Gauhati HC: GST Demand Cannot Be Based Solely on DRC-01 Summary; Proper SCN U/S 73 Mandatory

The Gauhati High Court, in a ruling, mentioned that a GST demand could not be raised merely on the grounds of a summary of a show cause notice in Form GST DRC-01, and that a proper SCN u/s 73 of the Central Goods andServices Tax (CGST) Act, 2017/ Assam Goods and Services Tax (AGST) Act […] The post Gauhati HC: GST Demand Cannot Be Based Solely on DRC-01 Summary; Proper SCN U/S 73 Mandatory first appeared on SAG Infotech Official Tax Blog.| SAG Infotech Official Tax Blog

CBDT Releases New Draft Form 130 for Consolidated TDS Certificate U/S 395

The Central Board of Direct Taxes (CBDT) has released Draft Form No. 130, offering a new consolidated TDS certificate u/s 395 of the Income-tax Act. The draft form is for easing certification of tax deducted at source on salary, pension, and specified interest income, bringing greater standardisation and reporting clarity for employers, banks, and deductors. […] The post CBDT Releases New Draft Form 130 for Consolidated TDS Certificate U/S 395 first appeared on SAG Infotech Official Tax Blog.| SAG Infotech Official Tax Blog

GST | Bombay HC: Summons U/S 70 of CGST Act for Inquiry & Do Not Amount to Detention

The Aurangabad Bench of the Bombay High Court stated that summons issued u/s 70 of the Central Goods and Services Tax (CGST) Act are intended for questioning and taking statements, and do not constitute detention. The Court stated that there is no need for a 7-day notice before issuing a summons, as per the section, […] The post GST | Bombay HC: Summons U/S 70 of CGST Act for Inquiry & Do Not Amount to Detention first appeared on SAG Infotech Official Tax Blog.| SAG Infotech Official Tax Blog

How GST Software Simplifies the Challan Facility for Taxpayers

In the GST structure, tax compliance is more than just filing the returns. It needs precise and timely tax payments. In the same procedure, the facility of the challan secures an important role, permitting the taxpayers to deposit the GST liabilities, including tax, interest, penalties, and late fees. While the GST portal delivers a standard […] The post How GST Software Simplifies the Challan Facility for Taxpayers first appeared on SAG Infotech Official Tax Blog.| SAG Infotech Official Tax Blog

CBDT Releases Draft Form 168 to Standardise Annual Information Statement (AIS)

The Central Board of Direct Taxes (CBDT) has introduced a new draft Form No. 168, which aims to simplify how taxpayers receive important information about their finances and taxes. This new form will provide a clear and organised overview of a person’s financial details for a specific tax year, making it easier for individuals to […] The post CBDT Releases Draft Form 168 to Standardise Annual Information Statement (AIS) first appeared on SAG Infotech Official Tax Blog.| SAG Infotech Official Tax Blog

Gujarat HC: GST Appeal Delays Beyond Limit Cannot Be Condoned Even Under Article 226

The Gujarat High Court stated that courts cannot condone delays in filing GST appeals after the statutory period, even while exercising writ jurisdiction under Article 226 of the Constitution. A writ petition filed by a partnership firm has been dismissed by the bench of Justice A.S. Supehia and Justice Pranav Trivedi after finding that the […] The post Gujarat HC: GST Appeal Delays Beyond Limit Cannot Be Condoned Even Under Article 226 first appeared on SAG Infotech Official Tax Blog.| SAG Infotech Official Tax Blog

Delhi (PB) GSTAT Upholds DGAP Finding in CG Foods GST Profiteering Case on Instant Noodles

The legal proceedings began when authorities examined the business practices of M/s C.G. Foods. The investigation was triggered by a complaint alleging that the company failed to reduce prices following a GST rate cut intended to benefit consumers purchasing instant noodles.” The GST rate for these goods was lowered from 18% to 12%, from November […] The post Delhi (PB) GSTAT Upholds DGAP Finding in CG Foods GST Profiteering Case on Instant Noodles first appeared on SAG Infotech Official ...| SAG Infotech Official Tax Blog

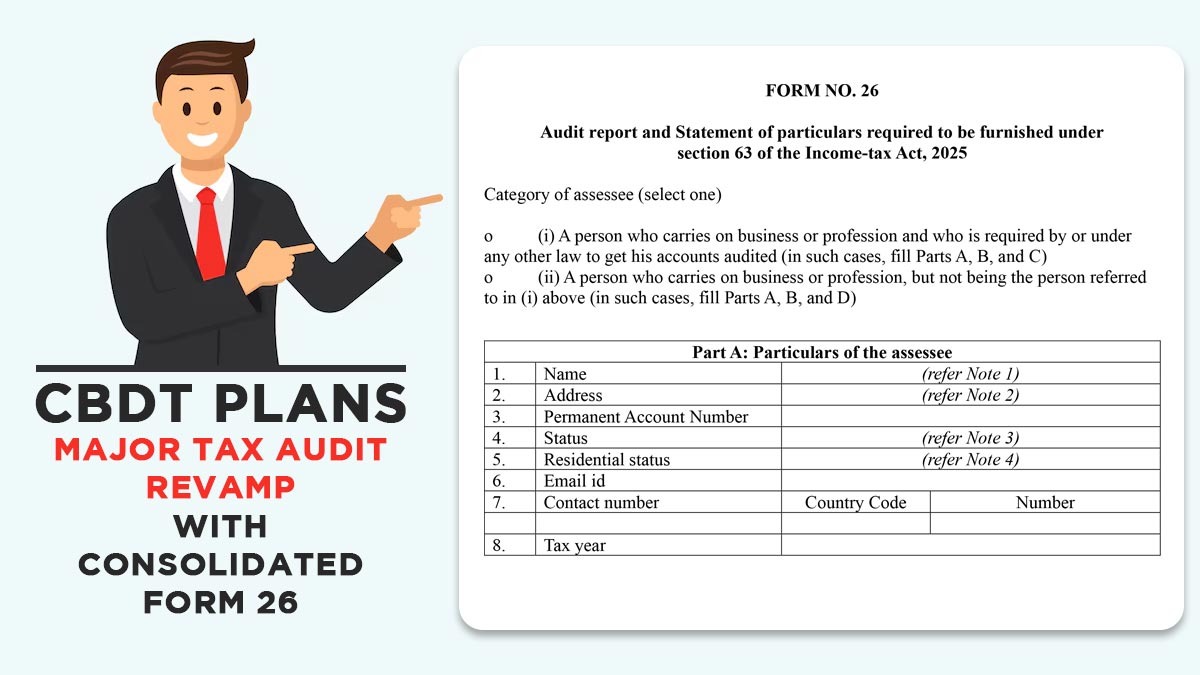

CBDT to Shift Existing Tax Audit Forms to Consolidated Form 26

The Central Board of Direct Taxes (CBDT) has put out a new draft form called Form No. 26. This form includes a new type of audit report and a set of details that individuals or businesses will need to submit, according to the rules outlined in the Income Tax Act of 2025. This draft form| SAG Infotech Official Blog

AP HC Dismisses Plea Against GST Assessment Over Missing DIN and Allegedly Unsigned SCN

The Andhra Pradesh High Court has ruled against a lawful challenge to a GST assessment and the procedure to recover outstanding taxes. The petition argued that the official assessment did not contain a Document Identification Number (DIN), and that earlier notices sent to the assessee were not signed. However, the court decided to dismiss the […] The post AP HC Dismisses Plea Against GST Assessment Over Missing DIN and Allegedly Unsigned SCN first appeared on SAG Infotech Official Tax Blog.| SAG Infotech Official Tax Blog

CBDT May Use GST Data to Strengthen Direct Taxes & Improve Compliance

The Income Tax Department in India is thinking about using information from the Goods and Services Tax (GST) system. This could help them find more people who should be paying taxes and encourage everyone to follow the tax rules better. The GST system collects detailed information at every phase of business activities, including production, transport […] The post CBDT May Use GST Data to Strengthen Direct Taxes & Improve Compliance first appeared on SAG Infotech Official Tax Blog.| SAG Infotech Official Tax Blog

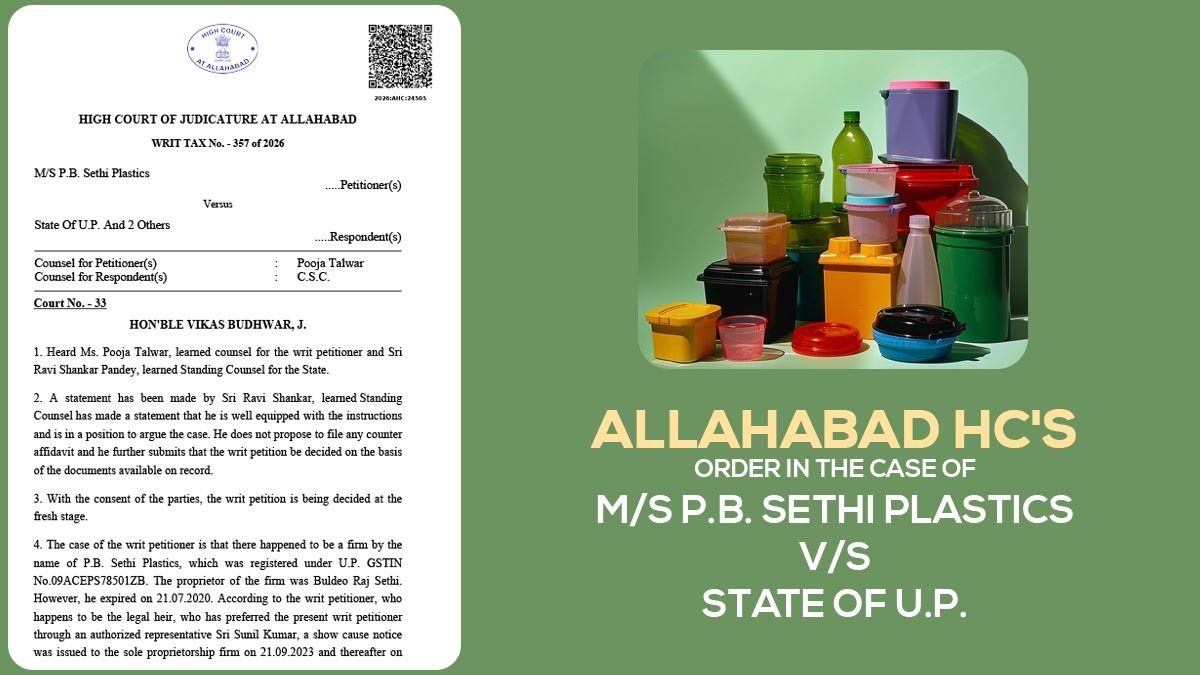

Allahabad HC Quashes GST SCN and Judgment Order Issued Against a Deceased Person

The Allahabad High Court has cancelled GST proceedings that were initiated against a company owner who has died. The court ruled that sending an SCN and making a judgment about taxation against someone who has passed is not lawfully permissible. Justice Vikas Budhwar observed that although tax dues may be recovered from legal heirs under| SAG Infotech Official Blog

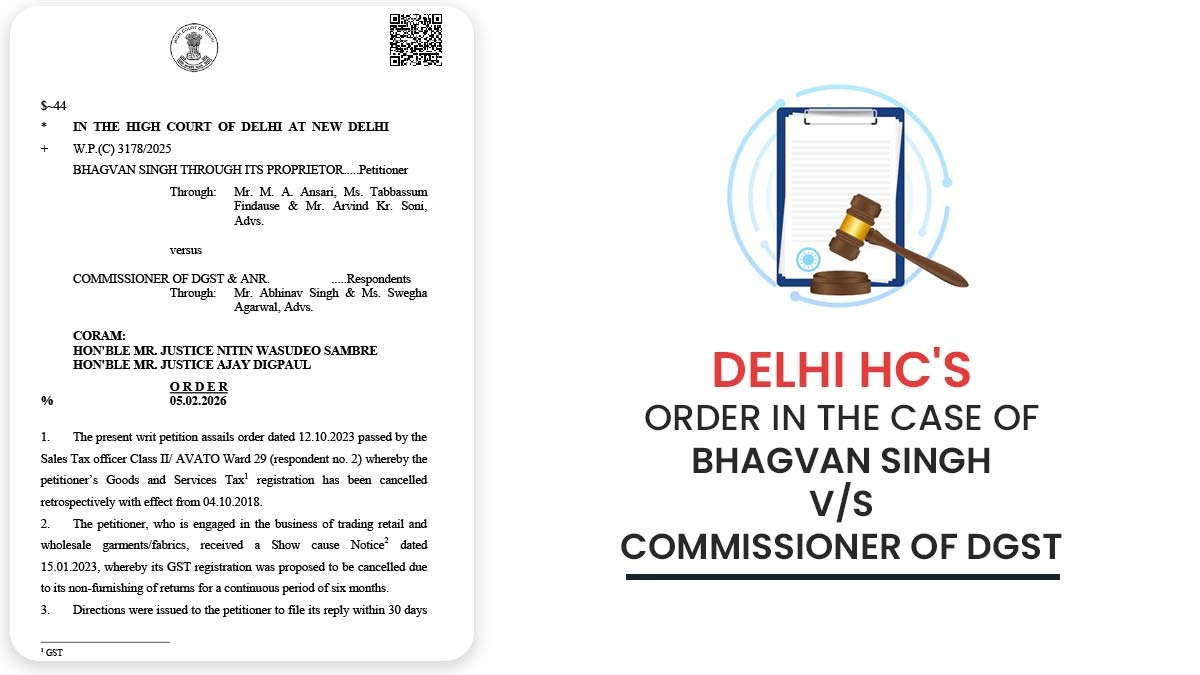

Delhi HC Orders Cancellation of GST Registration Must Be Mentioned in the SCN

The Delhi High Court stated that the objective of cancelling GST registration retrospectively must be mentioned in the show cause notice and restored the registration upon clearance of dues. The bench of Justice Nitin Wasudeo Sambre and Justice Ajay Digpaul has repeated stringent procedural safeguards controlling retrospective cancellation of GST registration, keeping in mind that| SAG Infotech Official Blog

GST E-Way Bill Generation Hits Second-Highest Ever at 13.68 Crore in Jan 2026

In January 2026, the generation of E-Way Bills reached over 13.68 crore, marking its second-highest level to date, according to data from the GST Network portal. This surge reflects strong economic activity and improved compliance within the system. However, experts have expressed a measured response to this development. The previous record was 13.84 crore, indicating| SAG Infotech Official Blog

How ITR Software Helps Taxpayers Avoid Penalties & Notices

A taxpayer can face income tax penalties and notices if the return is not filed on time or has mistakes. Here, we explain how ITR software helps this situation.| SAG Infotech Official Blog

SC Quashes ₹8.9 Cr GST Demand, Cites Lack of Proper Service Violating Natural Justice

The Supreme Court has quashed a GST demand order exceeding ₹8.9 crore directed at a company, determining that there was insufficient evidence to demonstrate proper service of the show cause notice. The Court's ruling emphasised that this deficiency constituted a breach of the principles of natural justice. The bench of Justice Aravind Kumar and Justice| SAG Infotech Official Blog

Madras HC Directs Forensic Verification Review as Tax Return Data Is Insufficient for GST Order

The Madras High Court recently issued a ruling directing a forensic examination of the records relevant to several writ petitions that contested GST assessment orders. Additionally, the court ordered the applicant to make a pre-deposit of ₹30 lakh, after which the attachment on the applicant’s bank account will be lifted. The K. N Raj Construction| SAG Infotech Official Blog

SAG Infotech Official Blog for GST & Income Tax, TDS Updates

SAG Infotech official blog publishes latest taxation articles and news (GST, Income Tax) related to chartered accountants and taxpayers. Subscribe Blog for More.| SAG Infotech Official Blog

Union Government Sets Up GST Appellate Tribunal Bench in Hyderabad

The Union government has formed the Hyderabad bench of the Goods and Services Tax Appellate Tribunal (GSTAT) in Telangana to hear appeals against orders passed under the GST law. Official directives have been released, designating Justice Sushil Kumar Sharma and Justice AP Ravi as judicial members, with Dr DK Srinivas appointed as the technical member.| SAG Infotech Official Blog

MCA Imposes ₹2.5 Lakh Penalty on Company & Director for Not Appointing Internal Auditor

The Ministry of Corporate Affairs (MCA) has fined a private limited company and its director ₹2.5 lakh because they failed to appoint an Internal Auditor, which is a requirement for businesses to ensure proper financial management. In accordance with Section 138 of the Companies Act, 2013, and as stipulated in Rule 13(1)(c) of the Companies| SAG Infotech Official Blog

Budget 2026: CBIC Confirms ‘Nil’ GST & Indirect Tax Legislation

The Central Board of Indirect Taxes and Customs (CBIC) has communicated to the Ministry of Parliamentary Affairs that there will be no legislative or non-legislative business for them to present to Parliament in the upcoming Budget Session of 2026. An Office Memorandum has been issued by the GST Policy Wing of the CBIC, which is| SAG Infotech Official Blog

GST Mismatch (GSTR-3B vs 2B): HC Rejects Anticipatory Bail Amid DGGI Investigation

The Punjab and Haryana High Court has rejected a request for anticipatory bail from Jitender Saharan, who is accused of being involved in a significant fraud related to the Goods and Services Tax (GST). This fraud involves improperly claiming and distributing tax credits amounting to over 8.24 crore rupees. The bench of Justice Manisha Batra,| SAG Infotech Official Blog

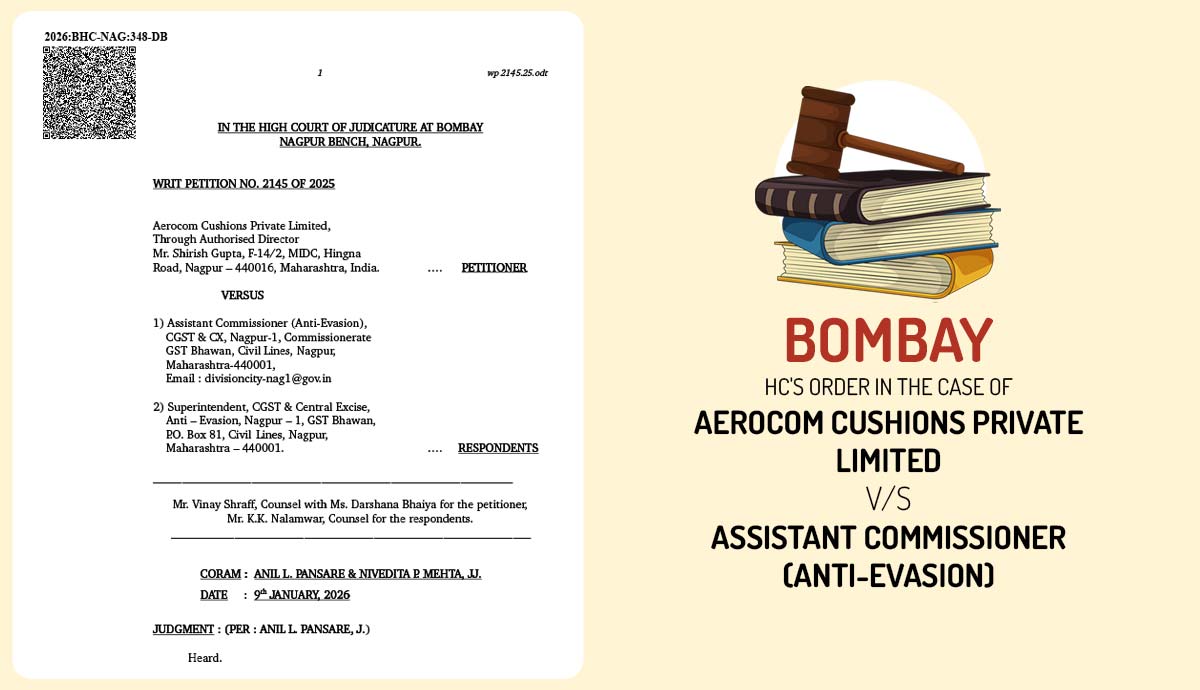

Bombay HC Clarifies GST Not Applicable on MIDC Plot Transfers to Third Parties

The Nagpur Bench of the Bombay High Court has provided relief to the business community, especially in Maharashtra, by holding that GST is not applicable on the transfer of plots allotted by the MIDC to third parties. This judgment clears long-standing confusion caused by GST notices issued to several companies over the years. The ruling| SAG Infotech Official Blog

How SAG Infotech’s Tax Software Empowers CA Experts

Find out how SAG Infotech’s tax software streamlines compliance work and empowers CA and professionals to operate faster, more accurately, and with ease.| SAG Infotech Official Blog

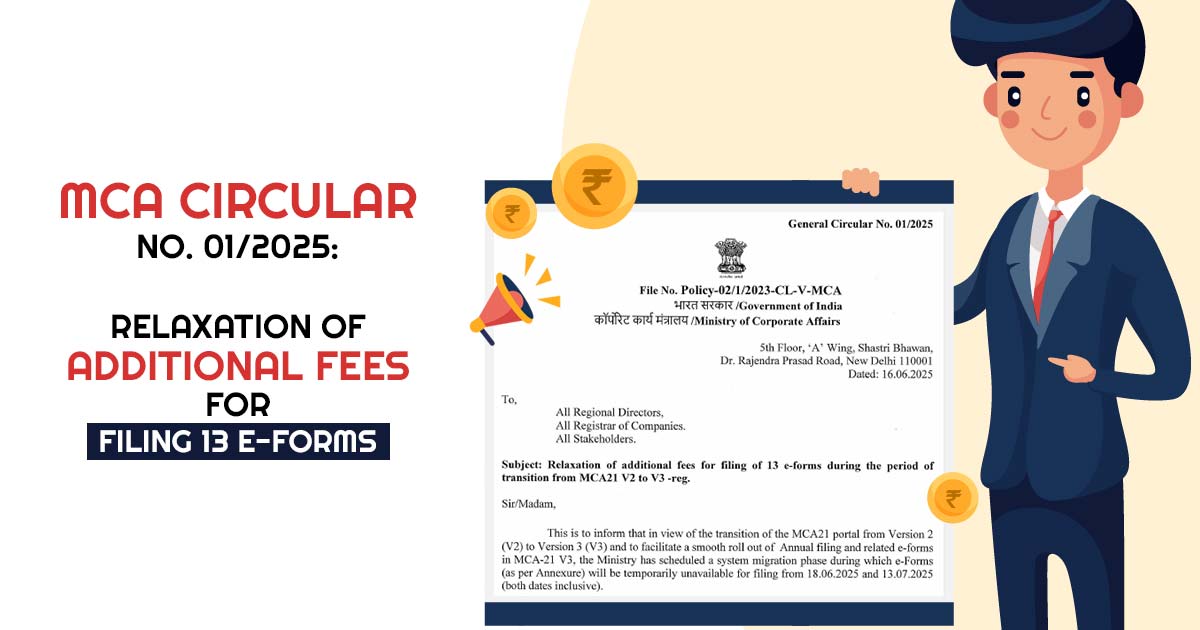

MCA Grants One-Time Fee Relaxation on 13 E-Forms Amid Transition to New Portal

The Ministry of Corporate Affairs (MCA) has decided to temporarily waive extra fees for submitting 13 online form. This decision is part of the switch from the old version of their online system (Version 2) to a new and improved version (Version 3). This change is intended to make it easier for businesses to adapt| SAG Infotech Official Blog