How to Manage Investment Portfolios in One Platform

Modern banks, wealth managers, and financial advisors face a growing challenge: client data lives in spreadsheets, portfolio analytics sit in one system, CRM data in another, and compliance workflows somewhere else entirely. This fragmentation creates operational risk, slows client service, and makes regulatory audits a painful exercise. The solution is a unified portfolio management platform […] L’article How to Manage Investment Portfolios in One Platform est apparu en premier sur Inves...| InvestGlass

How to Ensure Data Security in Wealth Management

Data security in wealth management has evolved from an IT concern to a board level priority that directly impacts client trust, regulatory compliance and business continuity. Wealth management firms hold uniquely sensitive information including portfolio details, KYC documents and passport scans, making them prime targets for sophisticated cybercriminals. Effective protection requires a combination of people, […] L’article How to Ensure Data Security in Wealth Management est apparu en pre...| InvestGlass

How to Implement CRM in a Financial Firm

A CRM in a financial firm must support strict regulations, complex portfolios, and multi channel client communication, not just contact management. Investment firms, as a specific type of financial business, require tailored CRM solutions to manage client portfolios, ensure regulatory compliance, and support growth strategies. A successful CRM rollout starts with clear regulatory, revenue, and […] L’article How to Implement CRM in a Financial Firm est apparu en premier sur InvestGlass.| InvestGlass

How to Manage Private Banking Clients Digitally

HNW and UHNW clients now expect mobile first, always on private banking experiences that still feel personal and discreet A modern private banking model combines a secure client portal, digital onboarding and KYC, and AI assisted relationship management Swiss data sovereignty and EU grade privacy are decisive for many cross border private banking clients in […] L’article How to Manage Private Banking Clients Digitally est apparu en premier sur InvestGlass.| InvestGlass

How To Manage High Net Worth Clients Using CRM

Managing high net worth clients demands more than spreadsheets and quarterly calls. In 2026, wealth managers face a new reality where discerning clients expect instant digital access, personalized attention, and ironclad data security. Customer relationship management has evolved from a simple contact management tool into the operating system of modern wealth management. A robust CRM […] L’article How To Manage High Net Worth Clients Using CRM est apparu en premier sur InvestGlass.| InvestGlass

The move to STANDUP Portfolios

By John De Goey, CFP, CIM Special to Financial Independence Hub One thing I do constantly is think about risk exposure and uncertainty. I try to actively think ahead on behalf of clients. What do they want and need? In doing that, I aim to be realistic in how I assess options, accepting that no […] The post The move to STANDUP Portfolios appeared first on Financial Independence Hub.| Financial Independence Hub

Demand-side energy management with Analytica for Cost-Effectiveness Solutions (ACES)

Discover how blending social dynamics with energy models revolutionizes climate policy, offering sustainable, culturally-informed solutions.| Analytica – Visionary Modeling

From Approved Idea to Delivered Outcome: Designing a Project Funnel

Most innovation failures don't happen in the idea funnel. They happen after approval. You've validated customer demand, scored the idea, built the business case, and secured the green light. Then the project stalls: It sits in a backlog indefinitely Gets reassigned three times across different teams Disappears into "pilot purgatory" where successful experiments never scale [...]| Accept Mission | Idea & Innovation software

Building on Quicksand: When Tech Chaos Stalls Innovation

You have brilliant teams and a clear strategy, yet delivering a seamless experience often feels like an uphill battle. Learn how Agile Enterprise Architecture aligns technology with business strategy to reduce duplication and accelerate value. The post Building on Quicksand: When Tech Chaos Stalls Innovation appeared first on Scaled Agile.| Scaled Agile

Escaping the Urgent: Why Immediate Demands Are Killing Your Future Growth

Stop sacrificing the future for today. Learn to balance immediate demands with long-term strategic investments to maximize economic outcomes. The post Escaping the Urgent: Why Immediate Demands Are Killing Your Future Growth appeared first on Scaled Agile.| Scaled Agile

Betting the Business on a Guess: When “Good Ideas” Waste Millions

Your "game-changing" project has a huge budget and full exec backing. But how do you know it's what customers want? Stop funding big guesses and start funding fast experiments. The post Betting the Business on a Guess: When “Good Ideas” Waste Millions appeared first on Scaled Agile.| Scaled Agile

Rowing in Different Directions: Don’t Let Your Legacy Portfolios Prevent Future Success

You leave the strategy off-site energized, but back in the office, nothing changes. The problem isn't your vision; it's a portfolio organization designed to deliver last year's results. The post Rowing in Different Directions: Don’t Let Your Legacy Portfolios Prevent Future Success appeared first on Scaled Agile.| Scaled Agile

Should We Constrain Equity Exposure in Managed Futures When Stacking on Equities?

Return stacking offers a compelling way to do more with every dollar. By layering uncorrelated strategies like managed futures on top of traditional equity and bond exposures, investors can seek improved diversification and more resilient portfolios. The post Should We Constrain Equity Exposure in Managed Futures When Stacking on Equities? appeared first on Return Stacked® Portfolio Solutions.| Return Stacked® Portfolio Solutions

Why Tight Stop-Losses Often Hurt Investors — and What Robust Capital Growth Really Requires - CFA Institute Enterprising Investor

Tight stop-losses feel disciplined but can erode long-term returns. Robust investing favors resilience over optimization.| CFA Institute Enterprising Investor

Book Review: A Dollar for Fifty Cents - CFA Institute Enterprising Investor

Closed-end funds have their place in a diversified portfolio, but investors shouldn't expect to make a quick buck.| CFA Institute Enterprising Investor

Shifting Tides in Global Markets: The Reemergence of International Investing - CFA Institute Enterprising Investor

With valuations stretched in the US, international markets are emerging as a compelling new source of growth.| CFA Institute Enterprising Investor

How US State Capital Is Reshaping Strategic Supply Chains - CFA Institute Enterprising Investor

US government equity is entering strategic supply chains. For investors, this is changing how risk, returns, and capital allocation are priced.| CFA Institute Enterprising Investor

Incentives Are Dangerously Aligned in Private Markets - CFA Institute Enterprising Investor

Private markets increasingly resemble a speculative supply chain, where rational actors and aligned incentives quietly compound systemic risk.| CFA Institute Enterprising Investor

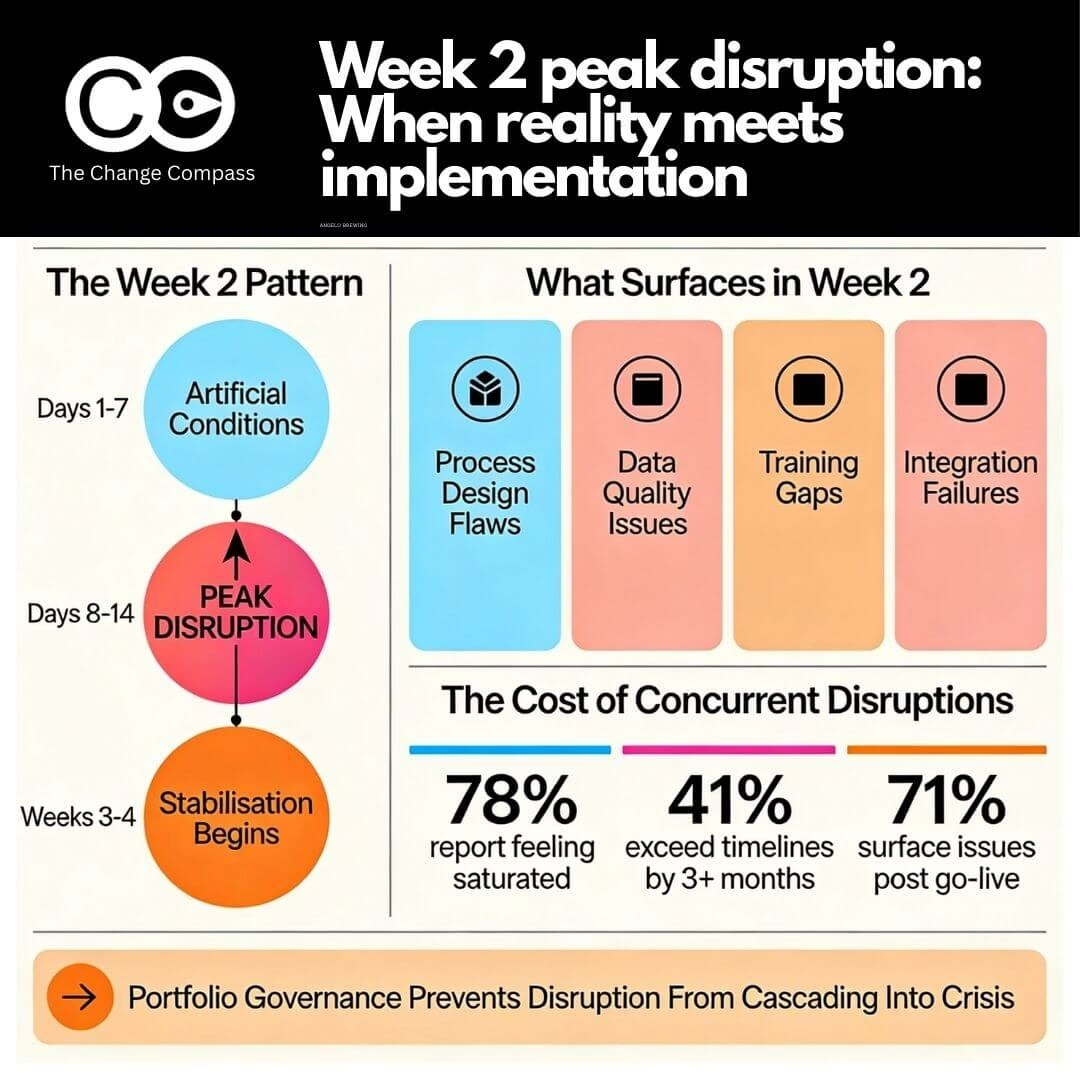

Why peak productivity disruption happens 2 weeks after go-live -

Peak productivity disruption happens 2 weeks after go-live. Learn why week 2 is critical for implementations, what diagnostic value disruption provides, how concurrent initiatives compound problems, and how change portfolio management prevents operational collapse with sequencing, consolidation, and governance.| thechangecompass.com

Learning value investing: A beginner’s guide to smarter investing

Forget about chasing hot market trends. The secret to value investing is much simpler: buying wonderful businesses at a fair price. The whole game is about finding solid companies that are temporarily on sale, investing with a long-term view, and letting the business's actual success do the heavy lifting for your returns. This one shift […] The post Learning value investing: A beginner’s guide to smarter investing first appeared on Investogy Blog.| Investogy Blog

A Modern Guide to Bond Allocation by Age

Figuring out your bond allocation is one of those classic investing puzzles. Get it right, and you strike a beautiful balance between growing your money and keeping it safe. A decent rule of thumb I've seen over the years is to start with 10-20% in bonds in your 20s and 30s. As you get older […] The post A Modern Guide to Bond Allocation by Age first appeared on Investogy Blog.| Investogy Blog

The Hidden Disadvantage of Single Stocks and How to Protect Your Wealth

The biggest pitfall of pouring your money into a single stock is simple: concentration risk. If that one company goes belly up, your entire investment can get wiped out. It's the classic "all your eggs in one basket" problem, and it's a stark contrast to diversified funds that spread your cash across hundreds or even […] The post The Hidden Disadvantage of Single Stocks and How to Protect Your Wealth first appeared on Investogy Blog.| Investogy Blog

Four Laws Of Software Economics (Part 4)

We’ve laid out three fundamental facts about commercial software: your development team will never be big enough; all of the profits are in the nth copy or nth subscriber; and the software bits we release are not the product. These led to three laws for software businesses (the Law| Rich Mironov's Product Bytes

How to Allocate Your Innovation Budget Across a Diverse Project Portfolio

Your leadership team says they want transformational innovation. Then they approve the budget using metrics that only favor safe, incremental improvements. This is the "ambition gap." It's the single biggest reason innovation budgets fail before a single dollar gets spent. Executives demand bold new growth engines while simultaneously enforcing financial planning processes designed for predictable, [...]| Accept Mission | Idea & Innovation software

The Three Horizons of Growth: Simple Model for a Complex Portfolio

Here's a paradox that destroys most companies. The management practices that make you profitable today are often the exact systems that blind you to tomorrow. Kodak invented the digital camera in 1975. They owned the patent. They saw the future coming. But their film business was too profitable to risk, so they buried the invention. [...]| Accept Mission | Idea & Innovation software

How to Score Your Innovation Portfolio: Self-Assessment Framework

Can't decide which innovation projects to fund? Here's a self-assessment framework to score, prioritize, and manage your portfolio effectively. 📊| Accept Mission | Idea & Innovation software

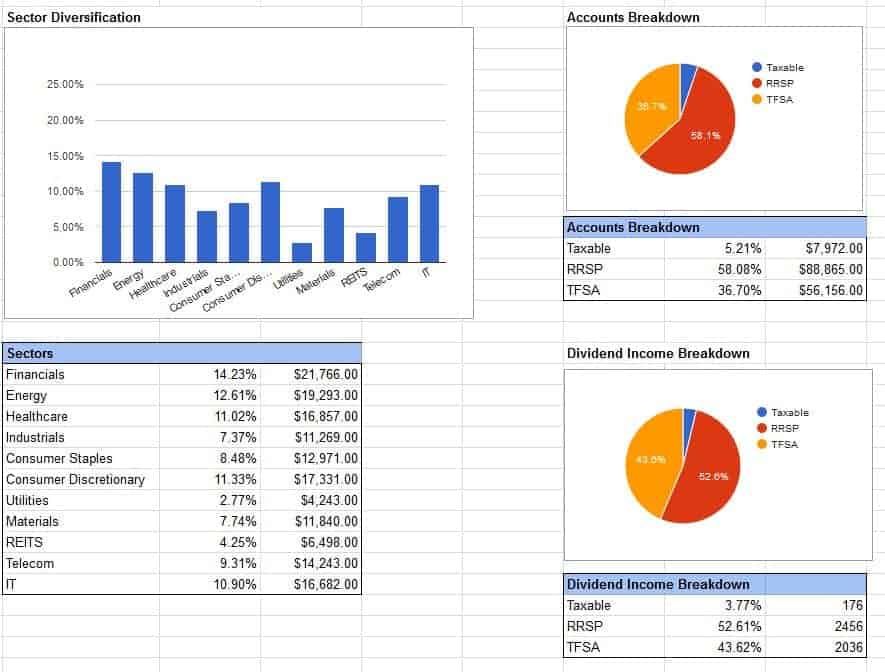

Portfolio Management: Taxable (non-retirement) Account

Asset location is just as important as asset allocation. Where you hold your investments will determine your personal after-tax return. Some goals and investments have long time horizons and can withstand to be in a retirement account that may not be touched for years. However, what if you have a short-term goal like a downpayment […] The post Portfolio Management: Taxable (non-retirement) Account first appeared on Beginners Passive Income.| Beginners Passive Income

Portfolio Management: Leverage (Debt) Overview

Debt is a weapon that should be handled with care. You can either use it to build out your passive income streams, protect your income streams and lifestyle, or destroy your wealth. There are many options for borrowing money so we will give a brief overview here for now. What is debt? Debt is when […] The post Portfolio Management: Leverage (Debt) Overview first appeared on Beginners Passive Income.| Beginners Passive Income

Portfolio Management: Retirement Accounts

There are many options now for investing in accounts meant to be used for retirement. It can be a little overwhelming! Let’s break down the different options you have so that you can choose which one makes the most sense for you. Retirement Accounts The idea is that you can put your money into an […] The post Portfolio Management: Retirement Accounts first appeared on Beginners Passive Income.| Beginners Passive Income

The True Definition of Passive Income

You may see many people on the internet talking about passive income. What’s not to be desired about earning money while you are doing other things? It’s a hot topic that deserves to be understood since there are a lot of misconceptions about what it is and how it is obtained. What is Passive Income? […] The post The True Definition of Passive Income first appeared on Beginners Passive Income.| Beginners Passive Income

Portfolio Management: Tax Loss Harvesting

While we would all love to follow the timeless investment advice to “buy low, sell high”, the reality is that it is very difficult to time the market. One of the risks of investing is that it is always possible to lose what you put into it, especially if you have need of the money […] The post Portfolio Management: Tax Loss Harvesting first appeared on Beginners Passive Income.| Beginners Passive Income

Portfolio Management: Dividend Taxes

While dividends represent one of the most passive income streams you can have, you also have to realize it increases your taxable income. This is of course assuming you are investing in a non-retirement account, also called a taxable account, and will receive a tax form indicating the income. In a retirement account, you only […] The post Portfolio Management: Dividend Taxes first appeared on Beginners Passive Income.| Beginners Passive Income

Portfolio Management: Capital Gains Taxes

Almost all passive investors must deal with capital gains at some point in their journey. There are various ways to avoid paying capital gains tax under the guidance of your tax professional, however you may find some forms of capital gains more favorable than other income streams you’ve added to your portfolio. Capital Gains The […] The post Portfolio Management: Capital Gains Taxes first appeared on Beginners Passive Income.| Beginners Passive Income

Revenus Passifs avec l’impression à la demande

Vous avez peut-être entendu dire que l’impression à la demande (print-on-demand en anglais) est un moyen de générer un revenu passif, et c’est vrai. Il n’y a jamais eu de meilleur moment pour commencer à gagner de l’argent avec l’impression à la demande. Après avoir aidé plusieurs marchands à configurer leurs magasins d’impression à la demande, […] The post Revenus Passifs avec l’impression à la demande first appeared on Beginners Passive Income.| Beginners Passive Income

21 Things You Can Sell on Craigslist for Cash

You can sell hundreds of items on Craigslist from antiques to automotive vehicles and parts, clothing, beauty and health items, CDs, DVDs, electronics, furniture, home appliances, sporting goods, tools, toys and games. Some examples include cell phones, cards, fishing rods, mattresses, washers, driers, air conditioners, books, consoles and more. The post 21 Things You Can Sell on Craigslist for Cash first appeared on Beginners Passive Income.| Beginners Passive Income

12 Passive Income Ideas For Web Developers

The median annual active income for web developers was $73,760 in May 2019. However, in order to transition from active to passive income, web developers can implement ideas such as creating and selling web-based chatbots, running monetized blogs, flipping profitable websites and domain names, developing and supporting API bridges, and more. The post 12 Passive Income Ideas For Web Developers first appeared on Beginners Passive Income.| Beginners Passive Income

14 Things to Value Your Pokemon Cards

Pokemon card price values range from $0.05 to over $200,000 and the final price depends on factors such as rarity, condition, shape centring, proxies, type, set, year, print, edition, errors, language, and grading. In the end, a card is worth how much someone is willing to pay for it. The post 14 Things to Value Your Pokemon Cards first appeared on Beginners Passive Income.| Beginners Passive Income

18 Passive Income Ideas to Start in Canada

You can earn passive income in Canada from well-executed passive income ideas like blogging, podcasting, chatbots, eCommerce, niche sites, dropshipping, or print-on-demand for example. It is important to choose an idea you are passionate about or interested in learning because it takes skill, patience, dedication, and hard work in order to succeed. The post 18 Passive Income Ideas to Start in Canada first appeared on Beginners Passive Income.| Beginners Passive Income

14 Passive Income Ideas to Start in India

Some passive income ideas you can carry out in India include eCommerce, gaming, podcasting, monetized chatbots, niche sites, dropshipping, and blogging. You can also participate in side-hustles like food delivery apps, flipping items on craigslist, flipping domains, flipping items on eBay and more. Learn more here. The post 14 Passive Income Ideas to Start in India first appeared on Beginners Passive Income.| Beginners Passive Income

6 Effective Ways to Manage Multiple Passive Income Streams

You can manage multiple income streams by prioritizing, eliminating, batching, automating, outsourcing, collaborating and reviewing your processes. Managing multiple streams of passive income requires some skill and knowledge on the best management practices for your business. Learn more here. The post 6 Effective Ways to Manage Multiple Passive Income Streams first appeared on Beginners Passive Income.| Beginners Passive Income

12 Passive Income Ideas to Start in The USA

Some excellent passive income ideas that can be done in the USA include blogging, podcasting, monetizing chatbots, eCommerce, monetized niche sites, dropshipping, print-on-demand, and more. You can also engage in side-hustles like food delivery apps, or peer-to-peer rentals. It all depends on what you are able to do and passionate about. The post 12 Passive Income Ideas to Start in The USA first appeared on Beginners Passive Income.| Beginners Passive Income

10 Passive Income Ideas With No Money or Investments

Not every passive income idea requires a large financial investment. Some passive income ideas do not require any investment and are fairly easy to start. Some can be done online such as gaming, YouTubing or starting a blog, while others may include AirBnB, renting out your things, ridesharing, or advertising with your car. Learn more here. The post 10 Passive Income Ideas With No Money or Investments first appeared on Beginners Passive Income.| Beginners Passive Income

6 Passive Income Streams for Chefs

There are many passive income-earning opportunities for chefs. As long as you are passionate and knowledgeable in something (in the culinary world or otherwise), you can turn it into a passive income source. Passive income sources that may be ideal for chefs include blogging, podcasting, creating niche sites, selling eBooks, affiliate marketing and more. Learn more here. The post 6 Passive Income Streams for Chefs first appeared on Beginners Passive Income.| Beginners Passive Income

Making Passive Income With A Self Service Store

You can earn passive income from a self-service store with an ideal location, a loyal clientele, good business management, the initial investment required to build the business, and more. However, you have to outsource and automate parts of the business to make it a passive income stream. Learn more here. The post Making Passive Income With A Self Service Store first appeared on Beginners Passive Income.| Beginners Passive Income

17 Online Passive Income Ideas

There are tons of side hustle ideas you can undertake outside of your normal schedule or day job to earn passive income. Making passive income from a side hustle is not something new. Passive income ideas such as eBooks, eCommerce, podcasts, dropshipping, and stock photography can make for excellent side hustles. Most of these ideas are easy to start even for beginners. Learn more here. The post 17 Online Passive Income Ideas first appeared on Beginners Passive Income.| Beginners Passive Income

8 Passive Income Ideas for Real Estate Agents

There are numerous passive income-earning opportunities for real estate agents. Some streams include blogging, podcasting, creating niche sites, chatbots, selling eBooks, affiliate marketing, YouTubing and many more. With hard work, dedication, and skill, you can turn your passion into a passive income stream. Learn more here. The post 8 Passive Income Ideas for Real Estate Agents first appeared on Beginners Passive Income.| Beginners Passive Income

What are Passive Income Streams?

Passive income streams are sources of income that enable a person to make a regular, sustainable income without having to trade time for money. Although the income you earn is passive, it takes time, money, effort and skill to initially build, and then run a passive income stream to keep it profitable. Learn more here. The post What are Passive Income Streams? first appeared on Beginners Passive Income.| Beginners Passive Income

9 Passive Income Ideas For Students

You can earn passive income as a student by dedicating time to building a passive income stream. Some great ideas for students include blogging, building niche sites, selling digital products, charging scooters, selling eBooks, affiliate marketing and more. Learn more here. The post 9 Passive Income Ideas For Students first appeared on Beginners Passive Income.| Beginners Passive Income

Reviewing Your Asset Allocation: Is It Time to Add More Bonds? - Gold IRA Rollovers

Thinking about your investment balance? Discover whether adding more bonds could help stabilize your portfolio amid changing market conditions.| Gold IRA Rollovers

Managing change: Best practices for leading organisational transformation -

Research-proven practices for leading organisational transformation: Use data-driven decisions, treat resistance as feedback, build authentic engagement, map change impacts, and manage portfolio capacity. Empirical insights for real transformation success.| thechangecompass.com

Roadmap Examples To Help You Make Better Roadmaps Faster

This blog showcases the best examples of roadmaps in specific categories, including: In each section, you will also find links to guides to help you create specific kinds of roadmaps and Visor templates to help you get started faster with an AI-generated roadmap in Visor, which is one of the best roadmapping tools available. You ... Roadmap Examples To Help You Make Better Roadmaps Faster| Visor

How To Create a Program Roadmap: Your Step-by-Step Guide With Examples

In this guide, I’ll explain how to create a program roadmap, with key pointers that will help you: In the first section, I’ve added some clarity about what program roadmaps are, how they differ from project roadmaps and portfolio roadmaps, and why a program roadmap is beneficial. If you already know what a program roadmap ... How To Create a Program Roadmap: Your Step-by-Step Guide With Examples| Visor

Best Tools to Manage Multiple Projects

There are many tools you can use to manage your projects, but which are the best tools for managing multiple projects? The distinction between managing projects independently and collectively is essential. Some tools might be great when you’re working on the level of an individual project but start to falter when you need to take ... Best Tools to Manage Multiple Projects| Visor

The Best Jira Alternatives for Your Exact Requirements (2025)

Using blogs and lists online to find the best Jira alternative for you can be a waste of time. You’ll read lots of very long lists – typically written by Jira competitors – of 20 or more alternatives to Jira, with no context, no detail, and no explanation of why each alternative can be a ... The Best Jira Alternatives for Your Exact Requirements (2025)| Visor

Best Agile Project Portfolio Management Tools 2025

Agile portfolio management tools enable you to manage your portfolios of projects using agile principles and practices. People used to view project portfolio management and agile methodologies as incompatible approaches. But as agile has become more prevalent and expanded beyond the borders of software development, program managers and portfolio managers have integrated agile principles into ... Best Agile Project Portfolio Management Tools 2025| Visor

Business Cases Are Stories About Money

Last week, I had three separate conversations with VPs of Product about business cases… initially framed as “do you have a template we should use so that our team can prioritize big investments?” Unpacking this, it became clear that their product teams wanted to jump straight into generating numbers and| Rich Mironov's Product Bytes

Enterprise Change Management: Strategy for Large Organizations

Enterprise change management has evolved from a tactical support function into a strategic discipline that directly determines whether large organizations successfully execute complex transformations and realize value from major investments. Rather than focusing narrowly on training and communications for individual projects, effective enterprise change management operates as an integrated business partner aligned with organizational strategy, […] The post Enterprise Change Management: Stra...|

Managing Change Saturation: How to Prevent Initiative Fatigue and Portfolio Failure

In today’s hypercompetitive business landscape, organisations are launching more change initiatives than ever before, often pushing their workforce beyond the breaking point. Change saturation occurs when the volume of concurrent initiatives exceeds an organisation’s capacity to adopt them effectively, leading to failed projects, employee burnout, and significant financial losses. The statistics paint a sobering picture. […] The post Managing Change Saturation: How to Prevent Initiat...|

Mental Tension and the Value of Falling Stock Prices

In a recent interview, Ted Weschler described his investment process as an eclectic collection of different reading material that is likely unique to him. For example, he mentions reading USA Today, Furniture Daily, and Uranium Weekly, three completely different types of publications with very different audiences. He says the combination of those three very different sources […] The post Mental Tension and the Value of Falling Stock Prices first appeared on Saber Capital Management.| Saber Capital Management

Flaws You Can Live With and a Framework for Decision Making

I recently read Annie Duke’s book on decision making called Thinking In Bets. One of her main points is that life is like poker and not chess. In chess, the superior player will always beat the inferior player unless the better player makes a mistake. There is always the correct move to make, and the […] The post Flaws You Can Live With and a Framework for Decision Making first appeared on Saber Capital Management.| Saber Capital Management

The 9 Best Portfolio Risk Management Tools in 2025 [Software & Strategies]

The Bottom Line: Portfolio Risk Management Portfolio risk management isn’t about eliminating risk — it’s about taking the right risks in the right amounts. If you only take a few tips from this article, let them be these: (I’ll explain all of these concepts in more detail below.) What You’ll Learn in This Article In […] The post The 9 Best Portfolio Risk Management Tools in 2025 [Software & Strategies] appeared first on WallStreetZen.| WallStreetZen

How to Visualize Your Entire Innovation Portfolio for Strategic Oversight

Can't see your innovation portfolio? Here's how CEOs build strategic dashboards with Three Horizons, bubble charts, and automated zombie detection. 📊| Accept Mission | Idea & Innovation software

Mind the Cycle: From Macro Shifts to Portfolio Plays - CFA Institute Enterprising Investor

Markets move on change, not levels. Spot shifts in growth, inflation, and liquidity early to stay ahead of the global cycle.| CFA Institute Enterprising Investor

Random Thoughts - AC Strike, Japan, Taiwan, Dividend Portfolio, Etc » Tawcan

Based on the recent readers' survey, 53.8% of you enjoy reading the Random Thoughts posts and 43.8% of you enjoy reading them when they’re investing-related.| Tawcan

The Lost Buy Box Fallacy

Let’s face it: Your organisation has built lasting relationships with all kinds of retail partners over the years. Wholesalers, distributors, and retailers all count into your vast distribution network. So of course, they all have their unique way of doing business with you. Some sell directly to consumers, others sell to smaller retailers. And some […] The post The Lost Buy Box Fallacy appeared first on Consulterce.| Consulterce

The Augmented LP: 6 Ways AI Can Enhance the Allocator’s Workflow - CFA Institute Enterprising Investor

AI can help LPs structure data, enhance due diligence, and improve oversight, while keeping human judgment central.| CFA Institute Enterprising Investor

Ignite Your Pipeline: 10 Ways Prospect Research Fuels Prospect Management - Helen Brown Group

This week on the Intelligent Edge, Consultant Susan Barclay shares how research can be the foundation of portfolio management.| Helen Brown Group

The Go/No-Go Scoring Model: Prioritizing Innovation Projects Without Gut Feel

Tired of picking innovation projects based on gut feel? Here's how weighted scoring models turn subjective debates into data-driven decisions. 📊| Accept Mission | Idea & Innovation software

Autopilot Investment App Review: Is This Automated Portfolio Platform Worth It in 2025?

Is the Autopilot investment app worth it in 2025? We go beyond the Nancy Pelosi tracker and dig in deep in this Autopilot review.| WallStreetZen

We Can’t Schedule Innovation, But We Can Schedule Discovery

Every week, I talk with CEOs who tell me they want to speed up innovation. In fact, they want to schedule it. Recently a product leader shared with me an OKR to ship one major innovation each quarter, measured as “users will give each innovative feature a top rating.” This| Rich Mironov's Product Bytes

When the Equity Premium Fades, Alpha Shines - CFA Institute Enterprising Investor

As the equity risk premium declines, alpha becomes critical. Discover how investors can adapt through factor strategies and global diversification.| CFA Institute Enterprising Investor

How to Use AI to Trade Stocks: 8 Proven Ways | WallStreetZen

Should you be using AI to trade stocks? Possibly, but only if you're using the right tools the right way. Here's how to do it right.| WallStreetZen

How to Manage Cost and Margin Support Agreements with Amazon

Whether it's to accept a cost price increase or to address a declining Net PPM. Cost Support Agreements (CSAs) have become the preferred choice in the| Consulterce

Tickeron AI Review: Is It Worth It in 2025?

Is Tickeron's AI software worth it? In this detailed review, we explore what's great and what's not so great about the platform and whether or not it's right for you.| WallStreetZen

Your Next Developer Costs $1M/Year in Revenue

As tech product managers, we’re often pitching the need for larger development teams. There’s an implied revenue obligation, though, that we should understand. Here are some back-of-the-envelope numbers — in three steps — for a likely discussion with your CFO or General Manager. [1] R&D as a Portion of| Rich Mironov's Product Bytes

Looking to Predict Market Trends? How to Use AI to Figure Them Out - Coruzant Technologies

Unlock the secrets to predict market trends with AI. Find out how AI technology is revolutionizing stock market analysis for traders.| Coruzant Technologies

EOL Cookbook

This product end-of-life recipe has been hiding on my hard drive for dog’s years, but never got published. It’s the natural companion to my Customer-Side EOL post. When it’s time to retire (aka sunset aka end-of-life aka put a fork in) a commercial product or service, here’| Rich Mironov's Product Bytes

The Endowment Syndrome: Why Elite Funds Are Falling Behind | CFA Institute Enterprising Investor

Endowments have long been considered elite investors, but outdated strategies and skyrocketing costs are eroding their edge| CFA Institute Enterprising Investor

Four Laws Of Software Economics (Part 3)

Our two previous posts noted that your development team will never, ever be big enough to catch up with your dreams (pushing us to The Law of Ruthless Prioritization [http://www.mironov.com/4laws1/]) and that all of the profits are in the nth copy (thus The Law of Build| Rich Mironov's Product Bytes

The Software Development Deli Counter

I’ve noticed a frequent executive-level misalignment of expectations across a range of software/tech companies, particularly in B2B/Enterprise companies and where Sales/Marketing is geographically far away from Engineering/Product Management. Let’s call it the software development deli counter problem [https://twitter.com/share?url=https://www.| Rich Mironov's Product Bytes

Product Sprawl

There’s a pattern I sometimes see at software companies, particularly those targeting enterprises or on the long march moving their installed base from on-premise to SaaS. The go-to-market materials present a glowing picture of well-planned products, but underneath there’s a jumble of mismatched pieces and arcane product history| Rich Mironov's Product Bytes

Four Laws Of Software Economics (Part 2)

Post #1 noted that your development team will never, ever, ever be big enough to catch up with your dreams. – which led to The Law of Ruthless Prioritization. Here’s a second fundamental reality of software economics: All of the profits are in the nth copy or nth user. Building| Rich Mironov's Product Bytes

Four Laws Of Software Economics (Part 1)

Newton taught us that gravity’s not just a good idea, it’s the law. I’ve spent a lot of the last decade with one foot in the engineering organization and the other with marketing/sales. While the two sides of the business communicate poorly, I think there’s| Rich Mironov's Product Bytes

Google Finance Dividend Portfolio Template: A Step-by-step Guide

Step by step guide on how to create a Google finance dividend portfolio template by utilizing Google Finance and Googlefinance functions| Tawcan

ASP Compression Analysis for Amazon Vendors [Complete Guide]

As a 1P vendor, you know that increasing your cost prices with Amazon can be difficult. The online retailer's price-follower strategy adds complexity to| Consulterce

How to Improve Product Availability on Amazon Vendor Central

Want to increase your sales and reduce out-of-stock rates on Amazon? You've come to the right place. Planning shopper demand and managing product| Consulterce

It’s Time to Reboot Your Portfolio

It’s been a while since the last new article appeared o [...]| Canadian Couch Potato

How Do You Measure Your Rate of Return?

All investors care deeply about their returns, and with [...]| Canadian Couch Potato

TD e-Series Returns for 2020

The TD e-Series index mutual funds remain a useful alte [...]| Canadian Couch Potato

Thinking About Investing and the Economy Post-Pandemic

Thinking About Investing and the Economy Post-Pandemic| Joshua Kennon