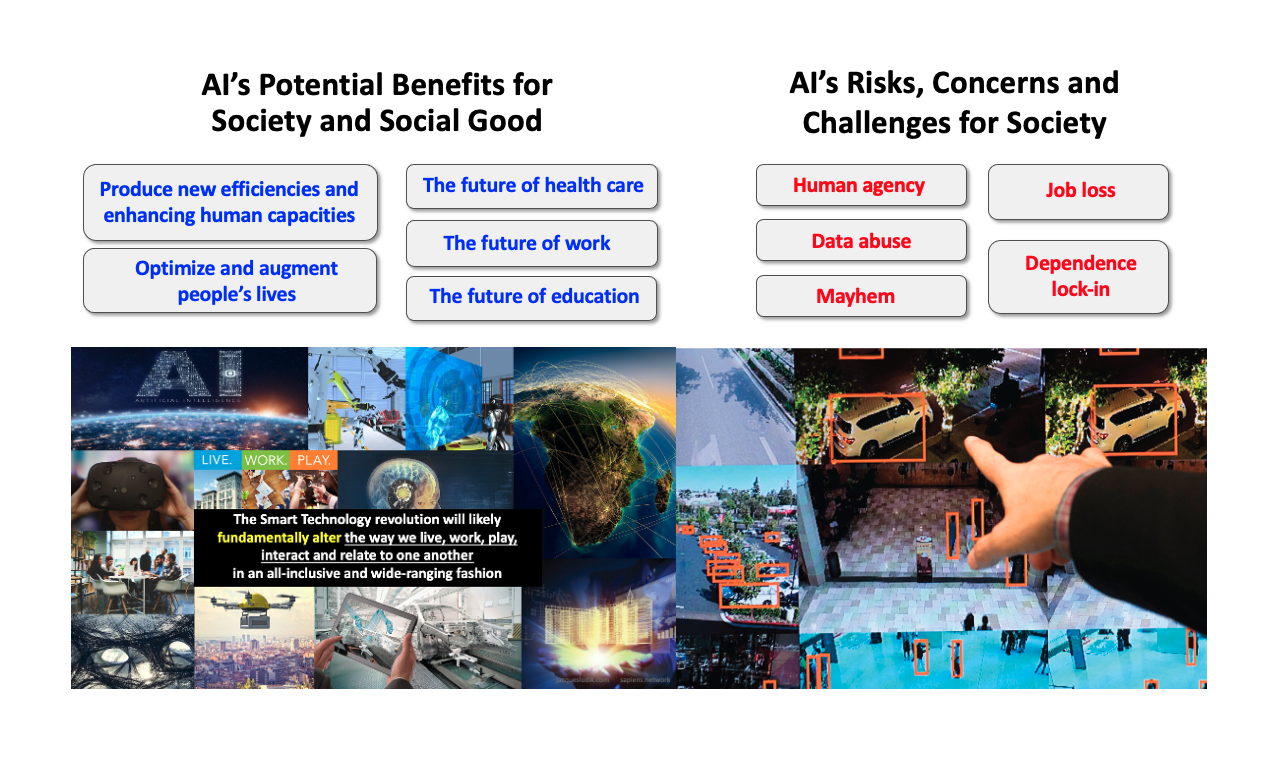

AI’s Impact on Society, Governments, and the Public Sector - Cortex Logic

In this Democratizing AI series of articles, we have so far, amongst others, covered AI’s revolutionary transformation on the world and its people across multiple industries, and will in this article consider AI’s impact on society, governments, and the public sector. We also know that the potential benefits of AI for society and social good are …| Cortex Logic

More employers offering financial wellness benefits | Employee Benefit News

Programs are becoming more comprehensive, with more companies focusing on fiscal programs while continuing to address physical and emotional wellness.| Employee Benefit News

Wellness programs cut sick days, improves productivity | Employee Benefit News

Employees not only find wellness plans helpful, they want them offered, according to a United Healthcare survey.| Employee Benefit News

Employee wellbeing: How are investment strategies changing?

New research from the Business Group on Health found a “surprising” level of ongoing investment in employee wellbeing.| HR Executive

The #1 Worry Keeping Your Members Up at Night (And How You Can Help)

When people worry so much about paying monthly expenses they're losing sleep, you have to work harder to convince people your membership is worth paying for.| blog.accessdevelopment.com

The #1 Worry Keeping Your Employees Up at Night + How You Can Help

People worry so much about paying monthly expenses they're losing sleep, and they crave help and empathy from their employers.| blog.accessperks.com

April is National Financial Literacy Month

April is National Financial Literacy Month! Discover how to improve your financial skills with free resources, events, and expert tips. Join the movement today.| Money Fit

How to Live Below Your Means Without Feeling Deprived

Want to spend less without feeling like you're missing out? Learn how to live below your means, avoid lifestyle creep, and build lasting financial stability.| Money Fit

Choosing the Right Financial Advisor: Essential Tips and Advice

Find the right financial advisor for your needs. Discover the key qualities and traits to look for when choosing a trusted advisor.| WealthKeel Advisors LLC

A Recipe for Financial Success: It's as Easy as Pumpkin Pie | Boldin

Do you have all the ingredients and the right recipe for financial success? It needn't be complicated. In fact, it can be as easy as pie.| Boldin

What Do You Need to Do in Your 20s, 30s & 40s, and 50s & 60s to Protect Your Financial Well-Being from the Possibility of Chronic Disease - Boldin

No matter your current health status, safeguarding your finances against chronic disease is a critical aspect of securing your future.| Boldin

The Ultimate HR Guide To Employee Burnout [Free E-Book]

Download the new FREE E-book designed to help HR Professionals spot and stop employee burnout before it becomes a major workplace problem.| blog.accessperks.com