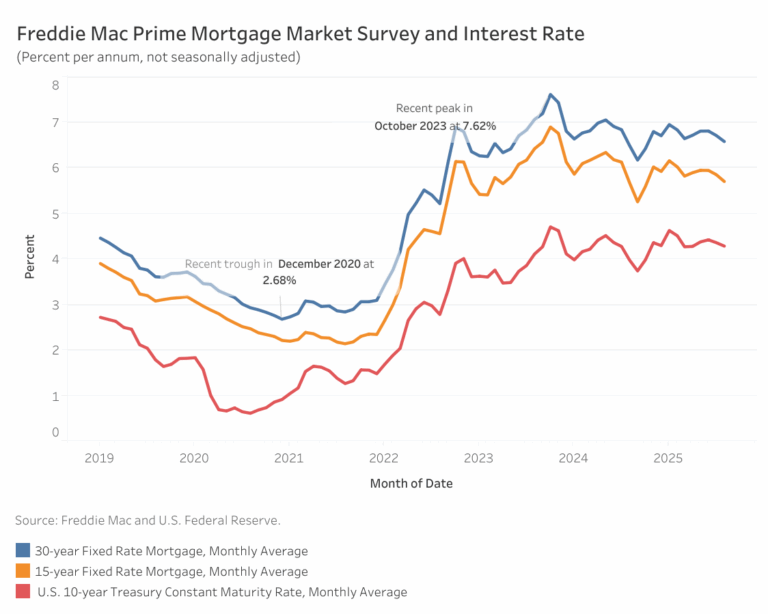

Mortgage Rates Move Lower, Hitting 10-Month Low

Average mortgage rates in August continued their steady decline and are now at their lowest rate since last November. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.59%, 13 basis points (bps) lower than July. Meanwhile, the 15-year rate declined 15 bps to 5.71%. Compared to a year ago, the 30-year rate is higher…| Eye On Housing