How to Rebalance Your Investment Portfolio For 2025

What is portfolio rebalancing, and should you do it? If so, then how and when? We cover everything you need to know.| Million Dollar Journey

Best Investments During a Recession in Canada

Is a recession coming and what should you do? How to prepare for a Canadian recession.| Million Dollar Journey

Qtrade Promo Code 2025 - $150 Free + $2,000 Cashback!

The recent 2025 Qtrade Promo Offer Code is one of the main reasons we have them at the top of Best Canadian Online Broker rankings. Every year the DIY brokerages put their best foot forward during the first few months of the year because they know it’s when Canadians pay the most attention to their finances. This is the first year I’ve seen an offer quite this good. (Last’s year’s Qtrade promo was also solid - but this one tops it for the folks with under $250,000 to invest.) To lock ...| Million Dollar Journey

RBC Investease Review 2025 - Best Big Bank Robo Advisor?

What is RBC InvestEase? Some people prefer to stick with the familiar and trusted, especially when it comes to choosing a robo advisor - and if this sounds like you, RBC InvestEase could be a good fit. Offered by one of Canada’s most well-known banks, RBC InvestEase offers clients the ability to dip their toes in passive investing while sticking with a tried and true financial name. In this RBC InvestEase review, we’re taking a look at how it compares to the best robo advisors in Canada s...| Million Dollar Journey

Justwealth Review 2025 - Pros, Cons & Promo

Why Justwealth? As I’ve updated my Justwealth review over the years, they have risen from a solid-but-not-elite option to the best robo advisor in Canada. How did they do it? By focusing on what matters. Frankly, while Justwealth has made great strides in the way their website looks, they still aren’t the most aesthetically-appealing option out there. They aren’t taking your money and paying a giant team of coders to make and update some beautiful app or clever TV marketing campaign. ...| Million Dollar Journey

Average Spending in Retirement Canada - Do You Have Enough?

You’d think it’d be a relatively easy quest to answer the question: How much will a Canadian spend in retirement? When I set out to create the first retirement course for Canadians looking to retire in the next 25 years (or in the early stages of retirement) I figured that determining how much the average Canadians spent in retirement would be pretty straightforward. You can check out what that course has to offer by clicking here. I also knew that it was quite important to get this infor...| Million Dollar Journey

Free Stock Trading in Canada 2025 - Best Brokers & Promos

The best free stock trading apps in Canada are giving DIY investors more control than ever. With no trading fees eating away at returns, it’s never been easier to build your own portfolio and keep more of what you earn. That said, let’s be clear - 'free trading app” doesn’t mean there are no costs at all. While some platforms have eliminated commissions on stock and ETF trades, there are always ways brokerages make money, whether through currency conversion fees, foreign exchange spre...| Million Dollar Journey

Best Retail Stocks in Canada For 2025

It is no secret that the Canadian stock market is not very well diversified by sector. Canada is largely financial, energy and materials, with all of that other stuff in between. By investing in Canadian retail stocks, investors can add some much-needed diversification. Canadian retail stocks can also help investors profit during times of economic strength and certain types of retail stocks can offer a nice hedge against periods of slow growth or recessions. A certain segment of Canadian ...| Million Dollar Journey

Stocktrades ETF Insights Review 2025

Stocktrades.ca's ETF insight tool review - is it worth the price & What can it help you with.| Million Dollar Journey

Best Short Term Investments in Canada (May 2025)

With interest set to fall, the best short term investments in Canada continue to evolve as we move toward the second half of 2025. As recently as 18 months ago, we were still seeing 5%+ GIC options, but now, I’d argue that high interest savings account options give you the best bang for your buck. The EQ Everyday Banking Account is currently the best combination of a risk-free, automatic 4% return, combined with full liquidity and instant access to your cash. A couple other short term inves...| Million Dollar Journey

Motive Financial Review 2025 - High Interest Online Bank

What Is Motive Financial? Motive Financial, which is under the Canadian Western Bank, is one of Canada’s best known online banks. They offer chequing, savings, RRSP, TFSA, and GIC accounts. In early 2025, Motive Financial officially became a part of National Bank. They are now going to be able to offer more products and services as a result of this merger. Is Motive Financial Safe & Legit? Safety is always a concern when it comes to finances. The idea of online banking, even though it is be...| Million Dollar Journey

Scotiabank Review 2025 - Pros, Cons, Fees & Promo

What is Scotiabank? Scotiabank, officially known as the Bank of Nova Scotia, is one of Canada’s Big Five banks. Established in Halifax in 1832, it has grown to be considered as Canada’s most international bank, serving over 25 million customers worldwide. It is one of Canada’s oldest and most trusted banks with a full range of banking products. In this Scotiabank review, I’m going to focus on Scotiabank’s Ultimate Package and Preferred Package, which offer the most value to custom...| Million Dollar Journey

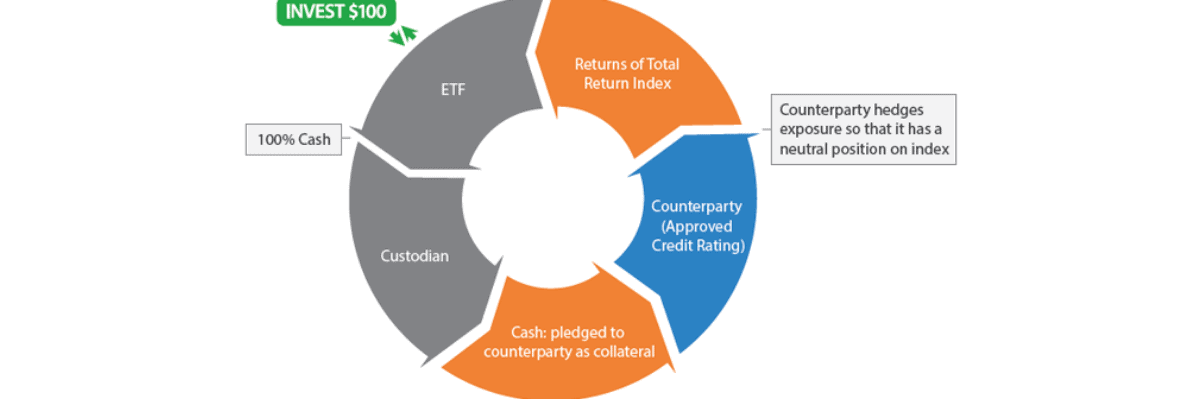

Best Swap-Based ETFs in Canada 2025

We review and compare Horizon's Total Return ETFs. Are Swap-Based ETFs a good investment?| Million Dollar Journey

Salary vs Dividends: Paying Yourself as a Small Business Owner

How and when to pay yourself through your business. Are dividends better than a salary? Should you use income splitting, are pensions worth it and more.| Million Dollar Journey

CCPC Taxation for Canadian Small Business Owners

Detailed guide on CCPC taxation - learn whether you should incorporate your business or not, and how much tax would you pay.| Million Dollar Journey

Best Financial Advisor in Canada 2025

When looking for the best financial advisors in Canada (or best financial planners in Canada) you’re going to run into a lot of slick salespeople who are really good at using confusing language and scaring you into the financial products that pay them best. Canada’s mutual funds and insurance products are amongst the most expensive in the world, and there is a massive amount of money to be made by selling them to you - even if they’re a really bad fit for your situation. Many people thi...| Million Dollar Journey

OAS Canada Ultimate Guide: Dates, Clawback, Deferment & More

Old Age Security - better known as OAS - is one of the least understood aspects of Canadian retirement planning that I’ve come across. In order to full wrap your head around OAS and how you can get the most out of it for your particular situation, this deep dive is going to cover: (use the table of contents below to jump to the section that pertains to you) OAS Eligibility (Who gets full or partial OAS) What is the OAS Clawback? (How Do I Keep My Whole OAS Cheque?) How Much OAS Will I Get? ...| Million Dollar Journey

Top 49 ETFs in Canada for August 2025

When I first started writing about Canadian personal finance twenty years ago, my list of the best ETFs in Canada could fit on a napkin. There were no Canadian all-in-one ETFs, no catchy tickers, and definitely no slick marketing campaigns. ETFs were basically niche tools used by hardcore index investors and a handful of spreadsheet-loving DIY types. Fast-forward to today, and the landscape has completely changed. While I still hold a solid chunk of Canadian dividend stocks in my portfolio, l...| Million Dollar Journey

Investing in Annuities in Canada 2024 - Is It a Good Idea?

As a former teacher you might think I’d be the last person who would want to learn more about investing in annuities in Canada. But with Rob Carrick over at the Globe and Mail writing about how right now might be the best time to buy Canadian annuities for several years (maybe a decade-plus), I thought it would be be a good time to update our Ultimate Canadian Annuity Guide. Now, it’s common knowledge that teachers enjoy a solid stream of pension income when they reach retirement. In ...| Million Dollar Journey

Simplii Financial Review 2025 Pros, Cons & Promo

If you prefer to do all your banking from the comfort of your home and don’t mind not having access to face-to-face help if required, then a bank that offers high interest savings accounts is a good choice for you. But not all online banks are created equal. Simplii Financial (as it has been known since 2017) has been around for a number of years, but how does it stack up to other online banks like EQ and Tangerine? In this Simplii Financial review, we are sharing our take on this online ...| Million Dollar Journey

Best Wealth Management Companies in Canada 2025

When I first wrote about the best financial advisors in Canada it got some attention from Canada’s wealth management companies due to the news and social media attention it received. If you’re not sure what exactly the difference is between a wealth management firm and a financial planning company – don’t worry – there isn’t one. The terms “financial planning,” “financial advisor,” and “wealth management,” are all vague terms with little legal meaning in Canada. You co...| Million Dollar Journey

Best GIC Rates in Canada For January 2026

With the Bank of Canada signalling that rate cuts will be slow-if-at-all in 2026, it has become abundantly clear that the best GIC rates in Canada have already topped out. Inflation is cooling (with a relatively modest 2.2% annualized measurement in December of 2025), economic growth is softening, and bond markets have priced in a gentler path forward. Put all of that together and you get a pretty straightforward conclusion: The eye-catching 5% GICs of two years ago are gone. In fact, anyth...| Million Dollar Journey

Questrade vs Qtrade - Who's The Best Canadian Broker 2025?

When I first launched Million Dollar Journey in 2006 and started writing about Canadian online brokers, the Qtrade vs. Questrade rivalry was already heating up. Fast forward nearly two decades, and not only has the rivalry intensified, but these two platforms have also solidified their positions as the leaders of Canada’s brokerage scene (leaving the big bank brokerages even further behind). As a DIY investor for the last 20 years, I’ve had firsthand experience with over a dozen brokerage...| Million Dollar Journey

EQ Bank Review 2025 - Fees, Pros, Cons & More

EQ Bank Account Options and Interest Rates Account TypeInterest RateBest ForDaily High Interest Account1.25%* (Plus 2.75% if you direct deposit your pay)People who want the highest consistent interest rate in Canada + free e-transfers + super cheap international money conversion + FREE BANKING + USD Accounts for Canadians EQ GICs2.60% - 3.60%Folks looking to get a high ultra-safe return EQ TFSA Account3.60%The highest guaranteed rate of return in a TFSA in Canada.EQ RRSP Account3.60%The hig...| Million Dollar Journey