9 Quantum Computing ETFs You Need to Know in 2026

All quantum computing ETFs explained in one place. Compare fees, holdings, regions, and risks before choosing a quantum computing ETF.| Column

Stock news for investors: Q4 results from Manulife, Sun Life, Air Canada, and more

Manulife reports $1.5B in Q4 profit while Air Canada rebounds to $296M. See how Sun Life, Brookfield, and other Canadian companies fared. The post Stock news for investors: Q4 results from Manulife, Sun Life, Air Canada, and more appeared first on MoneySense.| MoneySense

Old-school financial advice that no longer applies

From the 30% housing rule to the 4% retirement rule, financial advisers say outdated money advice is due for a rethink as young Canadians face higher housing costs and shifting career paths. The post Old-school financial advice that no longer applies appeared first on MoneySense.| MoneySense

Canadians fear a tougher road to retirement—and plan to help their kids along the way - MoneySense

Most Canadians say saving for retirement will be harder than it was for their parents, with many expecting to support their children financially.| MoneySense

What’s the Best Way to Invest $500,000 for Growth?

Earning money is often the easiest aspect of personal finance. The real challenge comes with figuring out how to compound growth and turn it into something that lasts for a lifetime. Whether you have $100,000, $500,000, or several million dollars, there are always going to be questions about how to optimize for ROI. And while we can’t give you financial advice, we can provide some suggestions and hypotheticals of what could be smart options for you and your finances. For the purposes of thi...| Under30CEO

Japan election: from stagnation to stagflation

In Japan, a general election is taking place tomorrow, just months after Sanae Takaichi became the nation’s first female prime minister. Takaichi is an arch-conservative, ultra nationalist and a devotee of Margaret Thatcher. She became prime minister last October by winning an internal party race for the presidency of the beleaguered governing Liberal Democrat PartyContinue reading "Japan election: from stagnation to stagflation"| Michael Roberts Blog

The debasement trade and the future of the dollar

The gold price against the US dollar is back above $5000 per oz after its recent short sharp contraction last week. The unprecedented rise in the gold price, particularly since the beginning of the Trump Mark 2 presidency one year ago, is the result of what is being called the ‘debasement trade’. This trade meansContinue reading "The debasement trade and the future of the dollar"| Michael Roberts Blog

Kevin Warsh – Wall Street’s man – Michael Roberts Blog

Kevin Warsh, President Trump’s nominee to replace Jay Powell as Chair of the Federal Reserve next May, is the epitomy of a Wall Street, hedge fund insider. Educated at Stanford University and…| Michael Roberts Blog

The Bezzle and the Bull Market

Every great bull market hides some level of fraud, unbeknownst to its victims. Its unique in that the fraudster and the defrauded feel wealthier despite it being an illusion. It’s Enron before everything blew up. The shareholders felt richer, as did Jeff Skilling and his cohorts, until it all unraveled. The difference between real wealth […]| Novel Investor

Weekend Reads – 2/6/26

Quote for the Week The much wider fluctuations in investment common stocks that have come about since World War I have made it practically impossible for buyers of common stocks to disregard price changes. It would be extremely unwise — and hypocritical — for anybody to buy a list of common stocks and say that […]| Novel Investor

Weekend Reads – 1/30/26

Quote for the Week Perhaps enough has been said to indicate the principal difficulties which beset the speculator who attempts to profit by the short swings of the stock. For practical purposes the occurrence of ripples and waves in the price movement is unpredictable. To attempt to trade on such movements is mere gambling with […]| Novel Investor

Summon Your Courage and Buy Stocks

Investors who conquer stock-phobia have an edge over those too focused on their rearview mirror By Jason Zweig Oct. 4, 2008 12:01 am ET During the Great Depression, an entire generation became convinced that owning stocks was dangerous. But if you were among the courageous few who bought and held stocks during and after the Depression, you […]| Jason Zweig

Messing Up the Closest Thing to a Sure Thing in the Stock Market

Index funds are a great way to match the performance of the market. So why do so many investors end up falling short? Index funds have made investing simple—but not easy. These portfolios that seek to match, rather than beat, a market’s returns usually charge extremely low fees and generate low tax bills. If you […]| Jason Zweig

How to Stay Sane When Markets Get Wild

Just about every volatility storm in the markets quickly morphs into a baloney blizzard, as Wall Street’s market strategists and a swarm of online pundits pretend to explain what just happened and concoct predictions of what will happen next.| Jason Zweig

Think Financial Confidence Makes People Invest? Gen Z Says Otherwise

So what does matter? Three things that sound more like therapy goals than investment strategies. The post Think Financial Confidence Makes People Invest? Gen Z Says Otherwise appeared first on StudyFinds.| StudyFinds

Options Trading Series: Part 14 – Year 2025 Review - Early Retirement Now

Trading options for supplemental income solves Sequence Risk: generate enough cash flow & never liquidate assets! The year 2025 in review...| Early Retirement Now

Best Interest Rates Survey: Bank Accounts, Treasury Bills, Money Markets, ETFs – February 2026

Here’s my monthly survey of the best interest rates on cash as of February 2026, roughly sorted from shortest to longest maturities. Banks and brokerages love taking advantage of idle cash, and you can often earn more interest while keeping the same level of safety by moving to another FDIC-insured bank or NCUA-insured credit union. […]| My Money Blog

Vanguard Money Market & Target Retirement Funds: Claim Your State Income Tax Exemption (Updated 2026)

Updated for 2026. Tax time is here again, and if you earned interest from a money market fund, a significant portion of this interest may have come from “US Government Obligations” like Treasury bills and bonds, which are generally exempt from state and local income taxes. However, in order to claim this exemption, you’ll likely […]| My Money Blog

Vanguard ETF & Mutual Fund Fee Cuts (February 2026)

Vanguard just announced a new round of expense ratio drops spanning 53 funds (roughly 25% of them), totaling close to $250 million in fee reductions in 2026. See their press release and full list of changes. This comes almost exactly a year after their February 2025 cuts which spanned 87 funds with an estimated $350 […]| My Money Blog

Fidelity Money Market Funds: Claim Your State Income Tax Exemption (Updated 2026)

Updated for 2026. As the brokerage 1099 forms for the 2025 Tax Year are coming out, here is a quick reminder for those subject to state and/or local income taxes. If you earned interest from a money market fund, a significant portion of this interest may have come from “US Government Obligations” like Treasury bills […]| My Money Blog

Estimate Your Personal Rate of Return (Quick Calculator)

Fixed for 2026. I initially wrote this calculator in 2007. Hey, at least you know it wasn’t AI! Some of you may be wondering how well your specific portfolio performed last year (or over any specific period of time). Let’s say you started the year with $10,000 and put in another $5,000 through 10 different […]| My Money Blog

How to Build a Multigenerational Family Philanthropy Strategy - Better Magazine

A long-term approach to family philanthropy can help align values across generations, strengthen engagement, and ensure giving reflects both legacy and intention.| Better Magazine

How to Invest in International Stocks

Sharing some tips on how and why to add international stocks to your portfolio because if you don't have them, it's time. The post How to Invest in International Stocks appeared first on The Boston Advisor.| The Boston Advisor

Go, Ruin Yourself (Wait, Don’t!) - Safal Niveshak

Two Books. One Purpose. A Better Life. Charlie Munger used to say that all he wanted to know was where he was going to die so he could simply never go there. It’s a brilliant way to look at life. If you can identify the traps that ruin most people, investing or otherwise, you just […]| Safal Niveshak

Letter to A Young Investor #20: You Can Invest. But How Much Can You Suffer?

Two Books. One Purpose. A Better Life. I am writing this series of letters on the art of investing, addressed to a young investor, with the aim to provide timeless wisdom and practical advice that helped me when I was starting out. My goal is to help young investors navigate the complexities of the financial world, […] The post Letter to A Young Investor #20: You Can Invest. But How Much Can You Suffer? appeared first on Safal Niveshak.| Safal Niveshak

A Cure for Investment Anxiety

Two Books. One Purpose. A Better Life. Douglas MacArthur was the American general who commanded Allied forces in the Pacific during World War II and later ran occupied Japan. William Manchester, in his biography of MacArthur, mentioned how in 1950, when MacArthur was in Tokyo, he read exactly five newspapers every morning. What’s unusual was […] The post A Cure for Investment Anxiety appeared first on Safal Niveshak.| Safal Niveshak

Ranking The Moat Of Popular Canadian Dividend Stocks » Tawcan

As investors, we often talk about the moat of a company. What does this mean exactly?| Tawcan

How Do You Subdivide Land for Profit: An International Investor’s Guide

For property owners and international investors, understanding how do you subdivide land is a crucial step toward unlocking significant value. Subdivision is the formal process of dividing a single parcel of land into two or more smaller, independent lots. Once complete, each new plot receives its own legal title, allowing it to be sold, developed, […] <p>The post How Do You Subdivide Land for Profit: An International Investor’s Guide first appeared on International Property For Sale | Ho...| International Property For Sale | Homesgofast

Re-Introducing WatchMojo Studios: Scripted Stories & Unscripted Formats

For nearly two decades, WatchMojo has been known as a digital-first media company that understood audiences before “audience-first” became a buzzword. But from the beginning, WatchMojo was never just a YouTube company. It was a studio—one that happened to distribute... Continue Reading →|

10 Top Monthly Dividend Stocks for January 2026

Table of Contents Top 10 Monthly Dividend Stocks by Yield What Are Monthly Dividend Stocks? How Does Dividend Investing Work? Types of Monthly Dividend Stocks Ways to Evaluate Monthly Dividend Stocks Pros and Cons of Investing in Monthly Dividend Stocks Things to Avoid When Investing in Monthly Dividend Stocks FAQ While most dividend-paying stocks do […] The post 10 Top Monthly Dividend Stocks for January 2026 appeared first on SoFi.| SoFi

What Happens to Your 401(k) When You Leave Your Job? | SoFi

Ever wonder what happens to your 401(k) when you leave a job? Learn more about what you need to do with your 401(k) when you change jobs.| SoFi

SaaSmageddon: Will AI Eat the Software Business? – Economist Writing Every Day

A big narrative for the past fifteen years has been that “software is eating the world.” This described a transformative shift where digital software companies disrupted traditional industrie…| Economist Writing Every Day

5 Active Investment Decisions Physicians Are Making

Even When You Invest Passively The post 5 Active Investment Decisions Physicians Are Making appeared first on The Prudent Plastic Surgeon.| The Prudent Plastic Surgeon

HELOCs Sound Simple. The Risk Is What Most Doctors Miss.

Why we opened a HELOC on our primary home, the 3 uses that can make sense, and the risks doctors underestimate. The post HELOCs Sound Simple. The Risk Is What Most Doctors Miss. appeared first on The Prudent Plastic Surgeon.| The Prudent Plastic Surgeon

The Buffett Indicator, Explained Simply » The Prudent Plastic Surgeon

Buffett actually has a stock metric colloquially named after him: The Buffett Indicator. But, can this measure predict the stock market...| The Prudent Plastic Surgeon

How Jeffrey Epstein helped his publicist become a big-time venture capitalist

Masha Bucher is one of the more high profile female VCs in Silicon Valley. New emails released from the Department of Justice reveal a deep, years long relationship with convicted sex trafficker Jeffrey Epstein. The post How Jeffrey Epstein helped his publicist become a big-time venture capitalist appeared first on Forbes Australia.| Forbes Australia

Bitcoin crashes below $65,000 as historic free fall worsens

Bitcoin’s deep losses accelerated Thursday as the cryptocurrency fell 13% to plummet below the $65,000 mark as of mid-afternoon.| Forbes Australia

How One Author Is Revitalizing Value Investing Through Closed-End Funds

In honor of the 50th anniversary of Warren Buffett’s very first shareholder letter, a new book is making waves in the investment world—A Dollar for Fifty Cents: Proven Strategies to Outperform the Market with Closed-End Funds by portfolio manager and financial authority Michael Joseph, CFA. This groundbreaking guide is the very first release from IW$ Press, a […] <p>The post How One Author Is Revitalizing Value Investing Through Closed-End Funds first appeared on International Wealth ...| International Wealth Success (IWS)

CAN YOU TRUST AI TO GIVE YOU FINANCIAL ADVICE

Artificial intelligence is being promoted as the next frontier for investing. But can you trust AI? Not every AI app deserves your confidence; even the credible […] The post CAN YOU TRUST AI TO GIVE YOU FINANCIAL ADVICE appeared first on ADF Financial Services Consumer Centre.| ADF Financial Services Consumer Centre

Complete Guide to Types of Precious Metal Investments | Accuplan

Different types of precious metal investments can diversify your portfolio. This article details how you can start investing through a self-directed IRA.| Accuplan

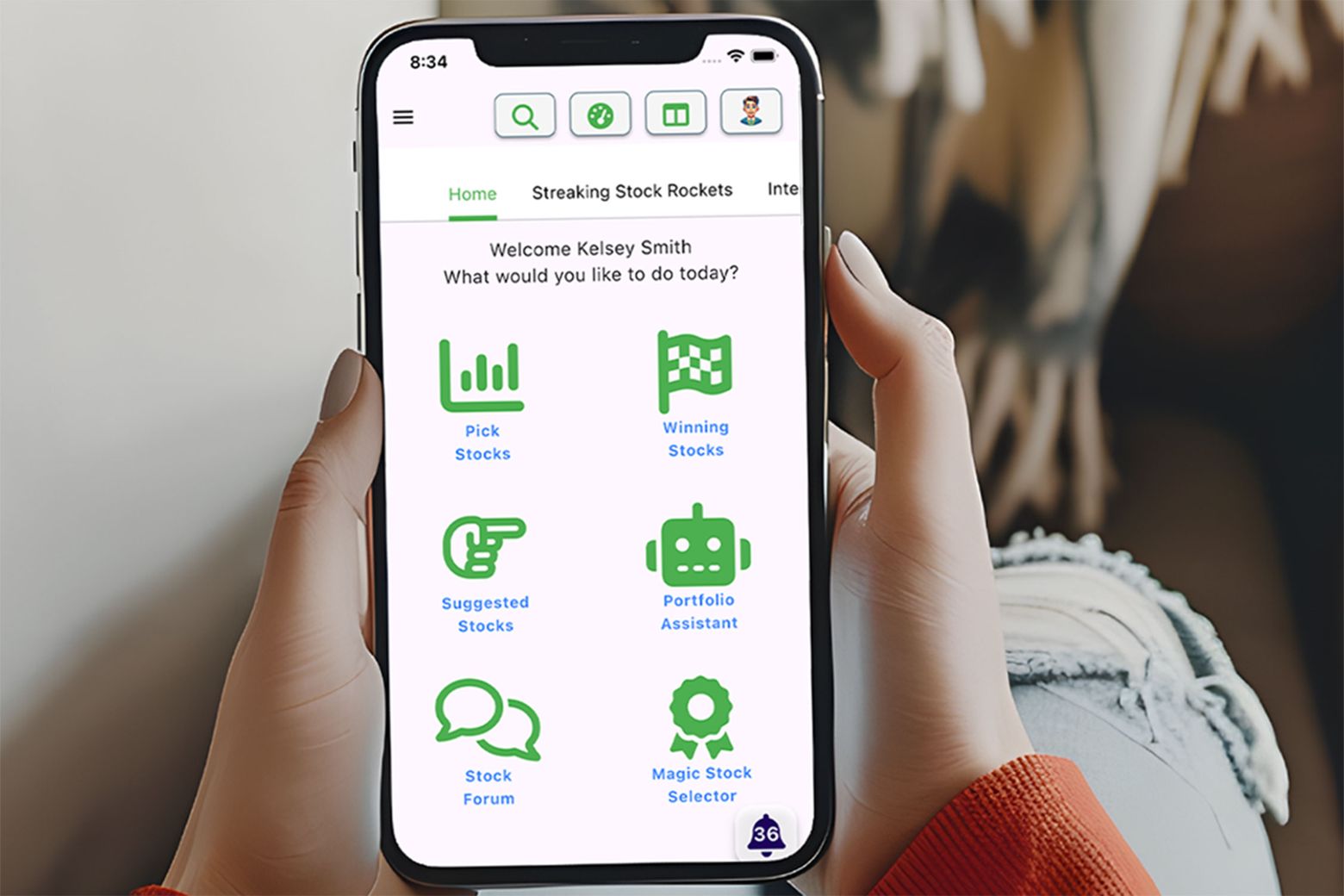

Price drop: Use OpenAI to find hot stocks to invest in

Build an optimized portfolio, track performance and fine-tune your investments with a lifetime subscription to this AI investing app. (via Cult of Mac - Your source for the latest Apple news, rumors, analysis, reviews, how-tos and deals.)| Cult of Mac

9 Best Quicken Alternatives for 2026 (Free & Paid)

Quicken was once the go-to budgeting tool. I used it when it was first released in the 1980s. Today, it’s been eclipsed by apps that enable you to manage every aspect of your finances, often for free. I’ve tested dozens of apps, and here are the best Quicken alternatives in 2026. My Top Picks Of...| ROB BERGER

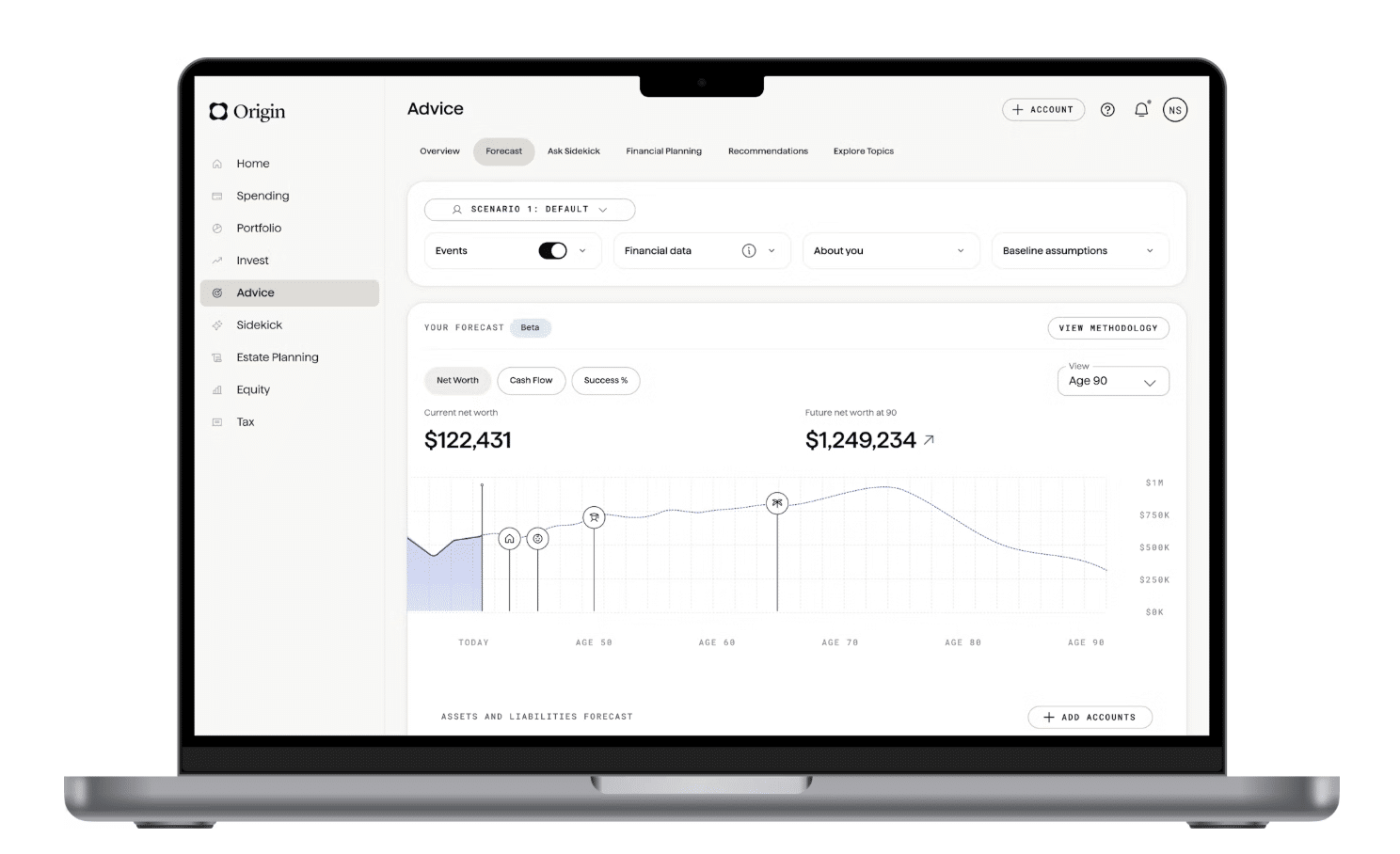

8 Best Investment Tracking Apps

The ideal investment tracking app makes managing investments a breeze. Investment apps can track not only the portfolio’s performance, but also its fees, asset allocation and projected future growth. What follows are some of the best investment tracking apps based on numerous factors, including cost, features and ease of use. Note that I have used...| ROB BERGER

3 Empower Alternatives – ROB BERGER

Empower recently migrated its financial dashboard with its other retirement apps. The migration created significant issues for some users, preventing them| RobBerger.com

Investors – Stop Living in the Past

One of the most common investing mistakes has nothing to do with picking the wrong fund or missing the bottom of the market. It comes down to how we talk about investing decisions in the first place. We tend to describe past market moves as if they’re still happening. The market is falling, what should…| Boomer & Echo

ETFs, Mutual Funds, and the Rise of Investing Slop

ETFs once meant low cost, simple investing. That’s no longer guaranteed. A look at how investing slop has crept in and why simplicity still matters.| Boomer & Echo

Gold Extremes’ Drawdowns

Originally posted by Adam Hamilton at Zeal LLC: Gold just soared to some of its most-overbought levels on record, climaxing its largest cyclical bull ever. That was followed by one of gold’s worst down days in history, formally slaying that monster bull. That popular-speculative-mania topping means a serious reckoning is underway. Gold’s drawdowns after […]| Dollar Collapse

Warren Buffett Bet, Year 8: Yeah Baby, Yeah! - 1500 Days to Freedom

Eight years ago, Dividend Growth Investor (DGI) asked me if I’d like to participate in the Warren Buffett bet. For those unfamiliar, in 2008 Buffett famously challenged the hedge fund industry: Can you beat the S&P 500 over a period of 10 years? Buffett won as the hedge fund got clobbered by the S&P 500. But I like […]| 1500 Days to Freedom

How to Start Investing This Year: A Beginner’s Guide to Growing Your Money

Imagine looking back a year from now and realizing you could have taken control of your money, grown your wealth, and built... Read More... How to Start Investing This Year: A Beginner’s Guide to Growing Your Money| Money Bliss

5 Investing Tips for High-Net-Worth Individuals

While basic investing tips, such as maintaining a diversified portfolio, apply to everyone, the following investing strategies are particularly important for high net worth (HNW) investors. The post 5 Investing Tips for High-Net-Worth Individuals appeared first on Creative Planning.| Creative Planning

Bitcoin vs. Gold: Investment Portfolio Showdown

Physical gold and “digital gold”—the leading cryptocurrency famously known as Bitcoin—have some surprising traits in common. Both are scarce, exist outside government control, and are often framed as protection against fiat currency debasement. However, these two assets could not be more different.| GLOBIS Insights

Real Estate Crowdfunding: The Ultimate Guide for Agents and Investors

Learn how real estate crowdfunding works, the pros and cons, and the best platforms for agents and investors looking to diversify without owning property.| The Close

Dow soars by 1,200 points to top 50,000 for the first time as chipmakers and airlines lead ferocious stock market rebound

Even with Friday’s surge, the S&P 500 still fell to its third losing week in the last four.| Fortune | FORTUNE

2 Canadian Dividend Stars That Are Still A Good Price

These companies have strong fundamentals, have consistently rewarded shareholders, and maintain a sustainable payout. The post 2 Canadian Dividend Stars That Are Still A Good Price appeared first on The Motley Fool Canada.| The Motley Fool Canada

Too Much U.S. Tech? Here’s the TSX Stock I’d Add Now

If your portfolio is overloaded in U.S. mega-cap tech, Constellation Software offers a quieter kind of software growth that can diversify the risk. The post Too Much U.S. Tech? Here’s the TSX Stock I’d Add Now appeared first on The Motley Fool Canada.| The Motley Fool Canada

Undervalued Canadian Stocks to Buy Now

Given their discounted valuations and strong growth prospects, these two Canadian stocks present attractive buying opportunities. The post Undervalued Canadian Stocks to Buy Now appeared first on The Motley Fool Canada.| The Motley Fool Canada

3 Canadian Stocks Ready to Surge in 2026

Wondering what stocks could surge in 2026? Here's a list of three Canadian stocks that could be set for substantial gains this year. The post 3 Canadian Stocks Ready to Surge in 2026 appeared first on The Motley Fool Canada.| The Motley Fool Canada

An Ideal TFSA Stock Paying 6% Each Month

TFSA owners should consider holding high dividend stocks such as Whitecap to create a stable recurring income stream. The post An Ideal TFSA Stock Paying 6% Each Month appeared first on The Motley Fool Canada.| The Motley Fool Canada

What to Expect From Brookfield Stock in 2026

Brookfield (TSX:BN) stock could be a stellar buy once volatility settles. The post What to Expect From Brookfield Stock in 2026 appeared first on The Motley Fool Canada.| The Motley Fool Canada

A 5.8% Dividend Stock That Pays Monthly Cash

This high-yield passive income machine blends safety with a monthly cash payout. The post A 5.8% Dividend Stock That Pays Monthly Cash appeared first on The Motley Fool Canada.| The Motley Fool Canada

If CAD/USD Swings, This TFSA Strategy Still Works

CAD/USD swings can make a TFSA feel volatile, so the best plan is a core in CAD assets plus a USD-sensitive counterweight. The post If CAD/USD Swings, This TFSA Strategy Still Works appeared first on The Motley Fool Canada.| The Motley Fool Canada

8.6% Yield? Here’s the Dividend Trap to Avoid in February

An 8.6% TELUS yield looks tempting, but it only holds up if free cash flow keeps improving and debt stays manageable. The post 8.6% Yield? Here’s the Dividend Trap to Avoid in February appeared first on The Motley Fool Canada.| The Motley Fool Canada

The Safest Monthly Dividend on the TSX Right Now? | The Motley Fool Canada

Granite REIT’s high occupancy and dividend coverage look reassuring, but tenant concentration and real estate rate risk still matter.| The Motley Fool Canada

My Path to Financial Independence as a Software Engineer

One of the watershed moments of my life was as a 20 year old intern attending a workplace presentation about personal finance. Over the course of one hour, I learnt about the power of buy-and-hold investing and compound growth. I learnt that even an average engineer with a five-figure salary can become a millionaire by … Continue reading My Path to Financial Independence as a Software Engineer→| Software the Hard way

TreasuryDirect tax forms: How to find the 1099s, decipher them

By David Enna, Tipswatch.com One of the great “joys” of having an account at TreasuryDirect is hunting for information on federal taxes you might owe on last year’s transactions. It’s not easy, and even when you find the information, it … Continue reading →| Treasury Inflation-Protected Securities

I Bond buying guide for 2026: Wait it out | Treasury Inflation-Protected Securities

AI-generated image for “investor with ticking clock” Perchance.org By David Enna, Tipswatch.com Last January, Series I Savings Bonds offered a fixed rate of 1.20% and had a lot of appea…| Treasury Inflation-Protected Securities

What is a QLAC and Should You Invest in One? 4 Experts Weigh In

A Qualified Longevity Annuity Contract (QLAC) is an annuity contract that can be funded with certain tax-advantaged retirement dollars, like a traditional IRA or an employer plan. The big idea is simple: you carve out a portion of your retirement savings today, and in exchange, an insurance company promises a guaranteed income stream later in […] The post What is a QLAC and Should You Invest in One? 4 Experts Weigh In appeared first on Gold IRA Guide.| Gold IRA Guide

Silver Bars (2026 Reviews): Buyer’s Guide, Prices, Sizes & Where to Buy

If you’re shopping for silver bars in 2026, here’s the simple rule: most bars sell for spot price + a premium, and the “best” bar is usually the one that fits your goal (lowest premium, easiest resale, easiest storage) without overpaying on fees, shipping, or taxes. Free 2026 Gold & Silver Investor’s Guide (No Cost) […] The post Silver Bars (2026 Reviews): Buyer’s Guide, Prices, Sizes & Where to Buy appeared first on Gold IRA Guide.| Gold IRA Guide

How Much Is A Gold Plated Quarter Worth? (2026 Update + Price History)

Contrary to popular belief, a “gold” coin or bar isn’t always worth its weight in gold. A lot of “gold quarters” sold online are simply gold-colored or gold-plated novelty coins. Because the gold layer is extremely thin (often measured in microns), they typically have little to no meaningful melt value, and resale demand can be […] The post How Much Is A Gold Plated Quarter Worth? (2026 Update + Price History) appeared first on Gold IRA Guide.| Gold IRA Guide

Stock news for investors: Rogers sees revenue gain, lifted by Blue Jays’ playoff success - MoneySense

An earnings roundup and operational updates from key Canadian companies, including Rogers, CPKC, CGI, Cascades, and Empire Co.| MoneySense

Guaranteed returns: Achieva GICs, a hidden gem of RRSP season

Guaranteed investment certificates (GICs) add stability to a balanced investment portfolio. They offer guaranteed returns, which is useful if you’re close to retirement. The post Guaranteed returns: Achieva GICs, a hidden gem of RRSP season appeared first on MoneySense.| MoneySense

Gen Z Canadians face job losses—but time is on their side

Despite job losses and rising costs, Gen Z Canadians have a powerful advantage: time. Why starting to save and invest early matters. The post Gen Z Canadians face job losses—but time is on their side appeared first on MoneySense.| MoneySense

Your money, your move: Engage in your financial future

Five platitudes you should never simply accept from your financial advisor. The post Your money, your move: Engage in your financial future appeared first on MoneySense.| MoneySense

A practical guide to investing at every life stage - MoneySense

Learn how to invest at every life stage, from your 20s to retirement, with age-based strategies, account tips, and guidance to balance growth, risk, and income.| MoneySense

2026 Goals And Resolutions » Tawcan

Since 2019, I have set goals and resolutions at the beginning of the year and put them down on a spreadsheet. I would write a post about my goals and| Tawcan

Why You Should Use Dividend Yield As A Valuation Tool For Stocks

“The concept of identifying undervalued and overvalued stock prices according to historic patterns of dividend yield can be applied to any stock with a reasonably long dividend history. However, investors who make the decision to include only high-quality, blue-chip stocks in their considerations will probably never regret it.” Source: Dividends Don’t Lie – Geraldine Weiss/Janet... The post Why You Should Use Dividend Yield As A Valuation Tool For Stocks appeared first on Dividend Gro...| Dividend Growth Investing & Retirement

Yield + Dividend Growth: A Simple Formula To Estimate Future Total Returns

“Dividend Yield + Dividend Growth = Prospective Return” Josh Peters, The Ultimate Dividend Playbook Yield + Dividend Growth = Total Return Estimate. Such a simple formula, but you’ll see from US and Canadian examples that it’s also been surprisingly accurate. That said, it has some pitfalls to be aware of too. Yield + Dividend Growth Estimate... The post Yield + Dividend Growth: A Simple Formula To Estimate Future Total Returns appeared first on Dividend Growth Investing & Retirement.| Dividend Growth Investing & Retirement

Chowder Number / Chowder Rule – The Perfect Mix of Dividend Yield and Dividend Growth

The Chowder Number/ Chowder Rule is all about finding the right mix between dividend yield and dividend growth. In a perfect world, we’d all be investing in high-yield, high-dividend growth stocks. The reality is that many high-yield stocks have lower dividend growth rates than lower-yielding stocks. So how do you find the right balance between... The post Chowder Number / Chowder Rule – The Perfect Mix of Dividend Yield and Dividend Growth appeared first on Dividend Growth Investing & ...| Dividend Growth Investing & Retirement

Double Your Dividend Income With Dividend Growth & Triple It With Dividend Reinvestment

Want to double your dividend income in 10 years? Invest in dividend growth stocks that average +7% dividend growth per year. Want to triple your dividend income in 10 years? Add in dividend reinvestment with a reasonably high starting dividend yield. A portfolio yielding 5% with +7%/year dividend growth will roughly triple its dividend income... The post Double Your Dividend Income With Dividend Growth & Triple It With Dividend Reinvestment appeared first on Dividend Growth Investing & Retire...| Dividend Growth Investing & Retirement

3 Reasons to Invest in Stocks with 10+ Year Dividend Growth Streaks

During the Global Financial Crisis, no Canadian stock with a 10+ year dividend growth streak cut its dividend. Looking for peace of mind high-quality investments that can weather recessions and continue to pay dividends you can rely on in retirement? Well, start by investing in companies with at least 10 years of consecutive dividend increases.... The post 3 Reasons to Invest in Stocks with 10+ Year Dividend Growth Streaks appeared first on Dividend Growth Investing & Retirement.| Dividend Growth Investing & Retirement

7 Dividend Growth Investing Resources I Can’t Live Without

Before I invest a cent of my hard-earned money into a dividend growth stock, I use these 7 dividend growth investing resources for every new investment. I wanted this list to be valuable, so to make it onto the list: It had to be a resource that I always use when researching or investing in... The post 7 Dividend Growth Investing Resources I Can’t Live Without appeared first on Dividend Growth Investing & Retirement.| Dividend Growth Investing & Retirement

44 Canadian Wide & Narrow Moat Dividend Growth Stocks

In Canada there are 9 wide moat stocks and 100 narrow moat stocks, but which of these companies with strong sustainable competitive advantages make good dividend growth investments? To answer this question, I did three things: I researched all Canadian wide and narrow moat companies to identify 44 stocks with a 5+ year dividend growth... The post 44 Canadian Wide & Narrow Moat Dividend Growth Stocks appeared first on Dividend Growth Investing & Retirement.| Dividend Growth Investing & Retirement

100 Canadian Narrow Moat Stocks

With only 9 wide moat stocks in Canada, narrow moat stocks are a necessary concession for anyone looking to build a diversified portfolio. Now a narrow moat might not be as good as a wide moat, but narrow moat companies are still expected to maintain their competitive advantages for 10-20 years. Not as long as... The post 100 Canadian Narrow Moat Stocks appeared first on Dividend Growth Investing & Retirement.| Dividend Growth Investing & Retirement

23 International Wide Moat Dividend Growth Stocks

As dividend growth investors, we know that wide moat stocks make a good starting point, but it is just one of many considerations on our hunt for high-quality dividend growth stocks. Which of these international companies with strong sustainable competitive advantages make good dividend growth investments? To help answer this question, I have separate articles... The post 23 International Wide Moat Dividend Growth Stocks appeared first on Dividend Growth Investing & Retirement.| Dividend Growth Investing & Retirement

Why Invest in Wide Moat Stocks?

A good investment strategy requires a long-term mindset, a long-term mindset needs high-quality companies, and high-quality companies are wide-moat stocks.| Dividend Growth Investing & Retirement

More Than Half Of Americans Worry They'll Run Out Of Money In Retirement

More than half of Americans worry they’ll outlive their retirement savings. A new survey shows how Gen X is rethinking retirement plans.| StudyFinds

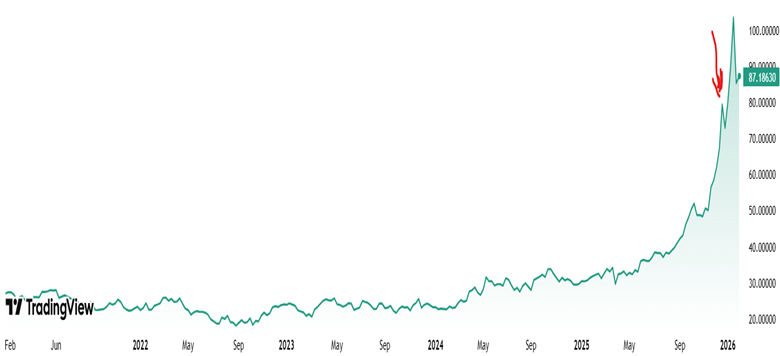

After the Crash: Silver Clawing Back Up After Epic Bust Last Week – Economist Writing Every Day

A month ago (red arrow in 5-year chart below), I noticed that the price of silver was starting into a parabolic rise pattern. That is typical of speculative bubbles. Those bubbles usually end in a …| Economist Writing Every Day

The 5 best San Diego real estate markets for investors in 2026

Crescent Lenders recently expanded its San Diego bridge loans program to include Logan Heights, North Park, City Heights, Clairemont Mesa, and El Cajon.| Times of San Diego

Taking Risks That the Market Decides to Reward

Getting rewarded by the market for the risks you take can be life-changing, but a diversified portfolio is more reliable. Learn the Nuts and Bolts I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action.Read Reviews The post Taking Risks That the Market Decides to Reward appeared first on The Finance Buff.| The Finance Buff

Market Insight | Jan 2026 | Progeny

In our latest video we provide a round up of investment market behaviour in 2025. Craig Melling, Director of Investment and Rob Harrison, Head of Smart| Progeny

China’s ‘gold fever’ sparks US$1 billion scandal as trading platform collapses | South China Morning Post

Chinese platform JWR faced a liquidity crisis as investors rushed to cash in on surging gold prices, leaving customers billions of yuan out of pocket.| South China Morning Post

Unlock Your Financial Future with the Fidelity Investments App

Thinking about your money and where it’s going? It can feel like a lot, right? Well, the fidelity investments app might just make things a bit simpler. It’s designed to help you keep an eye on your investments and maybe even make some smart moves. We’ll look at what it can do and how you […] The post Unlock Your Financial Future with the Fidelity Investments App appeared first on tradersdna - resources for traders/investors for Forex, Stocks, Commodities, Bitcoin, Blockchain, Fintech ...| tradersdna – resources for traders/investors for Forex, Stocks, Commodities...

Top Fee-Only Financial Advisors in San Diego (2026 Guide) | Bull Oak

Looking for a fee-only fiduciary financial advisor in San Diego? Learn how to evaluate firms, compare options, and avoid costly mistakes.| Bull Oak

SWPPX Vs. SWTSX – Which Index Fund To Buy?

How do you ensure that your investment portfolio has the needed diversification to suit your investment objectives? As there are so many funds available, what are the best value stocks you can consider before investing your hard-earned money? Let’s find out in this SWPPX vs. SWTSX review which fund fits your situation best. SWPPX vs. ... Read more| Radical FIRE

FZROX Vs. FXAIX – Which Fidelity Fund Is For You?

Looking for your next investment? Do you want to find an asset class that you can buy and hold as part of your investment options? Let’s look at FZROX vs. FXAIX that you may include in your diversified portfolio. FZROX vs. FXAIX are mutual funds created by Fidelity Investments for long-term investors. Both funds invest ... Read more| Radical FIRE

4 Reasons Why the Dollar Remains the World Heavyweight | Kiplinger

The dollar may have taken a beating lately, but it's unlikely to be overtaken as the leading reserve currency any time soon. What's behind its staying power?| Kiplinger

The Wealth Ladder – Economist Writing Every Day

The Wealth Ladder is a 2025 personal finance book from data blogger Nick Maggiulli. The core idea is good: that the best financial strategies will be different based on your current wealth level. M…| Economist Writing Every Day

Venture Capital: All Chips on Black vs. Playing the Percentages… | On the Flying Bridge

Over the past 100 years there have been 29,078 publicly listed U.S. stocks, of which 4% of them accounted for nearly all the economic wealth created this past century. Less than 100 companies were …| On the Flying Bridge

How to Build Wealth, Buy Freedom, and Stay Rich | Morgan Housel on The Knowledge Project with Shane Parish

Morgan Housel discusses the keys for outperforming in the stock market and how to build real wealth. The post How to Build Wealth, Buy Freedom, and Stay Rich | Morgan Housel on The Knowledge Project with Shane Parish appeared first on Podcast Notes.| Podcast Notes